Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

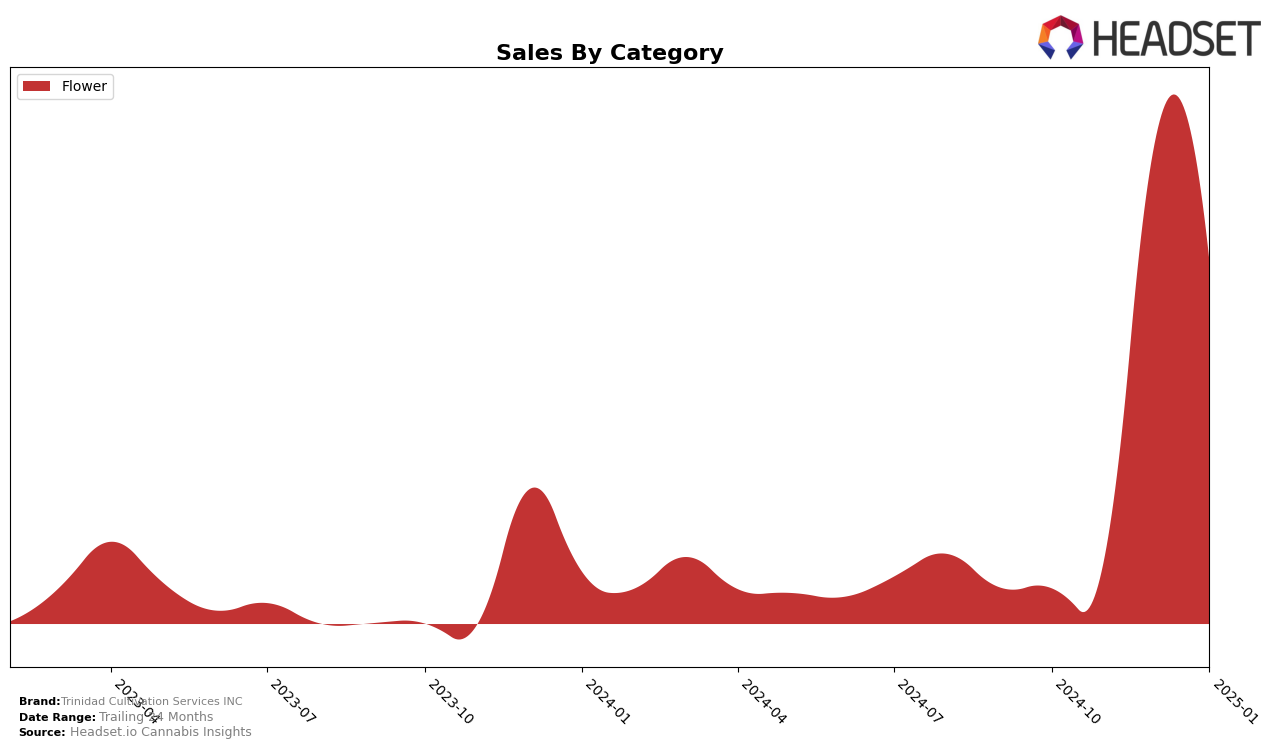

Trinidad Cultivation Services INC has demonstrated significant growth in the Colorado market, particularly within the Flower category. In October 2024, the brand was not ranked in the top 30, indicating a challenging start. However, by November 2024, it had ascended to the 47th position, showing initial signs of improvement. The upward trajectory continued as the brand achieved a remarkable 6th place ranking by December 2024, before slightly declining to 9th place in January 2025. This fluctuation suggests that while Trinidad Cultivation Services INC has made impressive strides, it may still face competition that affects its stability at the top tier.

Despite the slight drop in January 2025, the overall trend for Trinidad Cultivation Services INC in Colorado is positive, with sales figures reflecting this momentum. Notably, the brand's sales surged from $56,345 in October 2024 to $777,516 in December 2024, showcasing a substantial increase in consumer demand and market presence. The brand's ability to climb into the top 10 by December indicates a strong market strategy and product appeal in the Flower category. However, their absence from the top 30 in October highlights the competitive nature of the market and the importance of maintaining consistent performance to secure a lasting position among the leading brands.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Trinidad Cultivation Services INC has shown a remarkable trajectory over the past few months. Starting from a rank outside the top 20 in October 2024, the brand made a significant leap to 6th place by December 2024, before settling at 9th in January 2025. This upward movement indicates a strong surge in market presence, particularly in December, where sales saw a substantial increase. Despite this progress, Trinidad Cultivation Services INC faces stiff competition from brands like Green Dot Labs, which consistently maintained a top 5 position until January 2025, and Equinox Gardens, which also experienced a positive trend, moving from 11th to 8th place. Meanwhile, 710 Labs and Artsy Cannabis Co have shown fluctuating ranks, indicating potential vulnerabilities that Trinidad Cultivation Services INC could exploit to further enhance its market share.

Notable Products

In January 2025, the top-performing product for Trinidad Cultivation Services INC was Apricot Scone (Bulk) in the Flower category, which rose to the first position with sales of $116,603. Scoops of Cream (Bulk) followed closely in the second position, maintaining its strong performance from previous months. Puppy Breath (Bulk) climbed to the third position, showing a significant recovery after not being ranked in December 2024. Apples & Oranges (Bulk) experienced a drop to the fourth position from its top spot in December 2024. Toxic Avenger (Bulk) rounded out the top five, although it saw a decrease in sales compared to its second-place finish in November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.