Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

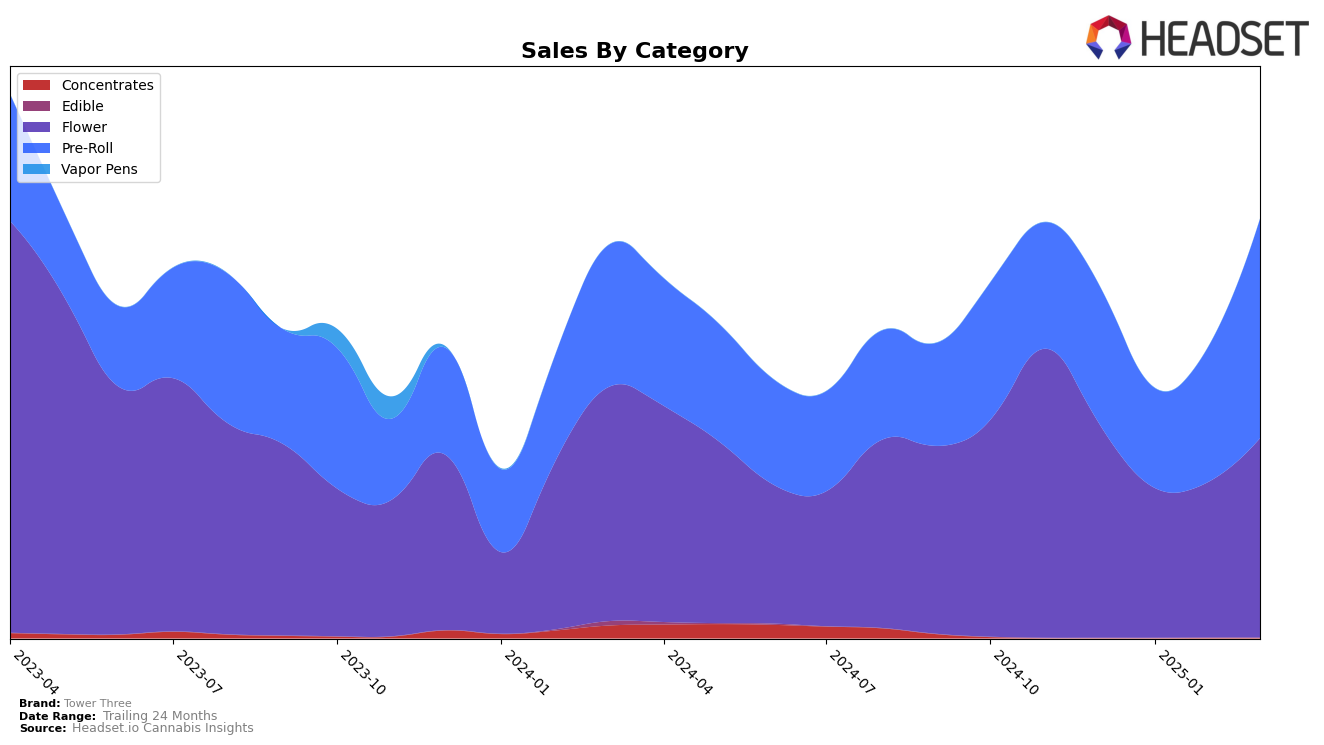

In the Massachusetts market, Tower Three has shown fluctuating performance across different categories. In the Flower category, the brand struggled to break into the top 30, with rankings hovering in the low 40s, peaking at 37th in March 2025. Despite not being in the top 30, there was a positive trend in sales from January to March, suggesting a potential improvement in consumer interest or market strategy. This indicates that while Tower Three is not a leading player in the Flower category, there is underlying momentum that could translate into better rankings if sustained.

Conversely, Tower Three's performance in the Pre-Roll category in Massachusetts has been more promising. The brand saw a significant climb from 38th in January 2025 to 14th by March 2025, reflecting a strong upward trajectory. This improvement is notable, especially considering the brand's ability to break into the top 30 and then advance to a higher tier within a short period. The Pre-Roll category appears to be a strength for Tower Three, as evidenced by the substantial increase in sales and ranking, positioning them as a competitive player in this segment.

Competitive Landscape

In the competitive landscape of the Massachusetts Pre-Roll category, Tower Three has shown notable fluctuations in its rankings and sales trajectory. Starting from December 2024, Tower Three was ranked 28th, experiencing a dip in January 2025 to 38th, before climbing back to 26th in February and achieving a significant leap to 14th by March 2025. This upward trend in March is particularly impressive, indicating a strong recovery and growth in market presence. In contrast, Miss Grass also improved its rank from 27th in December to 16th in March, suggesting a competitive push in the same period. Meanwhile, Glorious Cannabis Co. maintained a relatively stable position, ranking between 8th and 13th throughout the months, consistently outperforming Tower Three. Headliners and Springtime also demonstrated competitive resilience, with Headliners improving from 19th to 15th and Springtime maintaining a strong presence around the 13th position. Tower Three's sales surged in March 2025, surpassing those of Headliners and closing the gap with other competitors, signaling a potential shift in consumer preference and brand strength in the Massachusetts market.

Notable Products

In March 2025, Moonbutter Pre-Roll (1g) emerged as the top-performing product for Tower Three, climbing from second place in February to first place, with impressive sales reaching 5838 units. Mike & Gary Pre-Roll (1g) maintained a strong presence, advancing from third to second place, with sales totaling 4357 units. Black Maple Pre-Roll (1g) experienced a slight decline, moving from first in February to third in March. Glitter Bomb Pre-Roll (1g) improved its position from fifth to fourth place, showing a significant sales increase. Butterwolf Pre-Roll (1g), however, saw a decline from first in December to fifth in March, indicating a notable drop in its ranking over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.