Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

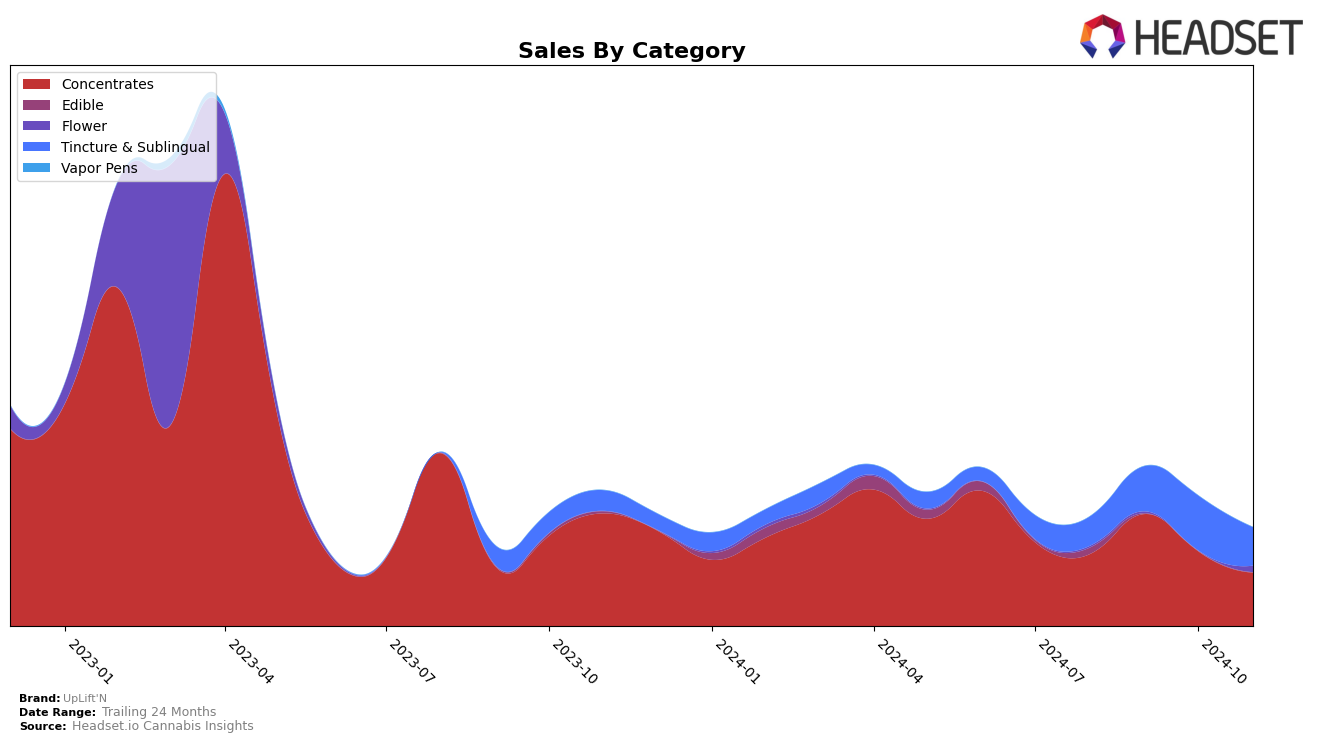

UpLift'N has shown varied performance across different categories in Michigan. In the Concentrates category, the brand did not make it to the top 30 rankings for August and continued to slide down, reaching 87th in September and further dropping to 99th in October. This indicates a declining trend in their performance within this category, which could be a point of concern for the brand. On the other hand, their performance in the Tincture & Sublingual category has been more promising. They were not ranked in the top 30 in August, but they climbed to 8th in September and further improved to 7th in October, which suggests a strong upward trajectory in this particular segment.

The absence of UpLift'N in the top 30 for the Concentrates category in August highlights a potential challenge in capturing market share in that segment. However, the consistent improvement in the Tincture & Sublingual category suggests that UpLift'N may be finding its niche there. This could indicate a strategic focus or a favorable consumer response to their products in this category. The sales figures reflect this trend, with a noticeable increase from September to October, underscoring their growing presence in the Tincture & Sublingual market. These movements across categories suggest areas where UpLift'N might need to bolster efforts or capitalize on existing strengths to enhance their overall market performance in Michigan.

Competitive Landscape

In the Michigan concentrates market, UpLift'N has experienced a challenging period from August to November 2024, as evidenced by its fluctuating rankings and sales. Initially absent from the top 20 in August, UpLift'N entered the rankings at 87th in September and slipped further to 99th by October, indicating a downward trend in market presence. This decline in rank is mirrored by a decrease in sales, suggesting potential challenges in maintaining competitive positioning. In contrast, brands like Levitate and Goodlyfe Farms have also seen declining ranks, with Levitate dropping from 42nd in August to out of the top 20 by November, and Goodlyfe Farms disappearing from the top 20 after August. These trends highlight a volatile market landscape where UpLift'N and its competitors are struggling to sustain momentum, underscoring the need for strategic adjustments to regain market share and improve sales performance.

Notable Products

In November 2024, Cosmic Mint Lift Strips 8-Pack (200mg) maintained its position as the top-performing product for UpLift'N, despite a decrease in sales to 470 units compared to the previous month. Sour Secret Full Spectrum Diamonds Banger (5g) rose to the second spot, showing significant growth from its fourth position in September and third in October. Lunar Lemon Lift Strips 8-Pack (200mg) slipped to third place after leading in September, with sales dropping to 278 units. Cold Snap Diamonds (1g) debuted at fourth place, marking its first appearance in the rankings. Super Lemon Haze Moon Rocks (2g) entered the top five for the first time, indicating an emerging interest in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.