Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

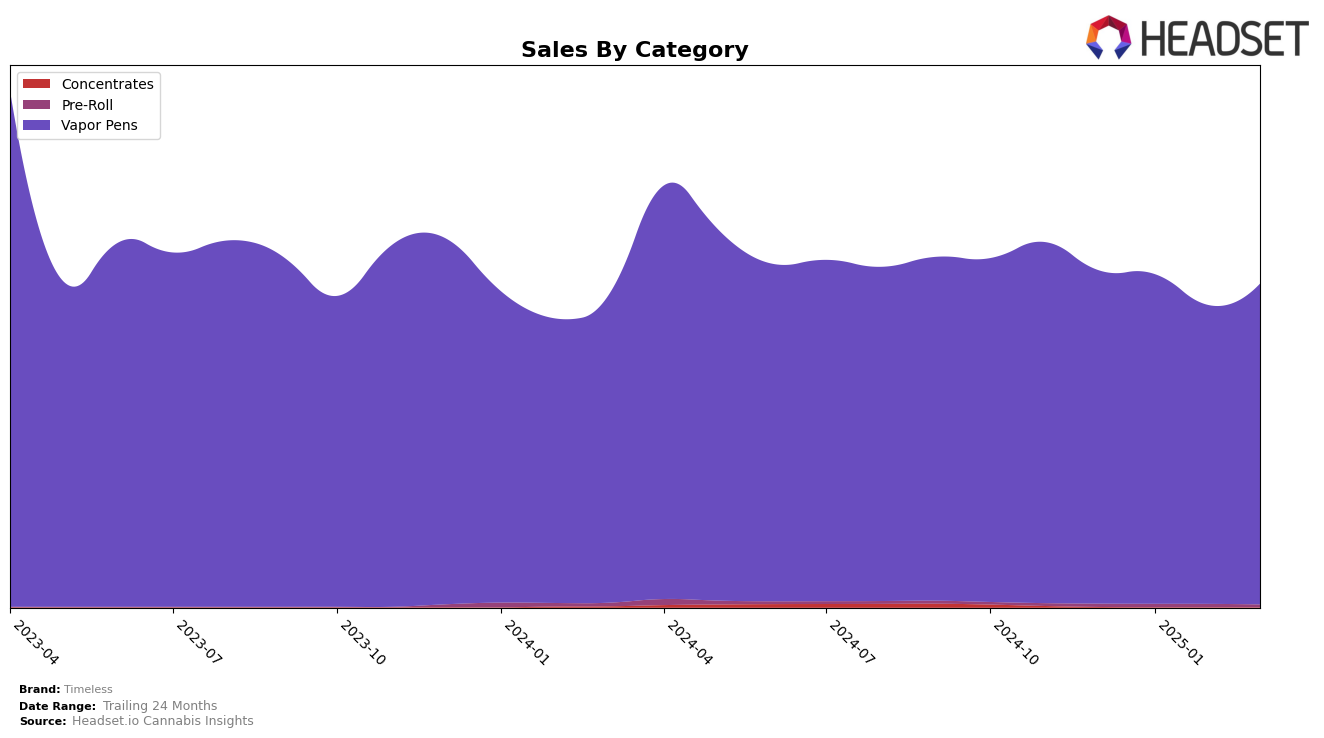

Timeless has shown consistent performance in the Vapor Pens category across several states, with notable stability in Arizona where it maintained a solid rank of 7th from December 2024 through March 2025. This consistency is echoed in New Jersey, where Timeless held the 10th position throughout the same period. However, the brand struggled to break into the top 30 in California, with rankings fluctuating between 54th and 58th, indicating a challenging market environment. In Illinois, Timeless showed a positive trend, moving from 36th to 32nd by February 2025, before a slight dip in March.

In Missouri, Timeless experienced some volatility, with its rank slipping from 16th in January to 19th by March 2025, reflecting a potential shift in consumer preferences or increased competition. Meanwhile, Ohio presents a more dynamic picture, where Timeless improved its position from 19th in January to 15th in February, before settling at 17th in March. The brand's sales in Arizona saw a notable increase from December to March, highlighting its strong foothold in that market. While Timeless has shown resilience and growth in certain regions, the variability in rankings across different states suggests that there may be underlying challenges that need to be addressed to achieve more widespread success.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Timeless has maintained a steady presence, consistently ranking at 7th place from December 2024 through March 2025, with a slight dip to 8th in January 2025. This stability in rank is noteworthy given the fluctuations experienced by other brands. For instance, Jeeter saw a rise to 7th in January before settling back to 8th, while Dime Industries experienced a slight decline from 4th to 5th by March. Despite these shifts, Timeless's sales have shown a positive trend, peaking in March 2025, indicating strong consumer loyalty and effective marketing strategies. Meanwhile, iLava has remained stable at 9th, and WTF Extracts experienced a notable drop from 4th to 6th, potentially opening opportunities for Timeless to capitalize on market share. This analysis highlights Timeless's resilience and potential for growth amidst a dynamic competitive environment.

Notable Products

In March 2025, the top-performing product from Timeless was Chill - Blue Dream Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank for four consecutive months with sales reaching 3952 units. Rest - Blackberry Kush Distillate Cartridge (1g) also showed consistent performance, holding the second position since December 2024. Energy- Alaskan Thunder Fuck Distillate Cartridge (1g) remained steady at third place throughout the same period. Chill - Cactus Chiller Distillate Disposable (1g) improved its rank from fifth in December to fourth in March. Notably, Rest - Blackwater OG Distillate Cartridge (1g) debuted at fifth place in March, indicating a strong market entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.