Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

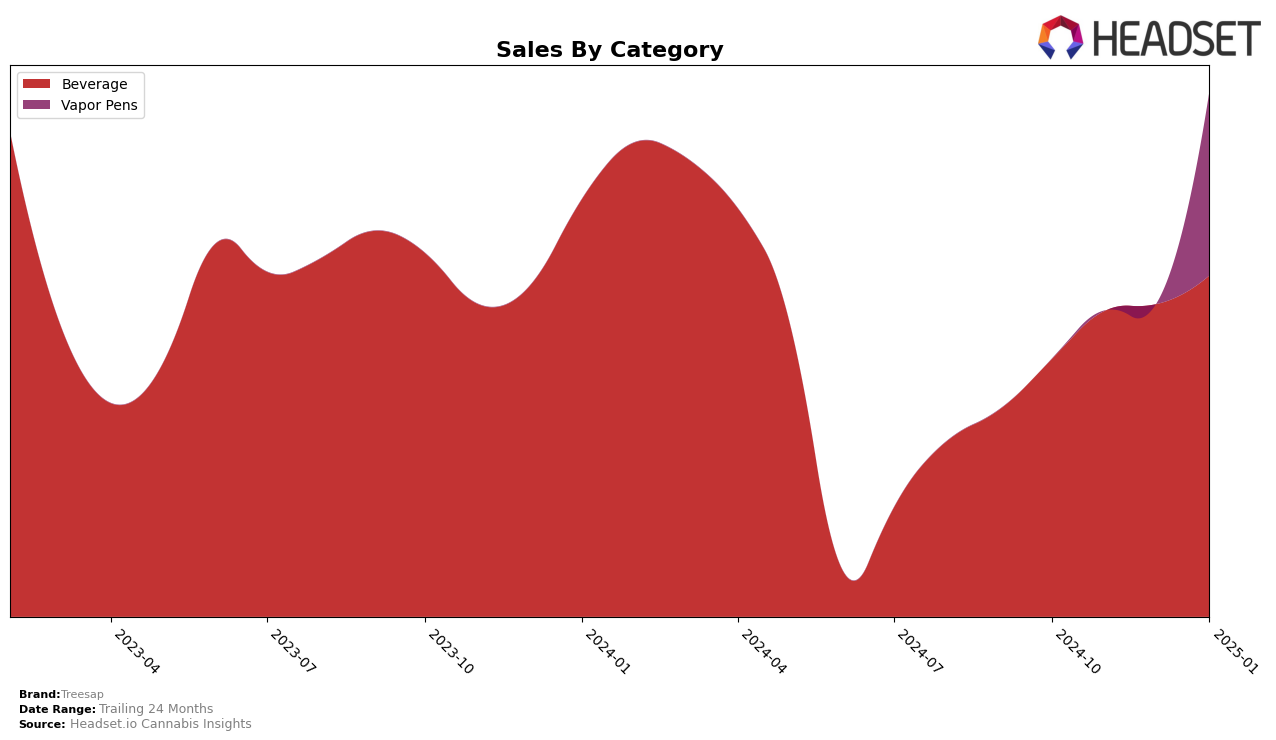

Treesap has shown a consistent upward trajectory in the Beverage category within California. Starting from a rank of 23 in October 2024, the brand steadily climbed to the 20th position by January 2025. This positive movement is indicative of a growing consumer preference and stronger market presence. The steady increase in sales, from $13,796 in October to $18,273 in January, underscores this trend. Such performance suggests that Treesap is effectively enhancing its brand visibility and consumer appeal in the Californian market.

While Treesap's performance in California is promising, their presence in other states and categories remains a mystery due to missing data. The absence of rankings in other categories or states could imply either a strategic focus on the Californian beverage market or challenges in penetrating other markets. It will be interesting to observe whether Treesap will expand its footprint in different states or categories in the coming months. The brand's ability to replicate its Californian success elsewhere could be pivotal for its long-term growth and market diversification.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Treesap has shown a notable upward trajectory in rank and sales from October 2024 to January 2025. Initially ranked 23rd in October, Treesap climbed to the 20th position by January, indicating a positive shift in market presence. This improvement is particularly significant when compared to competitors like Tonik, which fell out of the top 20 by January 2025, and 5G (530 Grower), which remained below Treesap despite a slight upward movement. Meanwhile, Kan+Ade and High Power maintained relatively stable positions, with Kan+Ade consistently ranking higher than Treesap, yet Treesap's sales growth trajectory suggests a narrowing gap. Treesap's strategic improvements have resulted in a significant increase in sales, positioning it as a rising competitor in the market.

Notable Products

In January 2025, the top-performing product from Treesap was the Watermelon Syrup (1000mg, 6oz) in the Beverage category, maintaining its leading position with sales reaching 272 units, up from 251 in December 2024. Tigers Blood Syrup (1000mg THC, 6oz) also in the Beverage category, followed closely in second place, having consistently held the top two positions over the past months. Notably, the Fruity Pebbles Distillate Disposable (1g) emerged as a new contender in the Vapor Pens category, securing the third position. Lemon Warheads Distillate Disposable (1g) and Rainbow Cotton Clouds Distillate All-in-One Disposable (1g) both shared the fourth rank in the same category. This marks a significant entry for the Vapor Pens category, which was not ranked in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.