Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

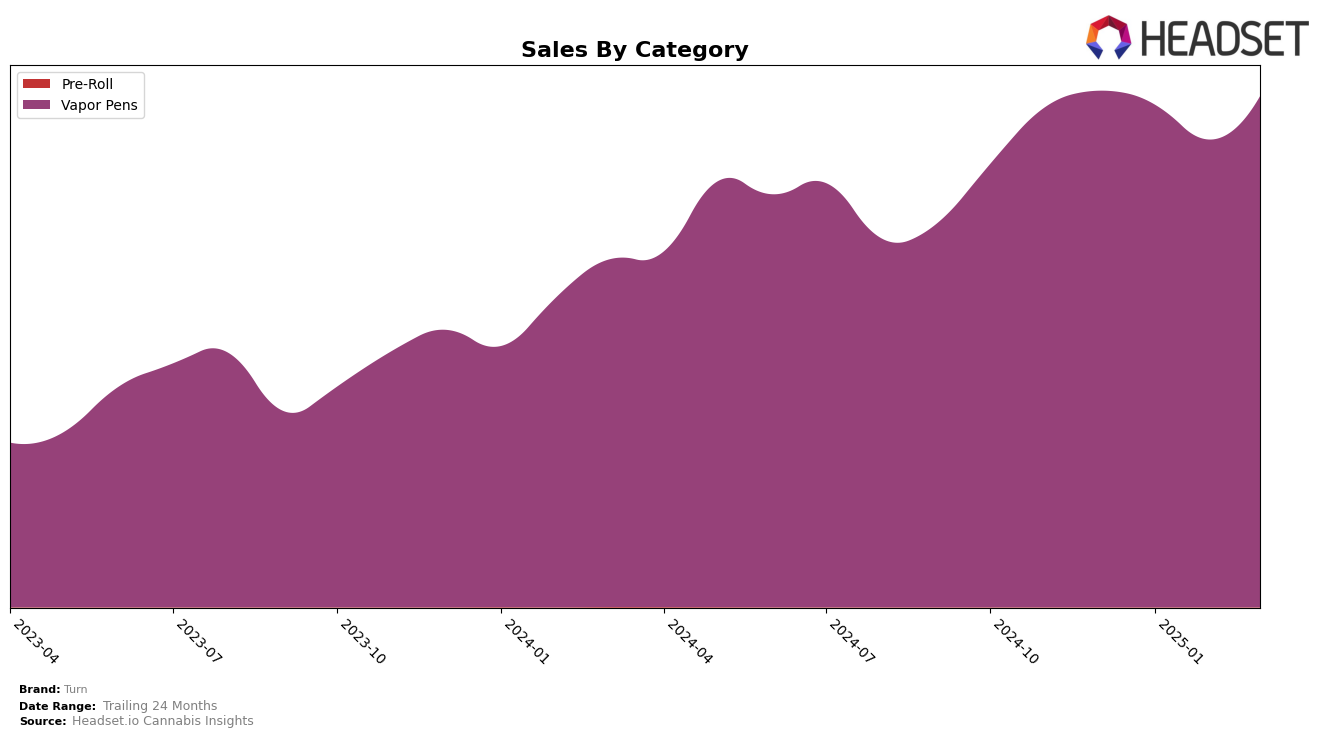

Turn has shown notable performance in the Vapor Pens category across various states. In Arizona, the brand has demonstrated a strong upward trajectory, moving from the 26th position in December 2024 to the 15th position by March 2025. This improvement is accompanied by a significant increase in sales, indicating a growing consumer preference for Turn's products in this state. Meanwhile, in California, Turn has maintained a stable presence in the top 10, although there was a slight dip in ranking from 5th in December 2024 to 7th in March 2025. Despite the fluctuation in ranking, the brand's sales figures remain robust, suggesting a resilient market position.

In New York, Turn's performance in the Vapor Pens category has been relatively steady, consistently holding a rank between 16th and 17th from December 2024 through March 2025. This consistency is reflected in the sales figures, which show a gradual increase over the same period. It is noteworthy that Turn did not fall out of the top 30 in any of these states, highlighting its competitive edge in the Vapor Pens category. The brand's ability to maintain and improve its position in these key markets indicates a strategic approach to growth and market penetration, though there are still areas where further insights could be explored.

Competitive Landscape

In the competitive landscape of vapor pens in California, Turn has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially ranked 5th in December, Turn saw a dip to 7th in January, briefly recovering to 6th in February before returning to 7th in March. This volatility suggests a competitive market environment, with brands like CAKE she hits different consistently maintaining a higher rank at 4th or 5th place, and Jetty Extracts showing stable performance around the 5th and 6th positions. Despite these challenges, Turn's sales figures, while showing a downward trend, remain competitive, indicating potential for recovery and growth. Brands such as Heavy Hitters and Cold Fire have also shown varying performance, with Turn generally outperforming them in sales, suggesting that strategic adjustments could help Turn regain and potentially improve its market position.

Notable Products

In March 2025, Turn's top-performing product was the Granddaddy Purple Live Resin Disposable Pod, maintaining its number one position consistently since January. The Hot Girl Summer Botanical Blends Disposable Pod climbed back to the second rank, showing a notable increase in sales from February. Strawberry Haze Botanical Blends Oil Disposable Pod held the third rank, maintaining its position from February. Watermelon Sugar High Live Resin Disposable Pod, while starting the year strong, dropped to fourth place in March. Berry Dream Live Resin Disposable entered the rankings at fifth place, marking its debut in the top five for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.