Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

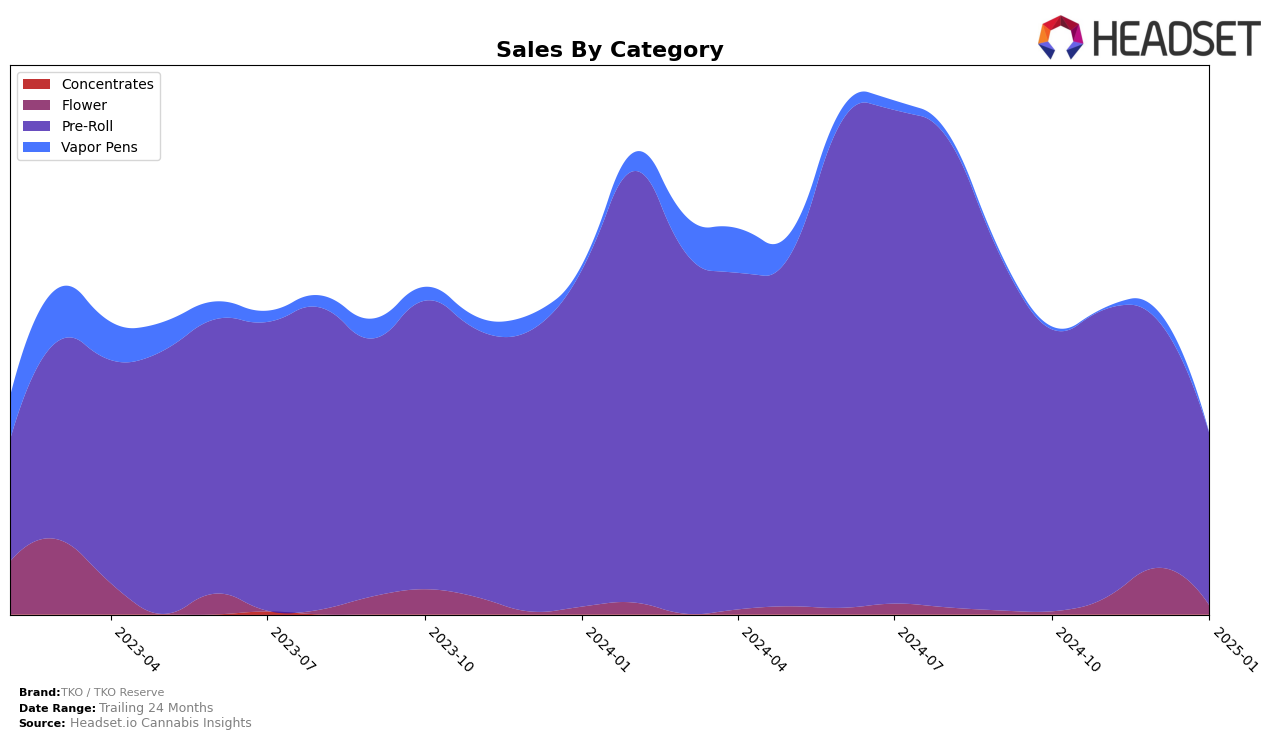

In the state of Oregon, TKO / TKO Reserve has shown a consistent presence in the Pre-Roll category, maintaining its position within the top 30 brands from October 2024 through January 2025. Despite a slight decline in sales from November to January, which saw a drop from $164,373 to $96,947, the brand managed to hold onto the 30th rank by January 2025. This indicates a resilience in maintaining market presence even as sales figures wavered, suggesting a loyal customer base or effective distribution strategies that keep it competitive within the state.

TKO / TKO Reserve's performance across other states and categories is notably absent from the top 30 rankings, which could be seen as a potential area for growth or a reflection of strategic focus on the Oregon market. The absence of rankings in other states might suggest that the brand's influence or distribution network is either limited or highly concentrated within Oregon. This strategic concentration could be a deliberate choice to dominate the Pre-Roll category locally before expanding further afield. However, without additional data on other states or categories, these observations remain speculative but highlight a key area of potential development for the brand.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, TKO / TKO Reserve has experienced a notable shift in its market positioning. Starting from October 2024, TKO / TKO Reserve held a steady rank of 23, but by January 2025, it had slipped to 30. This decline in rank is accompanied by a decrease in sales, which fell from a high in October 2024 to a lower figure in January 2025. In contrast, competitors like Emerald Fields Cannabis and Altered Alchemy have shown upward trends in sales and rankings, with Altered Alchemy jumping from 48 to 28 over the same period. Meanwhile, Piff Stixs maintained a stronger market presence despite a slight drop in rank from 11 to 29. These dynamics suggest that while TKO / TKO Reserve remains a significant player, it faces increasing competition and may need to strategize to regain its earlier momentum in the Oregon pre-roll market.

Notable Products

In January 2025, the top-performing product from TKO / TKO Reserve was No Drama Llama Pre-Roll (1g), securing the first rank with sales of 2097 units. Following closely was White Runtz Pre-Roll (1g) in the second position. Obama Kush Pre-Roll (1g) maintained a consistent rank at third place, having also been third in October and November 2024. New entrants Lava Cake Pre-Roll 2-Pack (1.5g) and Dragonfruit Diesel Pre-Roll 2-Pack (1.5g) captured the fourth and fifth spots, respectively. The rankings show a notable shift with the introduction of new products, impacting the pre-roll category's competitive landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.