Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

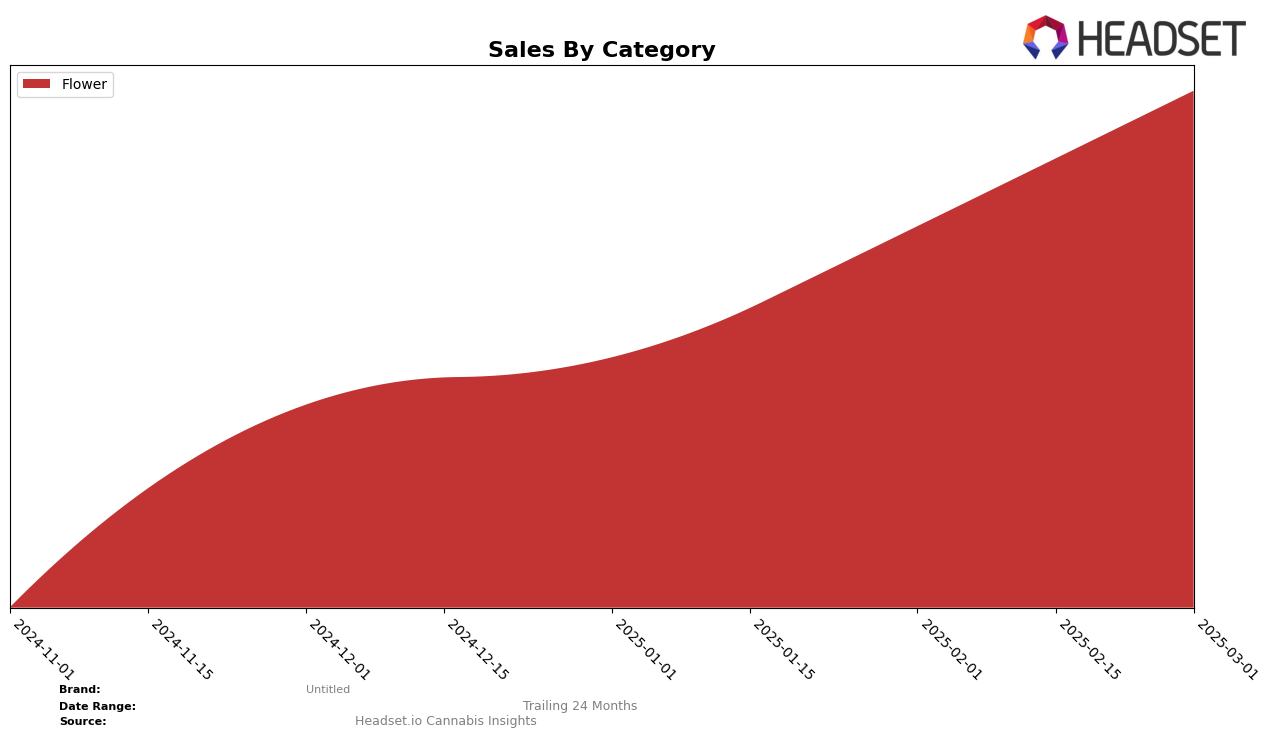

Untitled has shown a commendable upward trajectory in the New York market, particularly in the Flower category. Starting from a rank of 15 in December 2024, the brand has steadily climbed the ranks to reach the 7th position by March 2025. This consistent improvement indicates a growing consumer preference and possibly effective market strategies. The sales figures reflect this trend, with March 2025 showing a significant increase compared to previous months, signaling robust demand and successful brand positioning in this competitive category.

While Untitled's performance in New York is noteworthy, it's important to highlight that their presence in other states or categories might not be as prominent, given the absence of rankings in the top 30 for those areas. This could suggest potential areas for growth or a need for strategic adjustments to enhance their market share. The strong performance in New York's Flower category, however, sets a positive precedent for potential expansion and could serve as a model for replication in other markets.

Competitive Landscape

In the competitive landscape of the New York Flower category, Untitled has demonstrated a significant upward trajectory from December 2024 to March 2025. Initially ranked 15th in December, Untitled climbed to 7th by March, showcasing a robust improvement in market positioning. This rise is particularly notable when compared to competitors like The Plug Pack, which made an impressive leap from outside the top 20 in December to 5th place by March. Meanwhile, Matter. experienced a decline from 3rd to 6th place over the same period, indicating a potential shift in consumer preferences. Additionally, Rythm and Revert Cannabis New York showed more stable rankings, though both saw a slight drop by March. Untitled's sales growth trajectory aligns with its improved rank, suggesting effective strategies in capturing market share amidst fluctuating competitor performances.

Notable Products

In March 2025, the top-performing product from Untitled was Sour Diesel (3.5g) in the Flower category, achieving the number one rank with sales of 3380 units. This product showed a consistent upward trend from December 2024, where it was ranked fifth, gradually climbing to the top spot. Granddaddy Purple (3.5g) made a notable entry in March, securing the second rank with a strong sales figure. Tropicana Cherries (3.5g) maintained a steady performance, moving slightly down from fourth to third rank compared to February 2025. Green Crack (3.5g) re-entered the top rankings in March, holding the fourth spot after being unranked in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.