Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

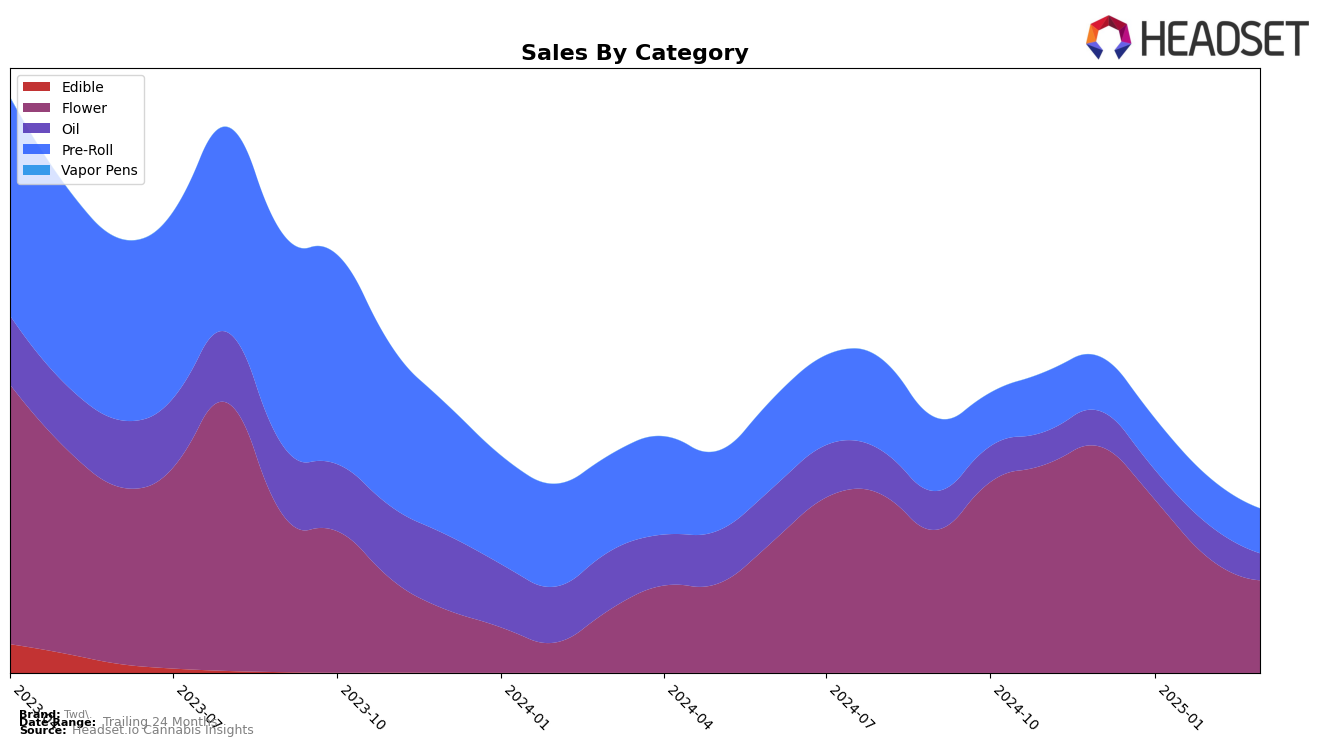

The performance of Twd. in the Alberta market has shown some fluctuations across different categories. In the Flower category, Twd. experienced a noticeable decline in rankings, dropping from 14th place in December 2024 to 34th by March 2025. This decline is mirrored by a decrease in sales figures, indicating potential challenges in maintaining market share. Meanwhile, in the Oil category, Twd. has maintained a more stable performance, consistently ranking 9th from January to March 2025. However, the Pre-Roll category in Alberta did not see Twd. in the top 30 after December, suggesting a struggle to compete effectively in this segment.

In British Columbia, Twd.'s performance in the Pre-Roll category has been relatively stable, with a slight improvement from 66th in December 2024 to 56th in February 2025, before settling at 62nd in March. This indicates a consistent presence in the market, albeit outside the top tiers. In Ontario, the Oil category saw Twd. drop from 12th in December 2024 to 18th by March 2025, reflecting a downward trend in both ranking and sales. Interestingly, in Saskatchewan, Twd. made a significant leap in the Oil category, entering the rankings at 3rd place in February 2025 and maintaining this position in March. However, the Flower category did not see Twd. in the top 30 after January, indicating a potential area for improvement.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Twd. has experienced a notable decline in its market position, dropping from 14th place in December 2024 to 34th by March 2025. This downward trend in rank correlates with a significant decrease in sales over the same period, suggesting potential challenges in maintaining consumer interest or competitive pricing. In contrast, brands like The Drop have shown an upward trajectory, climbing from 53rd to 30th place, indicating a successful strategy in capturing market share. Meanwhile, RIPPED and 3Saints have maintained relatively stable positions, with minor fluctuations in rank, suggesting consistent performance. The competitive pressure from these brands, alongside Twd.'s declining sales, highlights the need for strategic adjustments to regain its foothold in the Alberta Flower market.

Notable Products

In March 2025, the top-performing product for Twd. was Sativa Pre-Roll 1g, maintaining its position at rank 1 since December 2024, with a sales figure of 7460. Indica Pre-Roll 1g followed consistently at rank 2 over the same period, with sales showing a slight increase from February to March. Sativa 28g held steady at rank 3, while Indica 28g remained at rank 4, both showing declining sales figures month over month. A notable new entry in March was Max THC Sativa Oil Spray 30ml, debuting at rank 5. The stability in rankings for the pre-rolls indicates a strong customer preference for these formats from Twd., while the introduction of the oil spray suggests an expansion into different product categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.