Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

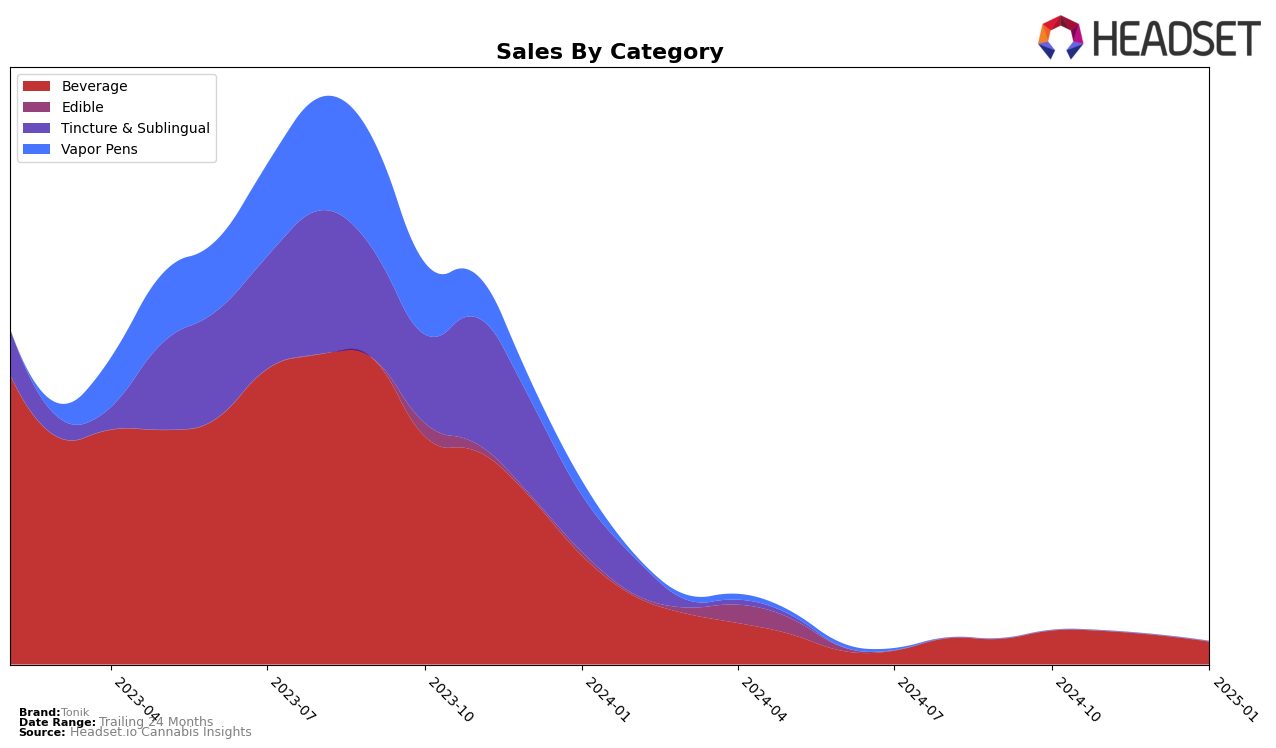

Tonik's performance in the beverage category in California demonstrates a slight decline over the observed months. Initially holding steady at the 20th rank from October through December 2024, the brand slipped to 22nd place in January 2025. This drop in ranking coincides with a noticeable decrease in sales, from $21,833 in October to $14,663 by January. The consistent rank of 20th for three consecutive months suggests a stable position within the top 30, but the subsequent decline indicates potential challenges in maintaining market share or increased competition in the beverage category.

Notably, Tonik did not appear in the top 30 rankings for any other states or provinces, which may suggest limited market penetration outside of California or perhaps a strategic focus on this particular state. The absence from other regional rankings could be a point of concern or an area for potential growth, depending on the brand's overall strategy. The data highlights the importance of monitoring both sales trends and competitive positioning to adapt strategies effectively in a dynamic market environment.

Competitive Landscape

In the competitive California beverage market, Tonik has maintained a steady presence, consistently ranking 20th from October to December 2024 before slipping to 22nd in January 2025. This slight decline in rank coincides with a downward trend in sales, from $21,833 in October to $14,663 in January. Meanwhile, Treesap has shown a positive trajectory, climbing from 23rd to 20th place, with sales increasing from $13,796 in October to $18,273 in January, surpassing Tonik's sales. Don Primo and Happy Daze have seen fluctuating ranks, with Don Primo re-entering the top 20 in December and Happy Daze maintaining a presence only in November and January. 5G (530 Grower) has shown a consistent improvement in rank, moving from 25th to 21st, indicating a potential threat to Tonik's market position. These dynamics suggest that while Tonik remains a significant player, it faces increasing competition from brands like Treesap and 5G, which are gaining momentum in both rank and sales.

Notable Products

In January 2025, Mother Pucker Lemonade (5mg) emerged as the top-performing product for Tonik, climbing from its fifth position in December 2024 to first place with notable sales of 215 units. Cherry-AK Syrup (1000mg) maintained a strong presence, securing the second position, a slight drop from its third place in December. Straw-Runtz Nano Syrup (1000mg THC, 2oz, 60ml) experienced a decline, moving from second place in December to third in January. Gdaddy Purp Nano THC Syrup (1000mg) stabilized at fourth place, showing a marginal improvement from its December rank. Meanwhile, Maui Wowie Nano Syrup (1000mg THC, 2oz, 60ml) saw a significant drop from first place in December to fifth in January, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.