Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

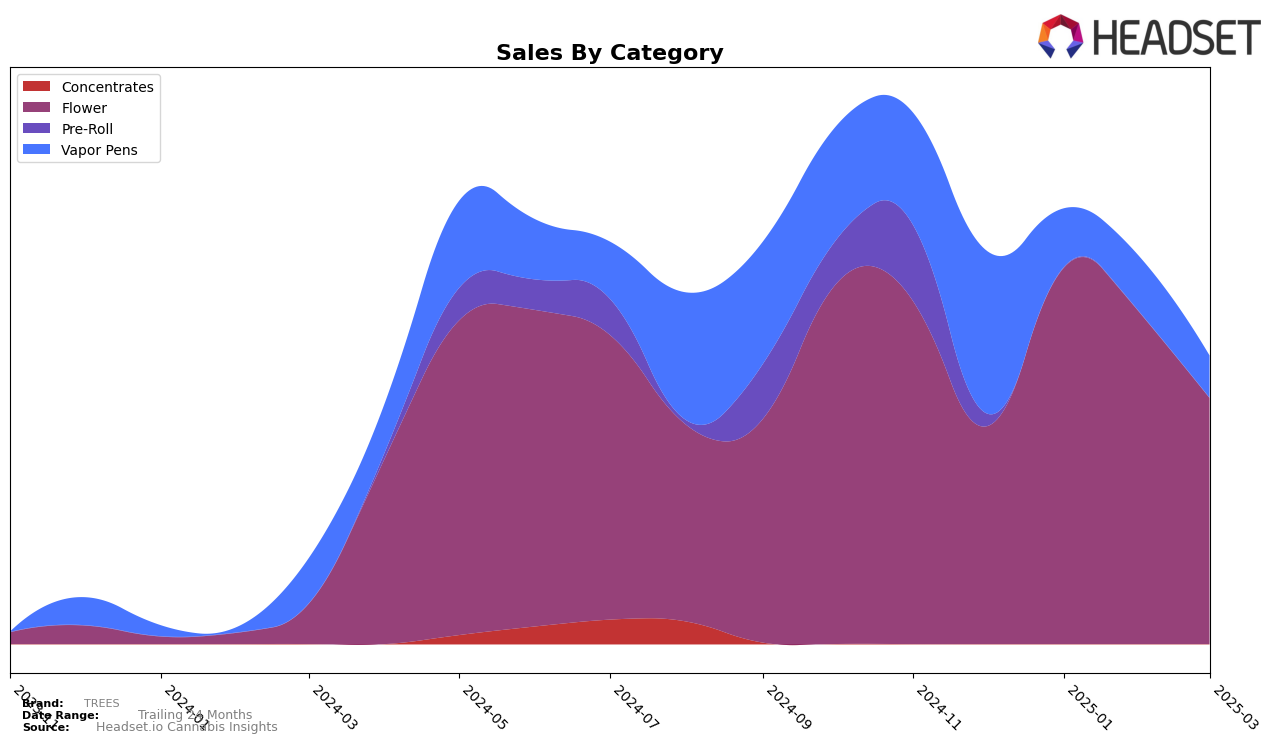

In the competitive market of Colorado, TREES has shown notable performance in the Flower category. From December 2024 to March 2025, TREES made a significant jump from the 14th position to 5th in January, maintaining this rank in February, before slipping slightly to 9th in March. This upward trajectory in the early months of 2025 reflects a strong market presence and consumer preference for their Flower products, despite a slight decline in sales in March. However, in the Pre-Roll category, TREES did not make it into the top 30 rankings from January to March 2025, which might be an area of concern or opportunity for growth.

When examining the Vapor Pens category in Colorado, TREES experienced a downward trend in rankings, moving from 26th in December 2024 to 52nd by March 2025. This decline suggests challenges in maintaining a competitive edge in this specific category. Despite this, the brand's initial position in the top 30 in December indicates potential that could be leveraged with strategic adjustments. The sales figures for Vapor Pens also reflect this downward trend, highlighting the need for a reassessment of market strategies to regain traction in this category. Overall, while TREES has shown strength in certain areas, there are clear opportunities for improvement in others.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, TREES has demonstrated notable fluctuations in its market position from December 2024 to March 2025. TREES experienced a significant rise in rank from 14th in December 2024 to 5th in January and February 2025, before dropping slightly to 9th in March 2025. This upward movement in early 2025 can be attributed to a substantial increase in sales, particularly in January, where TREES outperformed several competitors. Notably, Silver Lake maintained a consistently strong position, ranking between 6th and 8th, while Antero Sciences and Shift Cannabis showed significant improvements, with Shift Cannabis climbing from 41st in December to 11th in March. Meanwhile, Dro experienced a volatile period, dropping to 17th in January before recovering to 7th by March. These dynamics highlight TREES' competitive edge in early 2025, though the brand must remain vigilant to maintain its ranking amidst the shifting market positions of its rivals.

Notable Products

In March 2025, the top-performing product from TREES was Key Lime Mints Shake (1g) in the Flower category, securing the number one rank with sales of 7,505 units. Cherry Cake Distillate Cartridge (1g) in the Vapor Pens category followed as the second top performer. Pyxy Styx Popcorn (Bulk) made a notable climb to third place from its previous fifth position in February. Caked Up Cherries (Bulk) held steady in the fourth position, while Golden Goat Popcorn (Bulk) entered the top five for the first time. This shift in rankings highlights a strong performance in the Flower category, with multiple products maintaining or improving their standings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.