Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

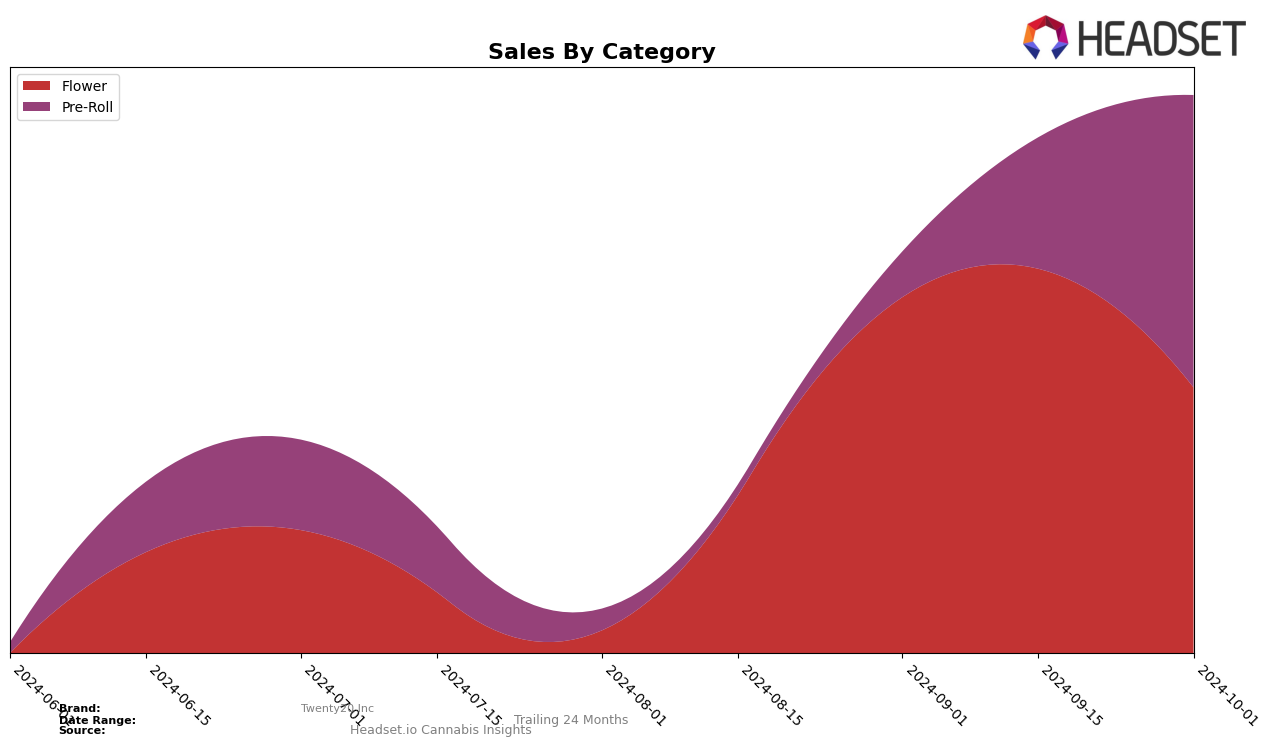

Twenty20 Inc has shown a notable performance in the Missouri market, particularly in the Flower category. Despite not making it into the top 30 brands in July and August, the brand climbed to the 44th position in September and improved slightly to 43rd in October. This upward trend is marked by a significant jump in sales from $36,955 in July to $106,115 in September, before settling at $79,311 in October. This indicates a growing presence and increasing consumer interest in their Flower products, even though they haven't yet cracked the top 30 rankings. The consistent improvement in rank suggests that Twenty20 Inc is gaining traction and could potentially break into higher ranks if this trend continues.

In the Pre-Roll category within Missouri, Twenty20 Inc demonstrated a significant leap in October, moving from the 60th position in September to 27th. This remarkable rise is underscored by a substantial increase in sales, from $14,056 in September to $87,222 in October. The brand's absence from the top 30 in July and August might have been a concern, but the recent surge in both rank and sales indicates a successful strategy or product offering that resonated well with consumers. This rapid ascent in the Pre-Roll category is a positive sign for the brand's potential growth and market penetration in Missouri, suggesting that they are effectively capturing consumer interest and market share in this segment.

Competitive Landscape

In the competitive landscape of the Missouri Pre-Roll market, Twenty20 Inc has shown a dynamic shift in its ranking and sales performance over the past few months. Despite not being in the top 20 in August 2024, Twenty20 Inc made a significant comeback by October 2024, climbing to the 27th position. This resurgence is notable when compared to competitors like Kaviar, which experienced a decline from 29th in July to being out of the top 20 by October, and Dealer's Choice, which improved its rank from 44th in July to 29th in October. Meanwhile, Safe Bet and Daybreak Cannabis maintained relatively higher ranks, with Safe Bet peaking at 18th in September before settling at 26th in October, and Daybreak Cannabis dropping from 15th in July to 25th in October. This competitive environment highlights Twenty20 Inc's potential for growth and resilience amidst fluctuating market dynamics, suggesting a strategic opportunity for the brand to capitalize on its recent upward trend in sales and ranking.

Notable Products

In October 2024, the Coffee Creamer Pre-Roll 5-Pack (2.5g) emerged as the top-performing product for Twenty20 Inc, climbing from its previous position in July to secure the number one spot with sales reaching 1688 units. The Chimax (3.5g) made a strong entry at the second position, demonstrating notable sales performance. Glitter Bomb (3.5g) followed closely, ranking third, showing competitive sales figures. The Wonka Bars Pre-Roll 5-Pack (2.5g) improved its ranking from fifth in September to fourth in October, with sales increasing significantly to 550 units. Finally, the Supreme Diesel Pre-Roll 5-Pack (2.5g) entered the top five rankings in October, highlighting its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.