Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

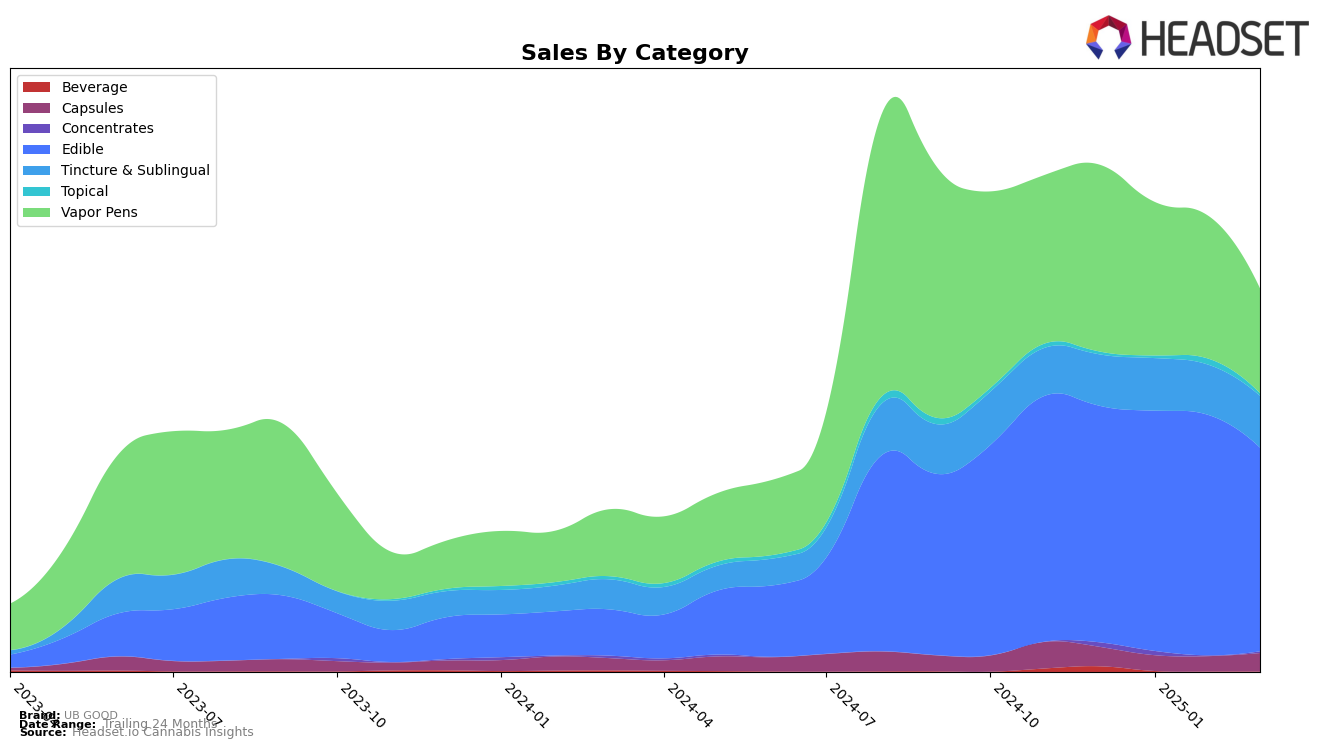

UB GOOD's performance across different states and product categories reveals some intriguing trends. In Nevada, the brand's presence in the Vapor Pens category has been inconsistent, with rankings not making it into the top 30 for several months. This could indicate challenges in capturing market share in this particular category within the state. On the other hand, in Ohio, UB GOOD has shown remarkable consistency and dominance in the Tincture & Sublingual category, maintaining the top position for several months consecutively. This suggests a strong foothold and customer loyalty in this segment, which could be a significant advantage for the brand in Ohio.

In the Ohio market, UB GOOD's performance in the Edible category is noteworthy, consistently holding a top-three position, although there was a slight slip from second to third place in March 2025. This indicates a robust presence but also highlights potential competitive pressures. Meanwhile, their performance in the Vapor Pens category in Ohio has seen a downward trend, with rankings dropping from 10th to 19th over the span of four months. This decline might suggest increased competition or changing consumer preferences. Despite these challenges, UB GOOD's steady performance in the Capsules category in Ohio, maintaining a fourth-place rank, underscores a stable demand for their products in this segment.

Competitive Landscape

In the competitive landscape of the edible category in Ohio, UB GOOD has shown resilience and adaptability in its market positioning. Over the four-month period from December 2024 to March 2025, UB GOOD maintained a strong presence, fluctuating slightly between the 2nd and 3rd ranks. This stability is noteworthy, especially when compared to the consistent top position held by Incredibles, which has dominated the market despite a downward trend in sales. UB GOOD's sales remained robust, although there was a noticeable dip in March 2025. Meanwhile, Certified (Certified Cultivators) and Wana experienced more significant fluctuations in rank and sales. Notably, Camino improved its position, moving from 8th to 4th, which could indicate a rising competitive threat. UB GOOD's ability to maintain its rank amidst these shifts suggests a strong brand loyalty and effective market strategies, though the decline in sales in March indicates a need for strategic adjustments to sustain its competitive edge.

Notable Products

In March 2025, UB GOOD's top-performing product was Cherry Pomegranate Extra Strength Releaf Gummies 10-Pack (500mg), maintaining its position as the number one product for four consecutive months, despite a sales figure of 4549. Pineapple Punch Extra Strength Gummies 10-Pack (500mg) consistently held the second rank, continuing its strong performance. Cherry Limeade Distillate Disposable (0.5g) remained steady at the third position, showing consistent demand. Notably, GO - CBD/THC 10:1 Juicy Pear Gummies 20-Pack (1000mg CBD, 100mg THC) entered the top rankings at fourth place, indicating a positive reception. Blue Rush (Shandy) Spark Distillate Disposable (0.5g) dropped from fourth to fifth place, suggesting a slight decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.