Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

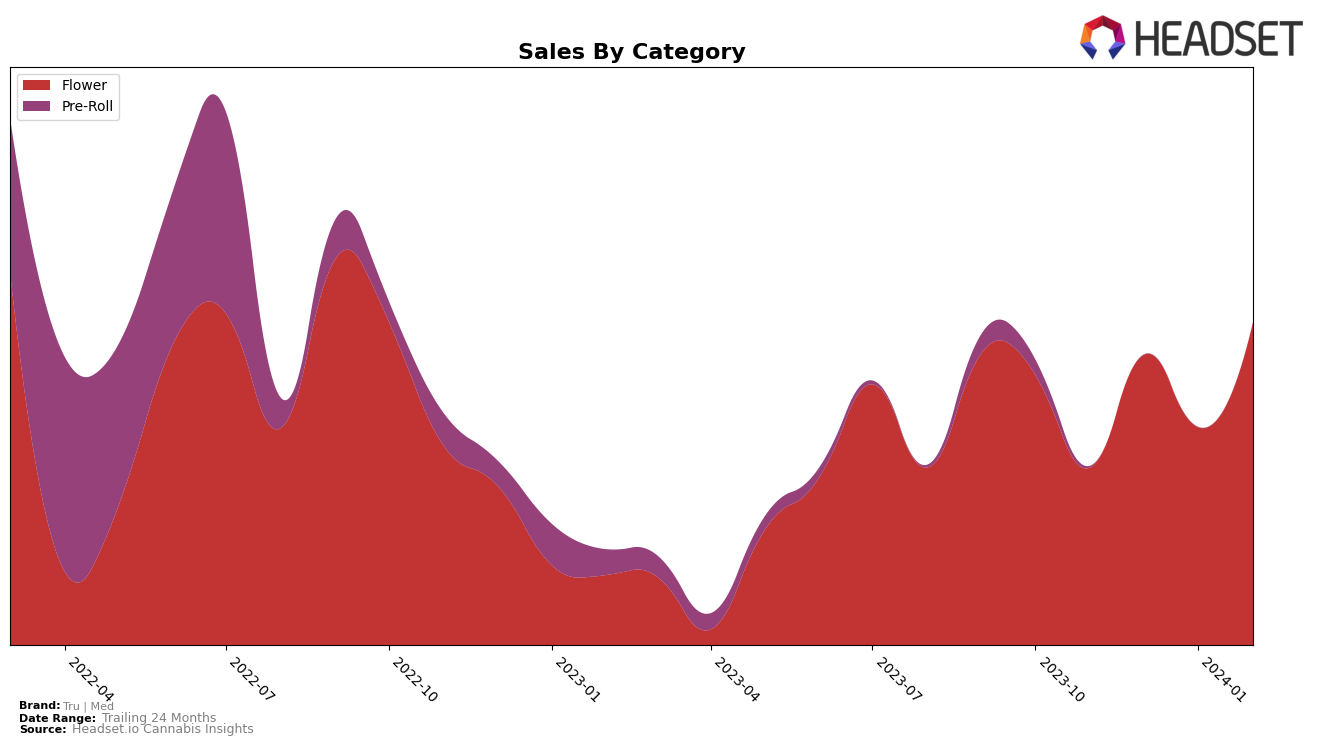

Tru | Med has shown a fluctuating yet noteworthy performance in the Arizona market, particularly in the Flower category. Initially ranking 34th in November 2023, the brand made a significant jump to the 25th position in December, showcasing an impressive upward trajectory. However, the following months saw a slight decline, with the brand dropping back to 32nd in January 2024 and then slightly improving to 30th in February. This rollercoaster performance indicates a volatile market positioning, but the consistent presence within the top 30 underscores Tru | Med's resilience and potential for growth. Notably, their sales in the Flower category saw a notable increase from November 2023's $166,196 to $303,051 by February 2024, suggesting an expanding customer base and increased market penetration in Arizona.

In contrast, Tru | Med's venture into the Pre-Roll category in Arizona presents a different narrative. The brand's initial ranking at 77th in November 2023, with sales amounting to $1,231, suggests a challenging entry into this market segment. The absence of rankings for the subsequent months up to February 2024 indicates that Tru | Med was not among the top 30 brands in the Pre-Roll category during this period. This might be viewed as a setback or a period of adjustment for the brand as it navigates the competitive landscape of the Pre-Roll market. Such a stark difference in performance between categories highlights the brand's strengths and areas for potential strategic realignment to capture a broader market share in Arizona's cannabis industry.

Competitive Landscape

In the competitive landscape of the Arizona flower market, Tru | Med has experienced fluctuating rankings over the recent months, indicating a dynamic position amidst its competitors. Initially ranked 34th in November 2023, Tru | Med saw a notable improvement in December, climbing to the 25th position, before slightly dropping to 32nd in January 2024, and then ascending again to 30th in February. This rollercoaster in rankings reflects Tru | Med's resilience and adaptability in a competitive market. Noteworthy competitors include Old Pal, which despite higher sales, has struggled to break into the top 20 rankings, indicating a potential for Tru | Med to capitalize on market share. Similarly, Fade Co. and Daze Off have shown volatility in their rankings, yet their sales in February suggest a growing threat to Tru | Med's market position. Conversely, LoneStar Select has consistently improved in rank, ending February just one position ahead of Tru | Med, despite a slight edge in sales. This competitive analysis underscores the importance of strategic positioning and market adaptation for Tru | Med in the ever-evolving Arizona flower market.

Notable Products

In February 2024, Tru | Med saw Twenty Nine (3.5g) as its top-performing product in the Flower category, with notable sales figures reaching 1336 units. Following closely, Reign Man (3.5g) secured the second position with RS11 (3.5g) maintaining its rank from January to February as the third top-selling product. Bubble Bath #25 (3.5g) and Garlic Cookies (3.5g) rounded out the top five positions, highlighting a diverse preference among Tru | Med's offerings. Notably, RS11 (3.5g) is the only product among the top five to have maintained its sales rank from the previous month, indicating a stable demand amidst changing consumer preferences. This ranking shift underscores a dynamic market where new entrants like Twenty Nine and Reign Man quickly captured significant attention.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.