May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

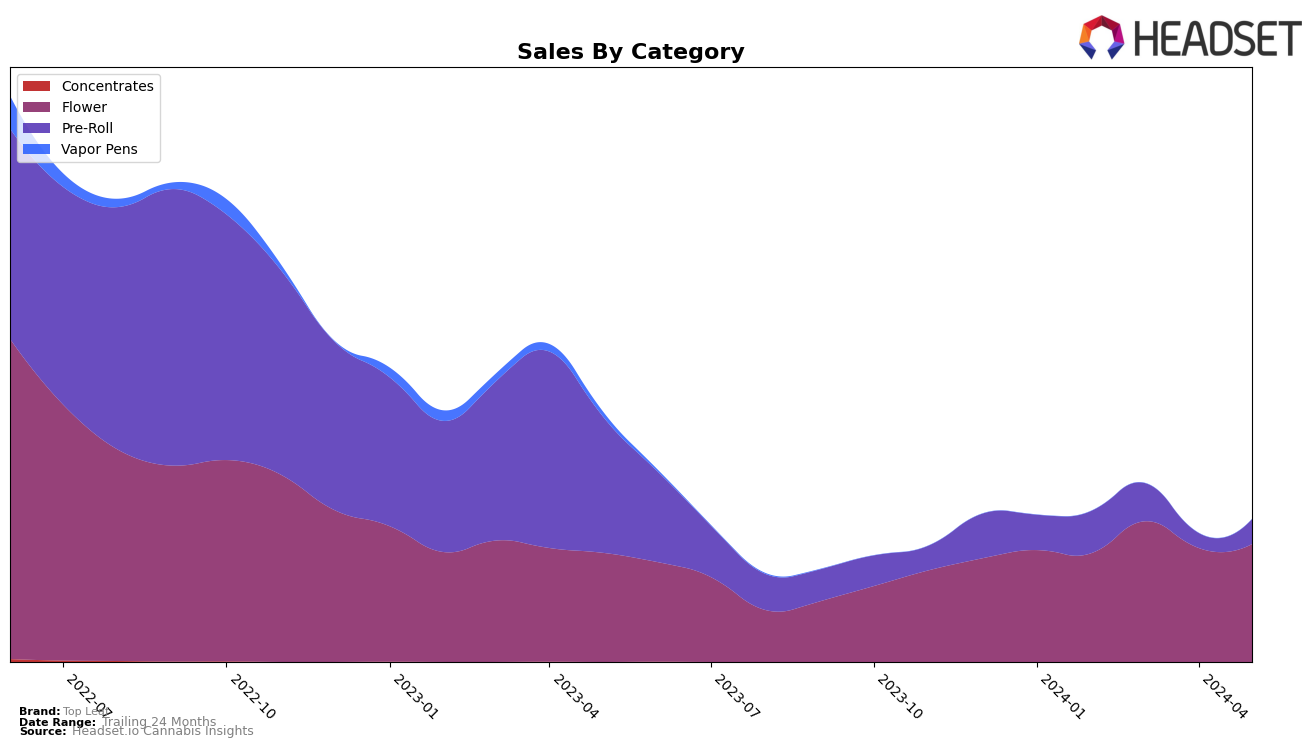

Top Leaf's performance in the Alberta market has shown a consistent decline in the Flower category over the past few months. Starting from a rank of 43 in February 2024, the brand has dropped to rank 53 by May 2024. This downward trend is also reflected in their sales, which have decreased from $123,910 in February to $93,873 in May. In the Pre-Roll category, Top Leaf's presence has been even less prominent, failing to make it into the top 30 brands in April 2024, and ranking 100 by May 2024, indicating potential challenges in maintaining market share in this category.

In contrast, Top Leaf has shown some resilience in the Saskatchewan market, particularly in the Flower category. After not ranking in the top 30 in February 2024, the brand climbed to rank 25 in March, though it experienced a dip to rank 34 in April. However, by May, Top Leaf had made a strong recovery to rank 21. This fluctuating yet overall positive trend is mirrored in their sales figures, which saw a significant rebound from $31,212 in April to $54,209 in May. This indicates that while the brand faces challenges, it also has the capability to recover and improve its standing in certain markets.

Competitive Landscape

In the highly competitive Alberta Flower market, Top Leaf has experienced a noticeable decline in rank and sales over the past few months. Starting from February 2024, Top Leaf's rank dropped from 43rd to 53rd by May 2024, with sales following a similar downward trend. This decline is particularly significant when compared to competitors like Nugz, which despite also experiencing a drop in rank from 27th to 49th, maintained relatively higher sales figures. Additionally, Pistol and Paris showed a more volatile ranking pattern but managed to surpass Top Leaf in both rank and sales by May 2024. Another notable competitor, Holy Mountain, although experiencing a drop from 21st to 51st, still maintained higher sales than Top Leaf. These trends indicate that Top Leaf is facing increasing pressure from both established and emerging brands, necessitating strategic adjustments to regain its competitive edge in the Alberta Flower market.

Notable Products

In May-2024, the top-performing product for Top Leaf was Alaskan TF 3.5g in the Flower category, maintaining its first-place ranking from the previous three months, with sales of 1264 units. The Alaskan TF Pre-Roll 3-Pack 1.5g followed closely in the second position, consistent with its rank in April-2024 and showing a notable increase in sales to 1209 units. LA Kush Cake Pre-Roll 3-Pack 1.5g secured the third spot, previously holding the top position in February-2024. Motor Breath 28g held steady at fourth place, as it did in April-2024. Britney's Frozen Lemons 3.5g entered the rankings for the first time in May-2024, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.