Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

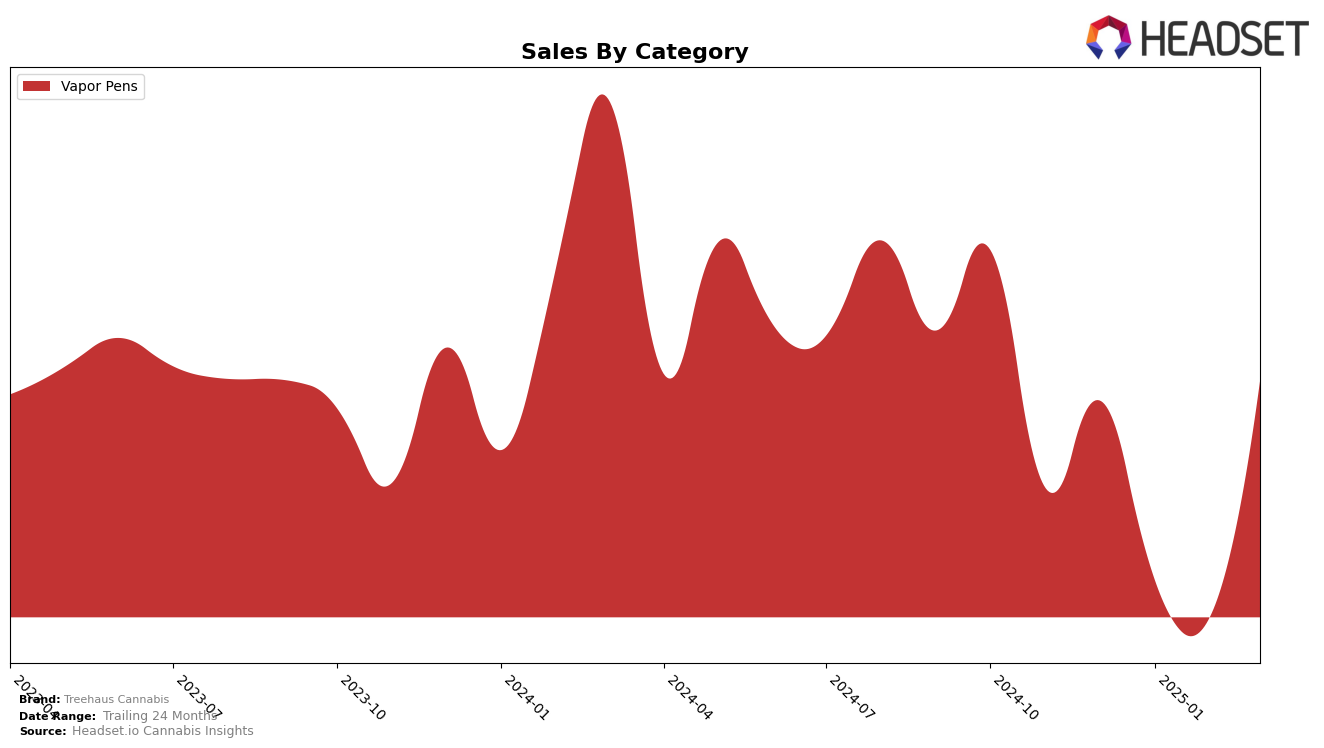

Treehaus Cannabis has shown varying performance across different states and categories in recent months. In Washington, the brand has demonstrated a commendable presence in the Vapor Pens category. Despite a slight dip in rankings from December 2024 to February 2025, Treehaus Cannabis made a notable recovery in March 2025, climbing back into the top 30 at rank 27. This upward trend suggests a positive reception and growing market share in Washington's competitive vapor pen market. Conversely, in Ohio, Treehaus Cannabis did not appear in the top 30 rankings for Vapor Pens, indicating a potential area for growth or increased marketing efforts to gain traction in this market.

It’s interesting to note that while Treehaus Cannabis has not yet secured a top 30 position in Ohio, their sales figures in Washington show a fluctuating yet resilient performance. The brand's sales in Washington experienced a dip from December 2024 to February 2025, before rebounding in March 2025. This recovery in sales aligns with their improved ranking, suggesting effective strategies may have been implemented to regain consumer interest and market position. The brand's ability to rebound in Washington could serve as a blueprint for potential strategies to increase their presence in other states like Ohio, where they are currently absent from the top-tier rankings.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Treehaus Cannabis has shown a fluctuating performance in recent months, with its rank improving from 39th in January 2025 to 27th by March 2025. This improvement is notable when compared to competitors such as Thrills, which experienced a decline from 18th to 26th in the same period. Despite this positive trend, Treehaus Cannabis faces stiff competition from brands like Terpnado, which maintained a relatively stable position, and 5Th House Farms, which consistently ranked higher. The sales data indicates that while Treehaus Cannabis saw a recovery in March 2025, its sales figures were still trailing behind these competitors, suggesting a need for strategic initiatives to capture more market share and enhance brand visibility in the Washington vapor pen market.

Notable Products

In March 2025, the top-performing product from Treehaus Cannabis was the Purple Hindu Kush Distillate Cartridge (1g) in the Vapor Pens category, maintaining its consistent rank of 1 since December 2024, with sales of 847 units. The Electric Lemonade Distillate Cartridge (1g) secured the second position, climbing from the third rank in February 2025, with notable sales improvement to 591 units. Demon Slayer CO2 Cartridge (1g) experienced a slight drop in rank from second in February to third in March, with sales reaching 500 units. New entries in the rankings for March include the Electric Lemonade Cured Resin Disposable (1g) and Purple Hindu Kush Cured Resin Disposable (1g), positioned at fourth and fifth, respectively. These products indicate a growing interest in cured resin disposables within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.