Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

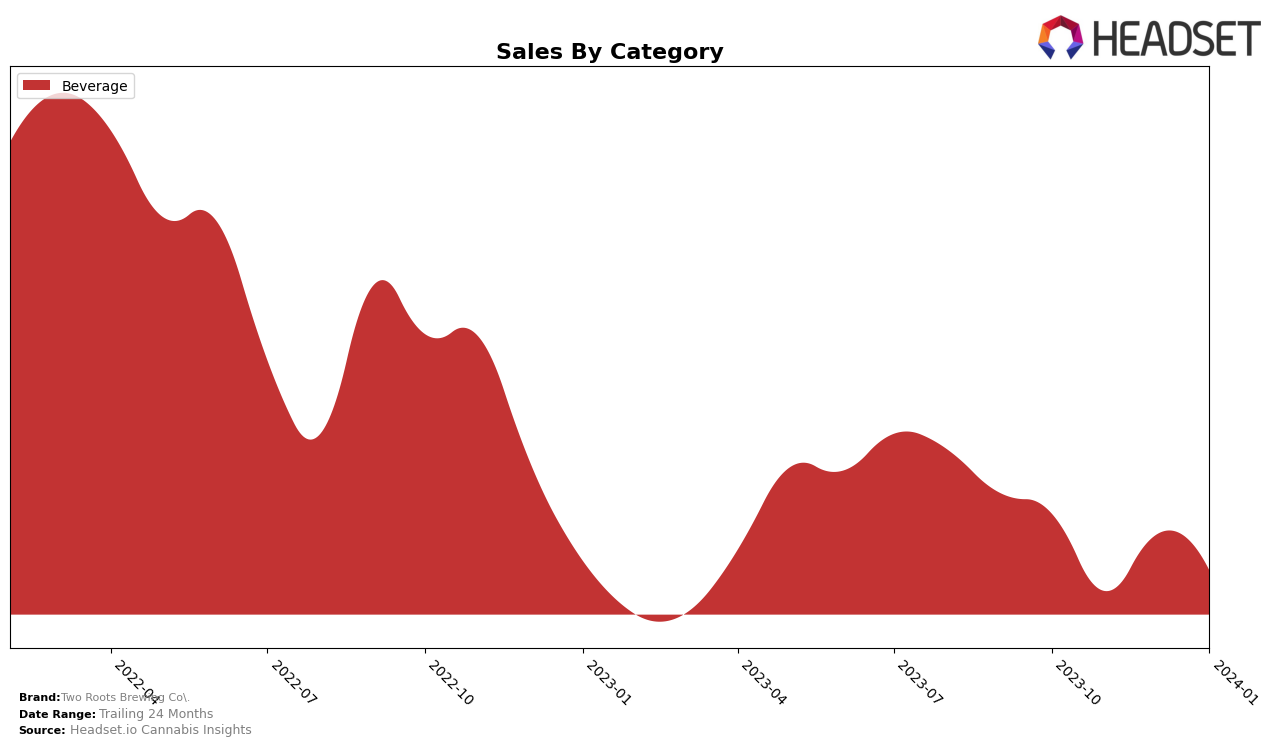

In the competitive Beverage category within Nevada, Two Roots Brewing Co. has shown a fluctuating but resilient performance over the last four months. Starting in October 2023 with a rank of 16, the brand experienced a slight dip in November, falling to 19th place, which indicates they were on the verge of dropping out of the top 20 brands in the state for that month. This drop could be perceived negatively, but the subsequent recovery to 17th in December and maintaining the 16th position into January 2024 suggests a robust ability to regain their footing in the market. The sales data, with October 2023 seeing over $2,500 in sales but a significant dip to $800 in November, points to a potential strategic adjustment or market fluctuation that impacted their performance temporarily.

While specific sales figures for December 2023 and January 2024 are not disclosed, the rank improvement and stabilization hint at a positive trend in consumer preference or effective marketing strategies by Two Roots Brewing Co. Their ability to bounce back in the rankings within such a competitive category is commendable. However, the lack of consistent top-tier ranking (e.g., within the top 10) could suggest room for growth or the need for strategic adjustments to solidify their market position further. The fluctuation in rankings and the significant sales drop in November, followed by a recovery, could indicate that Two Roots Brewing Co. is at a critical juncture, where understanding market demands and consumer preferences could be key to their sustained success in Nevada's cannabis beverage market.

Competitive Landscape

In the competitive landscape of the cannabis beverage category in Nevada, Two Roots Brewing Co. has experienced fluctuations in its market position, illustrating the dynamic nature of consumer preferences and competitive pressures. Initially ranked 16th in October 2023, it saw a slight decline to 19th in November before slightly recovering to 17th in December and stabilizing at 16th by January 2024. This trajectory indicates a resilience in maintaining its market presence amidst challenges. Notably, Pamos, a direct competitor, consistently outperformed Two Roots Brewing Co., maintaining higher ranks and showing a significant rebound in sales by January 2024, suggesting a stronger consumer preference or marketing effectiveness. Conversely, Keef Cola experienced a notable decline, dropping from the top 10 in October to 17th by January 2024, indicating potential opportunities for Two Roots Brewing Co. to capture a portion of Keef Cola's market share. New entrants like Mojo (Edibles) and HOPE Nevada have shown that the market remains open to newcomers, with HOPE Nevada, in particular, making a significant leap in rank and sales, underscoring the importance of innovation and marketing in gaining market traction.

Notable Products

In January 2024, Two Roots Brewing Co. saw its top product as the CBD/THC 1:2 Creative Waters Co. Cucumber Lime Sparkling Water (3mg CBD, 6mg THC) within the Beverage category, maintaining its number one rank from the previous two months with impressive sales figures of 307 units. This product has shown a consistent increase in popularity, climbing from the second rank in October 2023 to leading the sales by January 2024. Other products like the CBD/THC 1:1 Berry Lemon Sparkling Water (5mg CBD, 5mg THC) and the CBD/THC 3:1 Passion Fruit Tangerine Sparkling Water (3mg CBD, 1mg THC) did not rank in January 2024, indicating a shift in consumer preference towards the Cucumber Lime Sparkling Water. The Berry Lemon Sparkling Water, previously ranked second in November 2023, and the Passion Fruit Tangerine Sparkling Water, initially leading in October 2023, have both seen a decline in their sales and rankings, highlighting the Cucumber Lime Sparkling Water's growing dominance. This analysis underscores the changing dynamics within the Beverage category for Two Roots Brewing Co., with the CBD/THC 1:2 Creative Waters Co. Cucumber Lime Sparkling Water emerging as the clear favorite among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.