Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

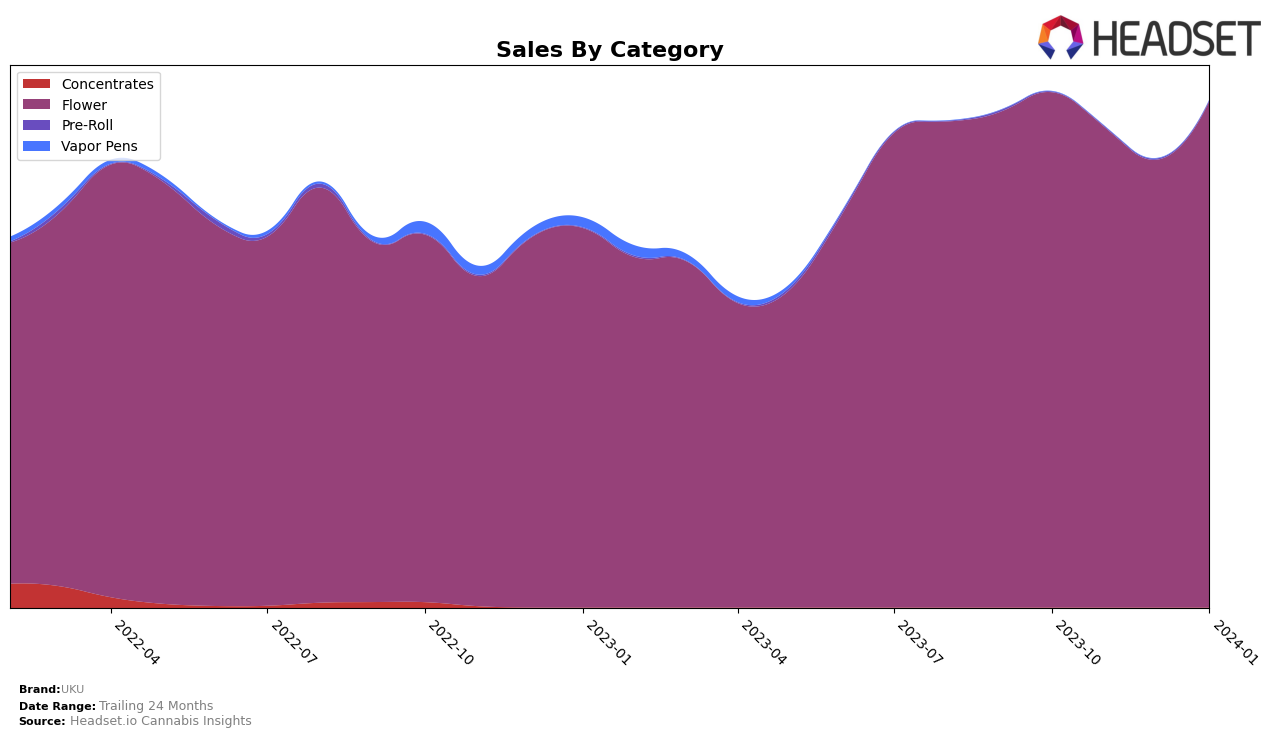

In the competitive cannabis market of Oregon, UKU has demonstrated notable consistency within the Flower category, maintaining top positions from October 2023 through January 2024. Their ranking slightly slipped from 2nd to 3rd place from October to December, but importantly, they remained within the top 3, showcasing their strong market presence. Despite a slight decrease in sales from October ($851,610) to December ($739,853), UKU managed to rebound in January 2024, with sales climbing back up to $837,172. This resilience and ability to recover in sales volume underscore the brand's adaptability and sustained consumer demand in Oregon's dynamic market.

While the data provides a snapshot of UKU's performance in the Flower category in Oregon, it's crucial to note the absence of information regarding their standing in other states or provinces, as well as their performance across different cannabis product categories. This omission highlights a potential area for further exploration to fully understand UKU's market footprint. The consistent top 3 ranking in Oregon suggests a strong brand presence and consumer loyalty within the state. However, without additional context or comparisons to other markets, the broader picture of UKU's performance remains partially obscured. This focused analysis on Oregon's Flower category offers valuable insights but also leaves room for further investigation into UKU's overall market strategy and performance.

Competitive Landscape

In the competitive landscape of the Oregon flower cannabis market, UKU has maintained a strong presence, consistently ranking among the top three brands from October 2023 through January 2024. However, it's notable that despite UKU's strong sales, it has been outperformed by Culture Farms and Doghouse Farms (OR), which have alternated in leading the market. Culture Farms, initially the top-ranked brand in October, experienced a slight dip in January 2024, indicating a potential opening for UKU to increase its market share. Conversely, Doghouse Farms (OR) showed remarkable growth, jumping from the third position in October to leading the market by January 2024. Meanwhile, Grown Rogue and Self Made Farm have also shown significant upward mobility in the rankings, suggesting an increasingly competitive environment. For UKU, maintaining its position will require strategic focus as these competitors continue to challenge its rank and sales within the Oregon flower cannabis market.

Notable Products

In January 2024, UKU saw Gush Mintz B Buds (Bulk) leading the sales within the Flower category, maintaining its top position from the previous month with a notable sales figure of 2024 units. Cap Junky (Bulk) followed closely, climbing from the third position in December to the second in January, showcasing a significant sales increase. Wonder Dawg (Bulk) made an impressive debut in the top ranks by securing the third spot, indicating a growing consumer interest. Kush Crasher (Bulk), despite its fluctuating performance in previous months, settled at the fourth rank, while Ice Cream Cake Popcorn (Bulk) entered the top five, highlighting a diverse consumer preference across UKU's product range. These rankings underscore a dynamic shift in consumer preferences, with Cap Junky (Bulk) showing the most notable rise in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.