Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Trail Blazin Productions has shown varied performance across different categories and states. In the Pre-Roll category in Washington, the brand did not make it to the top 30 rankings from August to November 2025. This indicates a challenging period for the brand in this particular category within the state. The absence from the top 30 rankings could suggest either a decline in market presence or increased competition. The sales figure for August was $35,746, but subsequent months did not have available data, which could imply a potential drop in sales or a strategic withdrawal from the category.

It's crucial to note that the lack of presence in the top 30 rankings for several months may reflect on Trail Blazin Productions' market strategy or external market conditions. While the brand's performance in Washington's Pre-Roll category did not show significant progress, it leaves room for speculation about their performance in other states or categories. This could either suggest a concentrated effort in other markets or a need to reassess their strategy in Washington. Further insights into their performance in other categories and states would provide a more comprehensive picture of their market positioning and strategic direction.

Competitive Landscape

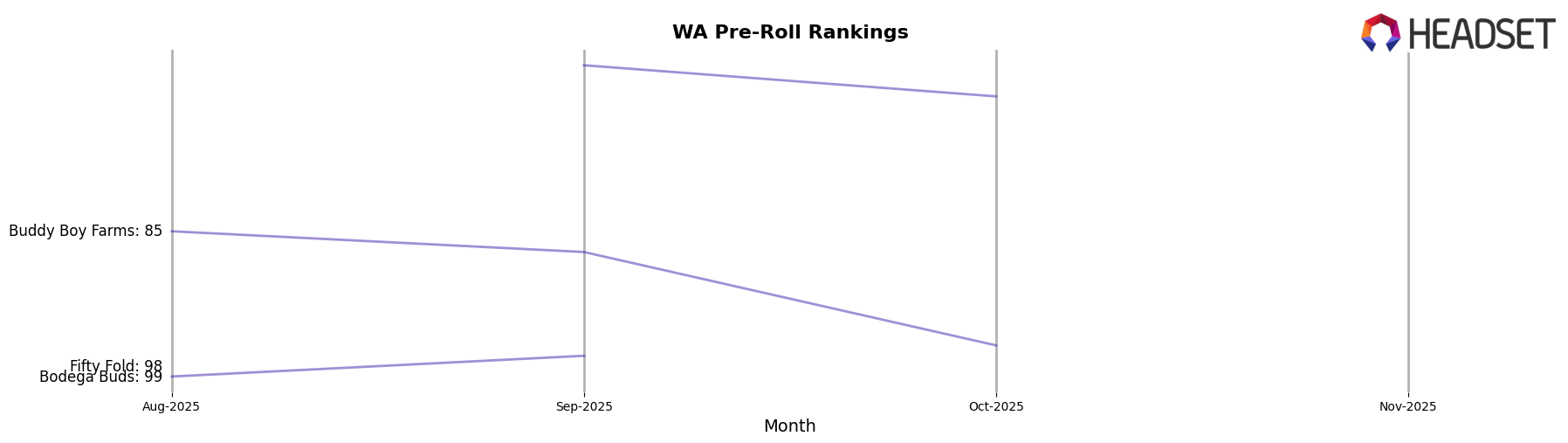

In the competitive landscape of Washington's Pre-Roll category, Trail Blazin Productions has shown a notable entry into the top 100 brands, securing the 97th rank in November 2025. This marks a significant milestone as the brand was not ranked in the top 20 in the preceding months. In comparison, Khalifa Kush maintained a stronger presence with ranks of 69 and 72 in September and October respectively, indicating a more consistent performance. Meanwhile, Buddy Boy Farms and Bodega Buds experienced a downward trend, with Buddy Boy Farms dropping from 85 to out of the top 100 by November, and Bodega Buds slipping from 97 to unranked. Fifty Fold was also absent from the rankings after August. This dynamic shift highlights Trail Blazin Productions' potential to capture market share from competitors who are experiencing declining sales and ranks, positioning it as an emerging player to watch in the Washington Pre-Roll market.

Notable Products

In November 2025, Trail Blazin Productions saw its Amnesia Pre-Roll 2-Pack (1.2g) regain the top position in sales, moving up from third place in October. Amnesia (3.5g) also performed exceptionally well, climbing from fifth to second place, with sales figures reaching 235 units. Dutch #47 Pre-Roll 2-Pack (1.2g) entered the rankings at third place after being unranked for two months. CBD Pennywise Pre-Roll 2-Pack (1.2g) made its debut in the rankings at fourth place. The 9# Hammer (3.5g) product maintained a consistent presence, holding steady at fifth place in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.