Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

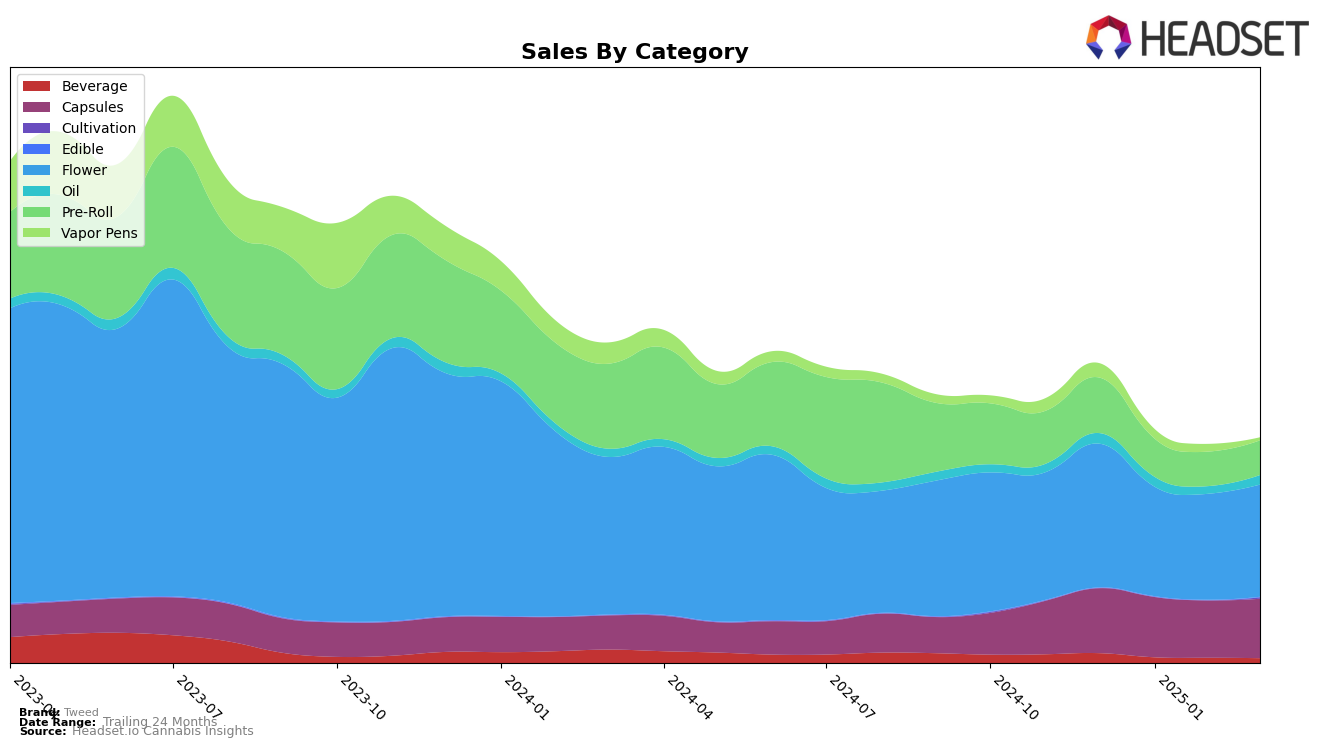

In Alberta, Tweed has shown a strong and consistent performance in the Capsules category, maintaining the top rank from December 2024 through March 2025. This dominance is further emphasized by a steady increase in sales, indicating a growing consumer preference for Tweed's capsule offerings. However, the brand's performance in the Flower category has been more volatile, with rankings fluctuating between 12th and 19th place over the same period. This suggests a competitive landscape in the Flower market, where Tweed faces challenges in maintaining a leading position. Meanwhile, the Pre-Roll category has seen Tweed dropping to 30th place by March 2025, highlighting significant room for improvement in this segment.

In Ontario, Tweed's Capsules maintain a solid third-place ranking throughout the analyzed months, underscoring its strength in this category. The Flower category sees a slight improvement, with Tweed moving up to 18th place in February and March 2025, indicating a positive trend. However, in the Pre-Roll segment, Tweed's position is less favorable, as it consistently ranks outside the top 30 in British Columbia by March 2025, reflecting challenges in capturing market share. Meanwhile, in Saskatchewan, Tweed's Capsules continue to dominate, holding the number one rank, but its Flower category performance is inconsistent, with a notable drop to 15th place in March 2025, suggesting fluctuating consumer preferences.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Tweed has shown a steady performance, maintaining its presence in the top 20 brands from December 2024 to March 2025. While Tweed improved its rank from 20th in December 2024 to 18th by February 2025, it faced stiff competition from brands like MTL Cannabis, which consistently held a higher rank, starting at 13th in December and only dropping to 16th by March. 1964 Supply Co and 3Saints also posed significant competition, with 1964 Supply Co maintaining a rank close to Tweed's and 3Saints showing a notable upward trend, surpassing Tweed by March. Despite these challenges, Tweed's sales in March 2025 showed a positive trend, indicating potential for further growth if it can leverage its brand strengths against these competitors.

Notable Products

In March 2025, Mega Packs THC Softgels 100-Pack (1000mg) maintained its position as the top-selling product for Tweed, with sales reaching an impressive 7354 units. The CBD/THC 1:1 Penelope Softgels 30-Pack (150mg CBD, 150mg THC) held steady at the second rank, showing a slight increase in sales from February. Quickies - Kush Mints Pre-Roll 10-Pack (3.5g) improved its ranking by one spot, moving from fourth to third place, indicating a resurgence in popularity. Kush Mints (3.5g) entered the rankings at fourth place, marking its debut in the dataset. Quickies - Chemsicle Pre-Roll 10-Pack (3.5g) slipped from third to fifth place, reflecting a decrease in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.