Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

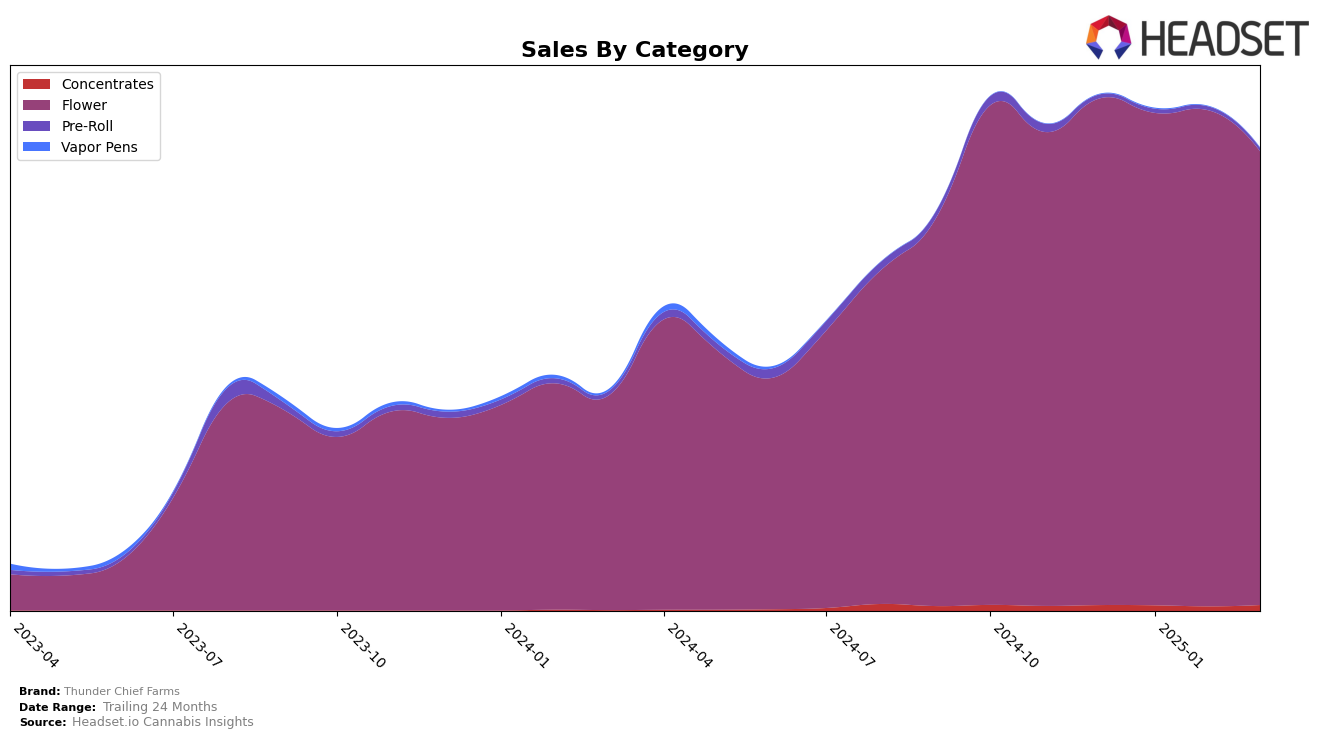

Thunder Chief Farms has shown a notable presence in the Washington cannabis market, particularly in the Flower category. Over the past few months, the brand has maintained a consistent ranking, fluctuating slightly between 12th and 16th place. This stability suggests a steady demand for their products, despite a slight decline in sales from December 2024 to March 2025. The brand's highest ranking during this period was 12th in February 2025, indicating a peak in consumer interest or effective sales strategies during that month.

Interestingly, Thunder Chief Farms has not appeared in the top 30 brands in any other state or category, which could be seen as a limitation in their market reach or a strategic focus on the Washington market. This singular focus might be advantageous if they are able to dominate or maintain a strong position in this region, but it also highlights potential growth opportunities in other states or product categories. The absence from other rankings could be interpreted as either a challenge or an opportunity, depending on the brand's long-term strategy and resource allocation.

Competitive Landscape

In the competitive landscape of the Washington flower market, Thunder Chief Farms has shown a notable upward trajectory in its ranking over the past few months. Starting at the 15th position in December 2024, the brand improved to 12th place by February 2025, before slightly dropping to 13th in March. This positive trend indicates a strengthening market presence, despite a slight decline in sales from February to March. Comparatively, Forbidden Farms experienced a consistent decline in rank, moving from 9th to 15th, alongside a significant drop in sales. Meanwhile, EZ Puff maintained a strong position, holding steady at 11th place in February and March, with sales rebounding in March. EZ Flower demonstrated a remarkable rise, climbing from 29th in December to 12th in March, suggesting a rapid increase in market share. Thunder Chief Farms' steady rank improvement amidst these shifts highlights its resilience and potential for capturing more market share in the competitive Washington flower category.

Notable Products

In March 2025, Butter (3.5g) maintained its position as the top-selling product from Thunder Chief Farms, continuing its streak as the number one ranked product for four consecutive months. Big Frank (3.5g) saw a significant rise in popularity, climbing from fifth place in February to second place in March, with sales reaching 392 units. Biggie's Revenge (3.5g) dropped slightly from second to third place, indicating a decrease in sales momentum compared to previous months. Gelato Crush (3.5g) re-entered the rankings at fourth place, suggesting a renewed interest despite its absence in February. Hawaiian Rain (3.5g) made its debut in the rankings at fourth place, highlighting its emerging presence in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.