Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

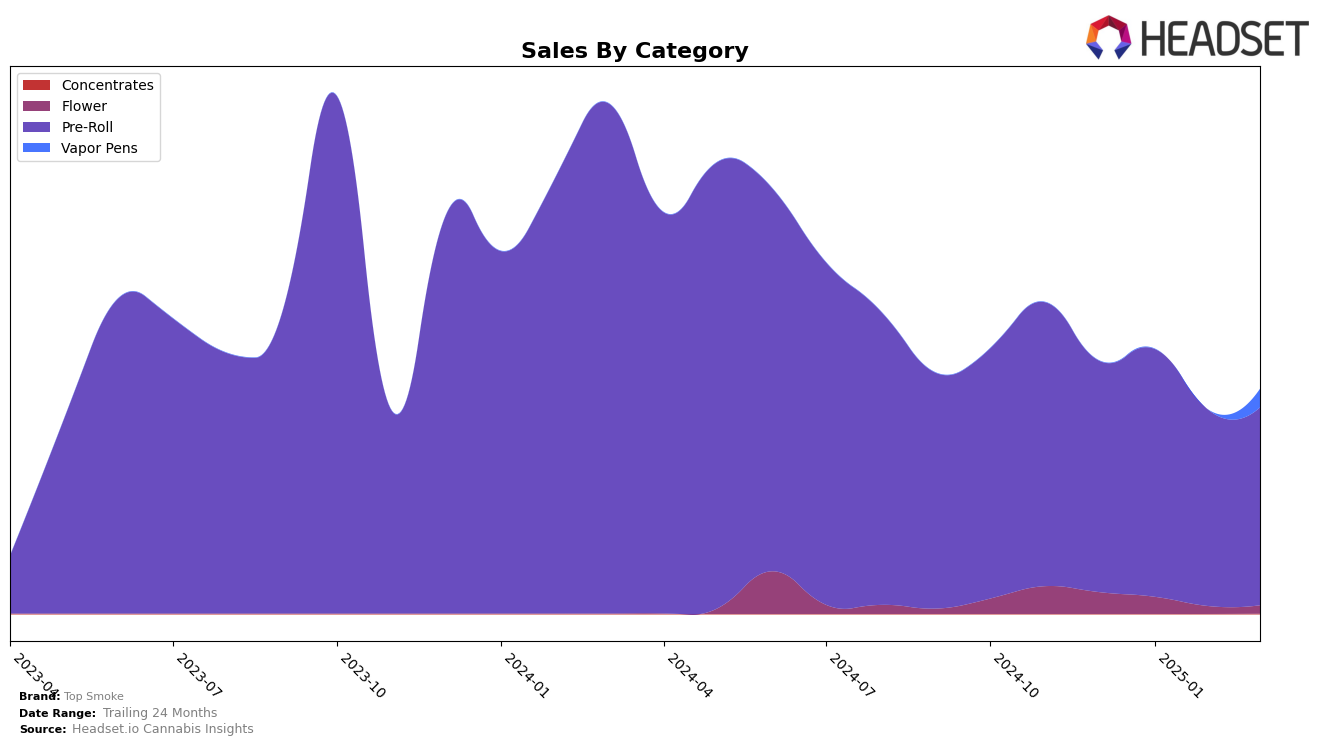

Top Smoke has demonstrated varied performance across different categories and states in recent months. In the Michigan market, the brand's presence in the Pre-Roll category has seen a slight decline. From December 2024 to March 2025, Top Smoke's rank shifted from 12th to 18th, indicating a downward trend. Despite this, the brand maintained a solid position within the top 20, which suggests a resilient market presence and potential for recovery. Meanwhile, the Vapor Pens category in Michigan did not see Top Smoke in the top 30 for several months until it appeared at rank 95 in March 2025, highlighting a significant opportunity for growth or a potential area for strategic focus.

The sales trajectory in Michigan's Pre-Roll category also reflects interesting dynamics. While sales figures in December 2024 were robust, there was a noticeable dip in February 2025, followed by a slight recovery in March. This fluctuation could be attributed to seasonal trends or competitive pressures within the state. The absence of Top Smoke from the top 30 in the Vapor Pens category prior to March 2025 suggests either a recent entry into this segment or a need to strengthen its competitive strategies. The brand's performance across these categories highlights the importance of maintaining market adaptability and strategic planning to capitalize on emerging opportunities and address challenges effectively.

Competitive Landscape

In the competitive landscape of Michigan's Pre-Roll category, Top Smoke has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially ranked 12th in December 2024, Top Smoke saw a slight improvement to 11th in January 2025, but then dropped to 15th and 18th in the subsequent months. This decline in rank coincides with a decrease in sales, particularly evident when compared to competitors such as Doobies, which consistently maintained a higher rank, peaking at 8th place in January and February 2025. Meanwhile, Swisher made a significant leap from 49th in December 2024 to 16th by March 2025, surpassing Top Smoke. The competitive pressures from brands like Goldkine and Play Cannabis, which also hovered around the top 20, suggest that Top Smoke needs strategic adjustments to regain its footing in the market.

Notable Products

In March 2025, Lemon Cherry Pre-Roll (1g) emerged as the top-performing product for Top Smoke, climbing to the number one rank with sales of 7,664 units. This product showed a consistent improvement in its ranking from fourth in January to second in February. Purple Punch Infused Pre-Roll (1g) made a significant debut in March, securing the second spot with notable sales figures. Runtz Pre-Roll (1g) maintained a strong presence, finishing third, although it dropped slightly from its previous second-place ranking in February. GG4 Pre-Roll (1g) rounded out the top four, despite a slight decline in sales compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.