Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

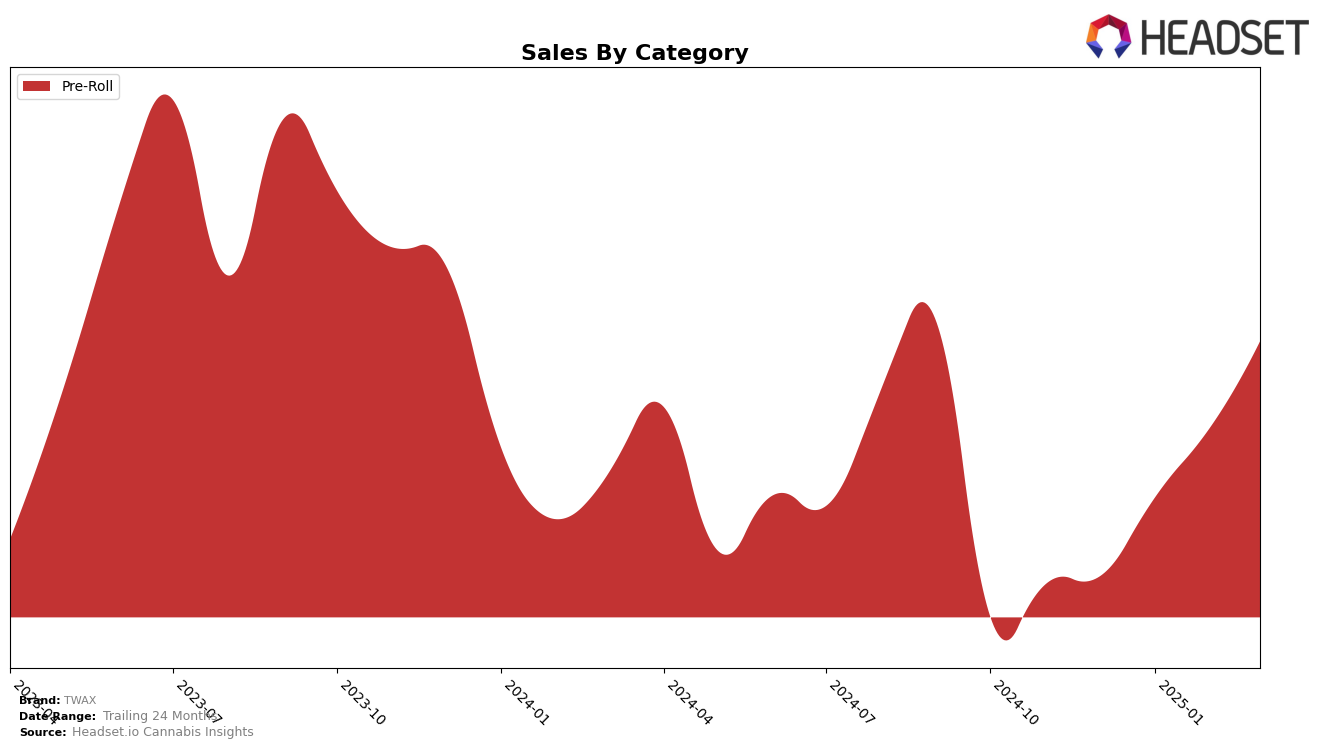

TWAX has showcased a notable upward trajectory in the Colorado pre-roll market over the past few months. Starting from a rank of 36 in December 2024, TWAX climbed to the 14th position by March 2025, indicating a strong performance in this category. This positive movement is accompanied by a steady increase in sales, reflecting growing consumer preference and market penetration. In contrast, the brand's performance in New Jersey tells a different story. Despite maintaining a presence in the top 50, TWAX's rank fluctuated slightly, and sales figures showed inconsistency, suggesting potential challenges in maintaining a steady foothold in this state.

Meanwhile, in Missouri, TWAX consistently remained within the top 20 for pre-rolls, which is a positive indicator of the brand's stable market position. However, the slight dip from 19th to 20th in March 2025 may warrant attention to maintain momentum. On the other hand, Nevada presents a mixed picture, with TWAX not appearing in the top 30 in January 2025, although it managed to regain some ground by March. This fluctuation could point to the volatility of the market or the need for strategic adjustments in brand positioning and marketing efforts in Nevada.

Competitive Landscape

In the Missouri pre-roll category, TWAX has shown a notable upward trajectory in its market position from December 2024 to March 2025. Starting at rank 33 in December, TWAX climbed to rank 20 by January and maintained a stable position around rank 19 to 20 through March. This positive trend in rank is mirrored by a consistent increase in sales, with TWAX's sales figures rising steadily each month. In comparison, Capital City Cannabis Company experienced a decline in rank, dropping out of the top 20 by February, and CLOVR showed fluctuations but managed to surpass TWAX in March. Meanwhile, Daybreak Cannabis maintained a strong presence, consistently ranking higher than TWAX, although its sales showed a downward trend by March. Pocket J's also demonstrated a significant rise, moving from rank 42 in December to just below TWAX in March. These dynamics suggest that TWAX is effectively capturing market share and improving its competitive standing in the Missouri pre-roll market.

Notable Products

In March 2025, the top-performing product for TWAX was the Lemon Haze Distillate Infused Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from February with sales of 4676 units. The Blueberry Distillate Infused Pre-Roll (1g) held steady at the second position, continuing its upward trend from the third rank in January. Grapevine Distillate Infused Pre-Roll (1g) consistently ranked third, showing stable performance over the past months. Banana Cream Distillate Infused Pre-Roll (1g) remained in the fourth spot, after a drop from the top position since December 2024. Lime Sorbet Distillate Infused Pre-Roll (1g) re-entered the rankings in March, securing the fifth position after missing from the list in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.