Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

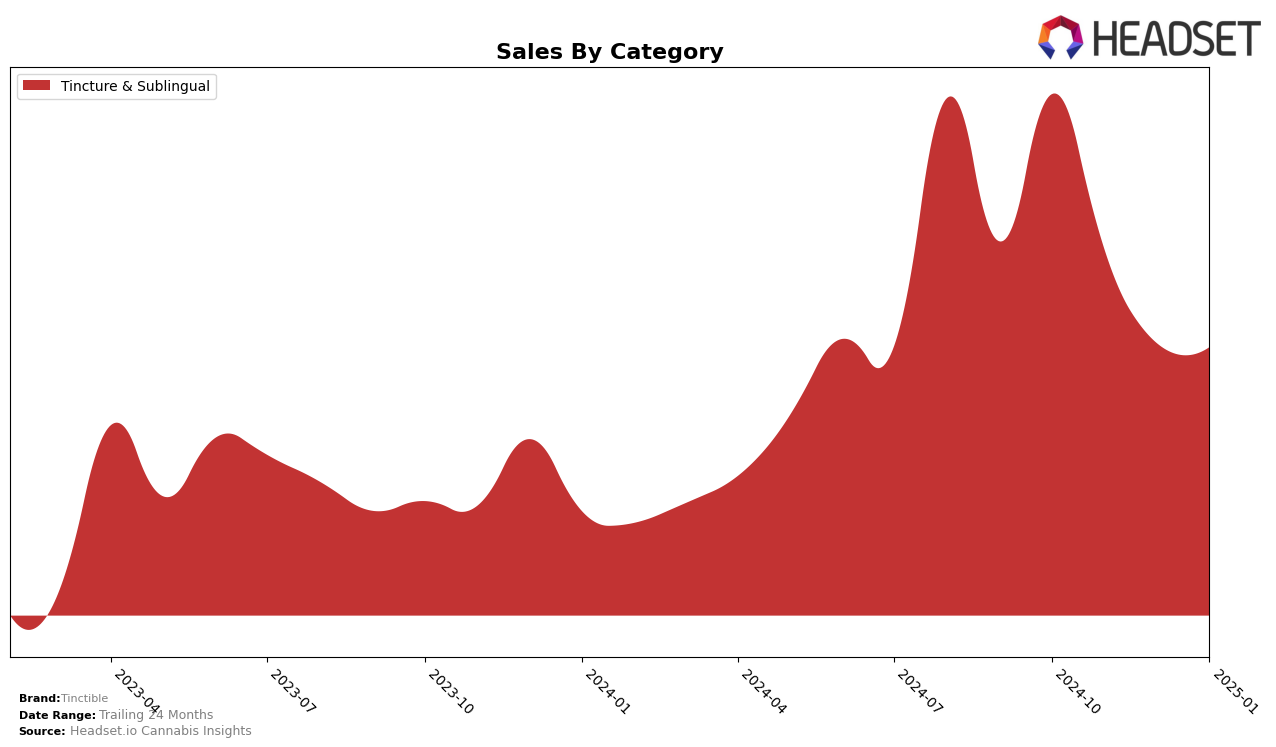

Tinctible has shown varying performance across different states and categories over the recent months. In Ohio, the brand has maintained a presence in the Tincture & Sublingual category, with rankings fluctuating from 4th in October 2024 to 7th in December 2024, before improving to 5th in January 2025. This indicates a competitive position, though the brand's sales have seen a downward trend from $48,230 in October 2024 to $28,395 in January 2025. The ability to remain within the top 10 despite declining sales suggests a strong brand loyalty or market strategy that keeps it relevant among consumers.

In other states, Tinctible's absence from the top 30 rankings in the Tincture & Sublingual category could be seen as a challenge, highlighting areas for potential growth or increased marketing efforts. The brand's performance in Ohio, however, is a positive indicator of its potential to capture market share if similar strategies are applied in other regions. Understanding the factors driving its success in Ohio could provide insights for replication in other markets. The fluctuating rankings and sales figures suggest that while Tinctible is a recognized name, there is room for strategic enhancements to boost its standing across various states and categories.

Competitive Landscape

In the Ohio Tincture & Sublingual category, Tinctible has experienced notable fluctuations in its market position over the past few months. Starting in October 2024, Tinctible held a strong 4th place but saw a decline to 6th in November and further to 7th in December, before rebounding slightly to 5th in January 2025. This volatility in rank is mirrored by a consistent decrease in sales over the same period, suggesting challenges in maintaining market share against competitors. Notably, Doctor Solomon's has maintained a steady 2nd place, indicating a strong and stable presence in the market. Meanwhile, Avexia has shown resilience, consistently ranking 4th or better, with sales figures that significantly outpace Tinctible's, especially in December 2024. The competitive landscape suggests that while Tinctible is a key player, it faces significant pressure from well-entrenched brands like Doctor Solomon's and Avexia, necessitating strategic adjustments to regain and sustain higher rankings and sales.

Notable Products

In January 2025, the top-performing product from Tinctible was Squeeze In- THC/CBG/CBD 2:1:1 Relief Blue Raspberry Gel 11-Pack, maintaining its first-place rank from December 2024 with notable sales of 582 units. The Squeeze In- CBD/THC 1:1 Spark Watermelon Gel 11-Pack climbed to the second position, up from third in December, reflecting a positive sales trend. The Squeeze In - THC/CBN 3:1 Blueberry Lavender Sleep Gel 11-Pack, despite being the leader in October and November, dropped to third place with a significant decline in sales. The Squeeze In - Island Punch Gel 11-Pack and the Squeeze In - THC Strawberry Elderflower Gel 10-Pack both settled at fourth place, with minimal sales figures compared to the top three. Overall, the rankings in January indicate a strong preference for products with a balanced cannabinoid profile, while those focused on specific effects like sleep saw a decrease in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.