Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

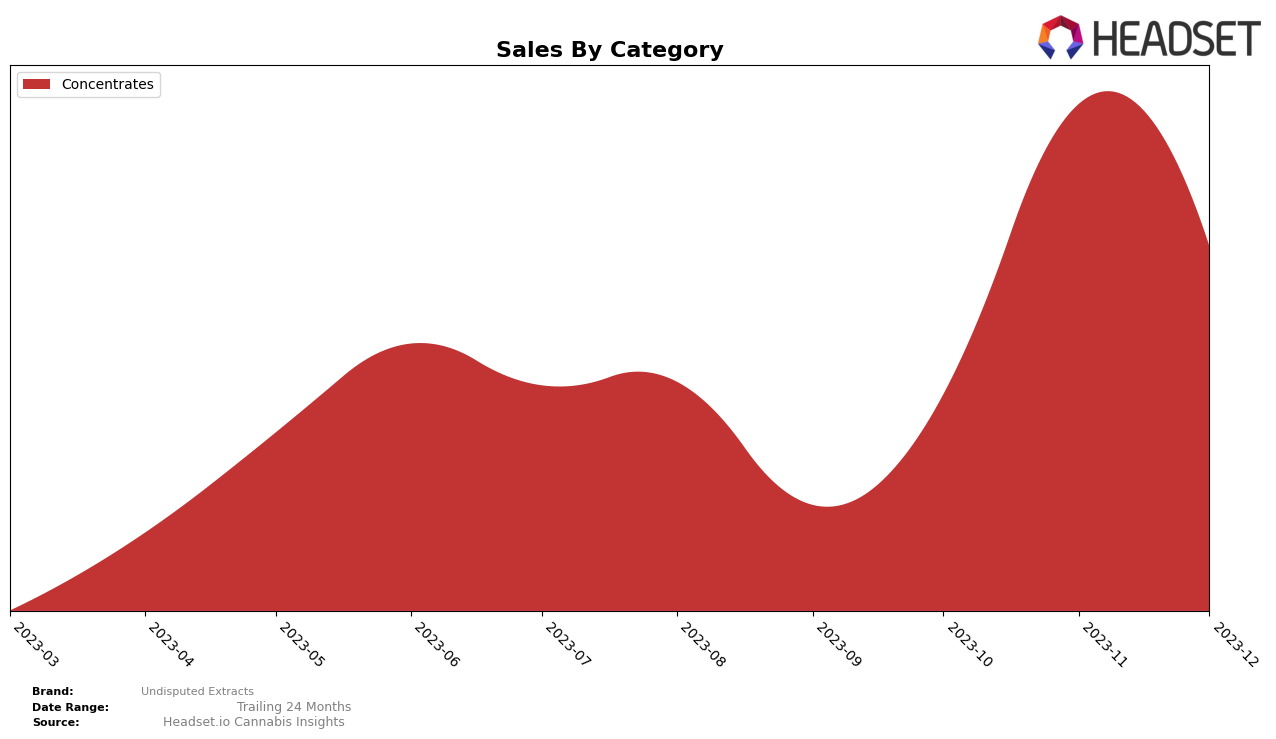

Undisputed Extracts, a brand known for their concentrates, has been showing an interesting trend in the Arizona market. Starting from a rank of 30 in September 2023, the brand made significant strides to reach the 16th position by November 2023. This is a commendable improvement, indicating a strong acceptance of the brand among consumers in Arizona. However, there was a slight dip in their ranking by December 2023, as they fell to the 20th position. This could be due to increased competition or other market dynamics.

In terms of sales, Undisputed Extracts demonstrated a notable increase from September to November 2023, with sales figures almost tripling. However, December saw a reduction in sales compared to November, which aligns with the drop in ranking for the same period. This could potentially hint at a seasonal trend or a change in consumer preference. It's important to note that despite the drop, the December sales were still significantly higher than the initial figures in September. This indicates that while there may be fluctuations, the overall trajectory for Undisputed Extracts in the Arizona market appears to be positive.

Competitive Landscape

In the Concentrates category for Arizona, Undisputed Extracts has shown a promising upward trend in rank from September to November 2023, moving from the 30th position to 16th. However, they dropped slightly to the 20th rank in December. This fluctuation indicates a dynamic competitive landscape. Notably, Amber has been a significant competitor, climbing from the 42nd rank in September to 24th in December. Abundant Organics and Nectar Farms have maintained a more stable presence in the top 20 throughout these months, indicating a strong foothold in the market. 22Red, on the other hand, has not managed to break into the top 20, suggesting a lesser threat to Undisputed Extracts. In terms of sales, Undisputed Extracts saw a significant increase from October to November, but a decrease in December, suggesting a need to sustain their growth momentum against these competitors.

Notable Products

In December 2023, the top-performing product from Undisputed Extracts was the Grape Illusion Shatter (1g) from the Concentrates category, with sales reaching a remarkable 973 units. Following closely was the Space Center Shatter (1g) securing the second position, improving from its fourth place in November. The Grape Gotti Crumble (1g) slipped to the third rank in December from its previous second place in November. The fourth and fifth places were occupied by the Forbidden Runtz Shatter (1g) and Biscotti Cured Batter (1g) respectively. It's important to note that the Biscotti Cured Batter (1g) saw a significant drop in its rank, falling from first place in September to fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.