Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

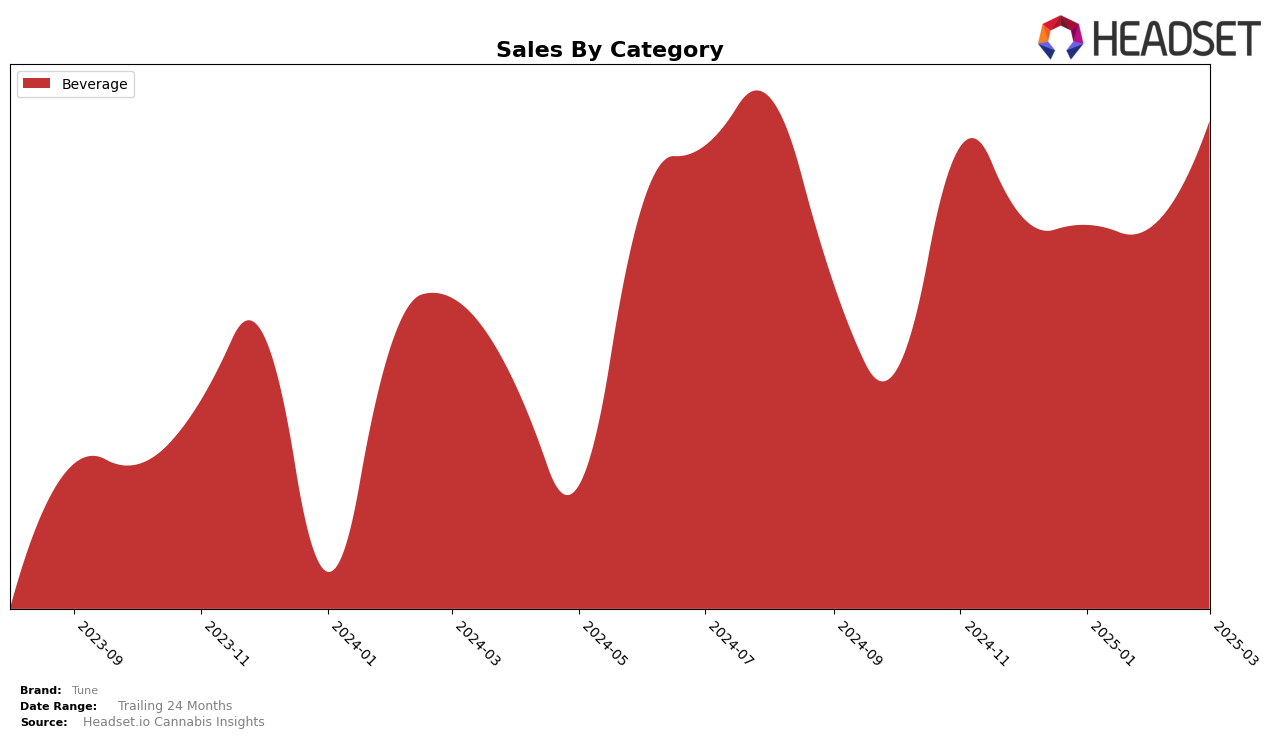

In the New York market, Tune has consistently held a strong position in the Beverage category, maintaining a steady rank of 2nd place from December 2024 through March 2025. This stability suggests a solid consumer base and effective market strategies, as the brand has managed to keep its position despite fluctuations in sales figures. Notably, there was a significant increase in sales from February to March 2025, indicating a positive trend that could be attributed to seasonal factors or successful promotional efforts. However, the brand's absence from the top 30 in other categories may suggest areas where Tune could explore growth opportunities or face challenges in diversifying its product offerings.

While Tune's performance in New York is commendable within the Beverage sector, the lack of presence in the top 30 across other states and categories presents both a challenge and an opportunity. The brand's focus on New York could be a strategic decision to consolidate its strengths in a key market, yet expanding its reach could potentially unlock new revenue streams. The absence of Tune in the rankings of other states might indicate either a nascent stage of market entry or a need for more aggressive marketing and distribution efforts. Understanding these dynamics and leveraging them effectively could play a crucial role in Tune's future growth trajectory.

Competitive Landscape

In the competitive landscape of the New York beverage category, Tune consistently holds the second rank from December 2024 through March 2025, indicating a stable market position. Despite its steady rank, Tune faces formidable competition from Ayrloom, which maintains the top position with significantly higher sales figures, suggesting a strong brand presence and customer loyalty. Meanwhile, Harney Brothers Cannabis and MyHi remain in the third and fourth positions, respectively, with sales figures notably lower than Tune's, highlighting Tune's competitive edge over these brands. Tune's sales exhibit an upward trend, particularly in March 2025, which could indicate effective marketing strategies or product innovations that resonate well with consumers. This stable ranking amidst fluctuating sales among competitors underscores Tune's potential for growth and market expansion in the New York beverage sector.

Notable Products

In March 2025, Raspberry Lime Infused Seltzer (10mg THC, 12oz) reclaimed its top position in the Tune lineup with impressive sales of 4692 units, marking a significant comeback from its fourth place in February. Sicilian Lemon & Rose Infused Seltzer (10mg THC, 12oz) rose to the second position, maintaining strong momentum from a first-place finish in February. Black Cherry Infused Seltzer (10mg THC, 12oz) consistently held the third spot across the months, demonstrating stable performance. Blackberry Cardamom Infused Seltzer (10mg THC, 12oz) dropped to fourth place after holding the second position from December through February. The Black Cherry Infused Seltzer 4-Pack (40mg) remained steady at fifth place, showing a slight increase in sales compared to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.