Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

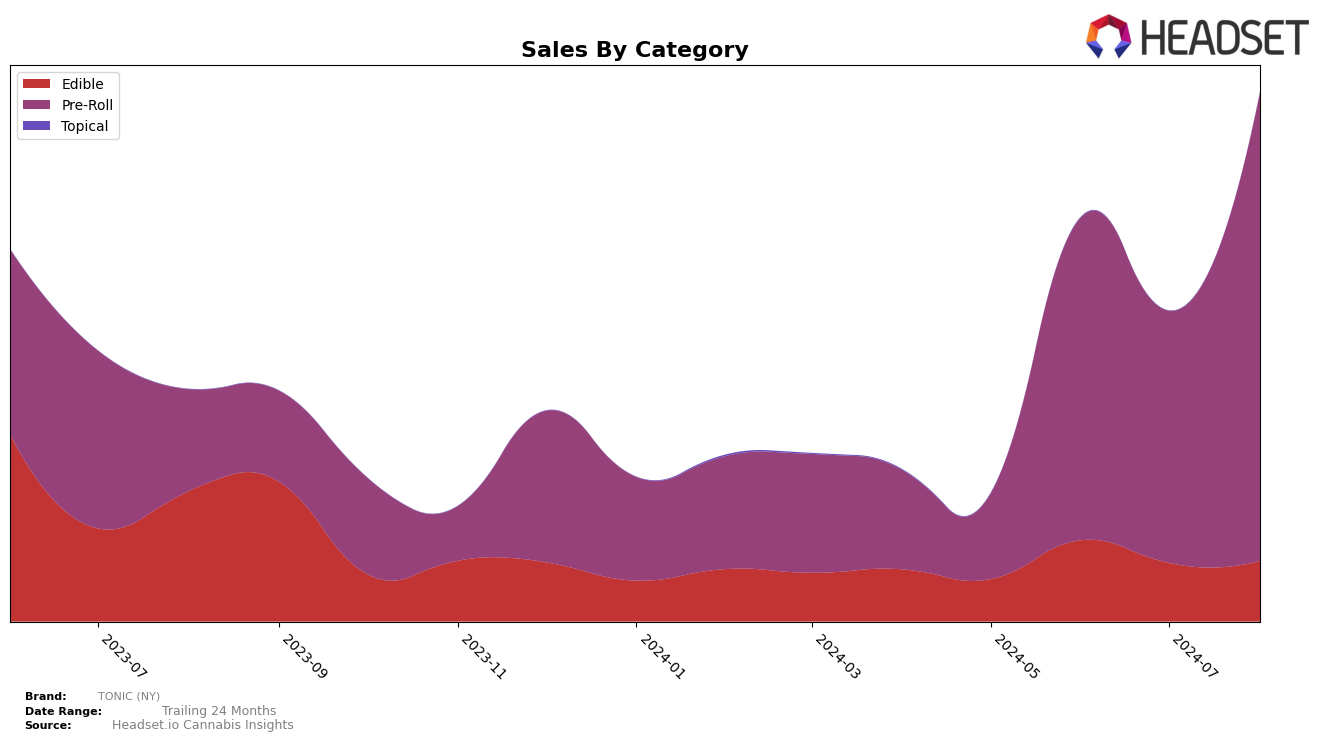

TONIC (NY) has demonstrated a mixed performance across different categories in New York over the recent months. In the Edible category, the brand has struggled to break into the top 30, with rankings consistently hovering in the 40s from May to August 2024. Despite this, there was a notable increase in sales from May to June, nearly doubling, but subsequent months saw a decline, indicating potential volatility in consumer demand or market competition. This suggests that while there is some interest in TONIC's edible products, it hasn't yet translated into a strong market position.

Conversely, TONIC (NY) has shown a more promising trend in the Pre-Roll category within New York. The brand has climbed steadily in rankings, moving from 63rd in May to 34th in August 2024. This upward trajectory is matched by a significant increase in sales, particularly notable from June to August, where sales more than doubled. This suggests a growing consumer preference for TONIC's pre-roll products, and it positions the brand as a rising competitor in this category. However, staying ahead will require maintaining this momentum and possibly addressing any challenges faced in the edible segment.

Competitive Landscape

In the highly competitive New York pre-roll category, TONIC (NY) has shown a significant upward trend in its rankings over the past few months. Starting from a rank of 63 in May 2024, TONIC (NY) has climbed steadily to reach the 34th position by August 2024. This upward movement is notable, especially when compared to competitors like Lobo, which saw a decline from 19th to 31st place over the same period, and Miss Grass, which dropped from 16th to 39th place. Meanwhile, OHHO and Zizzle have maintained relatively stable rankings, with OHHO improving slightly from 42nd to 35th and Zizzle fluctuating around the 27th to 32nd positions. This positive trend for TONIC (NY) suggests a growing market presence and increased consumer preference, positioning it as an emerging player to watch in the New York pre-roll market.

Notable Products

In August 2024, the top-performing product from TONIC (NY) was Sessions - Blueberry Milkshake Pre-Roll 2-Pack (1g) which maintained its leading position from July, achieving notable sales figures of 2971. Sessions - Cosmic Crasher Pre-Roll 5-Pack (2.5g) held steady at the second rank, showing a consistent performance. The CBD/THC 1:1 Blueberry Peach Chill Chews 20-Pack (100mg CBD, 100mg THC) remained in third place, demonstrating stable sales over the months. Sessions - Gummy Bears Pre-Roll (1g) continued to occupy the fourth spot, with minor fluctuations in sales. Lastly, Sessions - Peanut Butter Bomb Pre-Roll 5-Pack (2.5g) kept its fifth position after entering the rankings in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.