Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

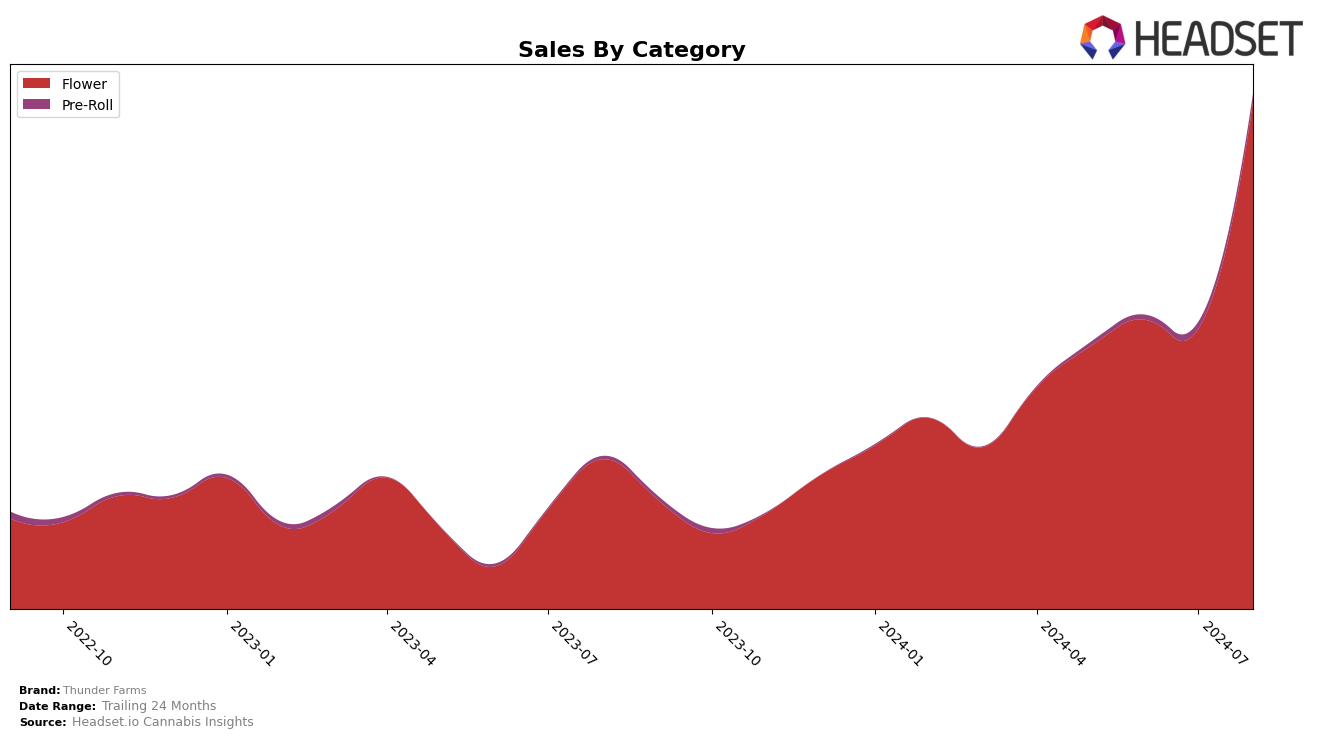

Thunder Farms has shown a notable performance in the Oregon market, particularly in the Flower category. After not being in the top 30 brands in May and July 2024, Thunder Farms made a significant leap to rank 18th in August 2024. This upward trend indicates a growing presence and possibly an increase in brand recognition or product quality. The August sales figure of $354,277 further underscores this strong performance, marking a substantial increase from previous months. This movement is particularly impressive given the competitive nature of the Flower category in Oregon.

Despite the positive trend in Oregon, Thunder Farms' performance across other states and categories remains less clear due to missing ranking data. This absence from the top 30 brands in other regions and categories could be seen as a challenge for the brand, indicating areas where they may need to improve or invest more resources. However, the strong performance in Oregon could serve as a blueprint for success in other markets if similar strategies and quality improvements are applied. Overall, while there are promising signs, there is still significant room for growth and expansion for Thunder Farms.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Thunder Farms has demonstrated notable fluctuations in rank and sales over the past few months. After starting at rank 37 in May 2024, Thunder Farms saw a slight improvement in June, maintaining a similar position before dropping back to rank 37 in July. However, a significant leap occurred in August, where Thunder Farms surged to rank 18, indicating a substantial increase in market presence. This upward trajectory in August aligns with a dramatic rise in sales, which jumped from $194,488 in July to $354,277 in August. In contrast, Frontier Farms and PDX Organics also showed improvements, with PDX Organics moving from rank 26 in July to rank 16 in August, and Frontier Farms climbing from rank 19 to 20. Meanwhile, Urban Canna and Midnight Fruit Company experienced slight declines in their rankings, with Midnight Fruit Company dropping from rank 12 to 19 and Urban Canna from 20 to 17. These shifts highlight the dynamic nature of the market and suggest that Thunder Farms' recent strategies may be paying off, positioning them as a rising competitor in the Oregon flower category.

Notable Products

In August 2024, Thunder Farms' top-performing product was Alaskan Thunder Fuck (Bulk) in the Flower category, maintaining its number one rank consistently since May, with an impressive sales figure of 9270 units. The Alaskan Thunder Fuck B-Buds (Bulk) emerged as the second best-seller in the Flower category. The Super Boof Pre-Roll (0.5g) secured the third spot in the Pre-Roll category, showing a notable jump from its debut in July. Tropical Popsicle B-Buds (Bulk) and Apple Fritter Pre-Roll (0.5g) rounded out the top five, ranking fourth and fifth respectively. These rankings highlight a strong preference for bulk flower products and a growing interest in pre-rolls.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.