Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

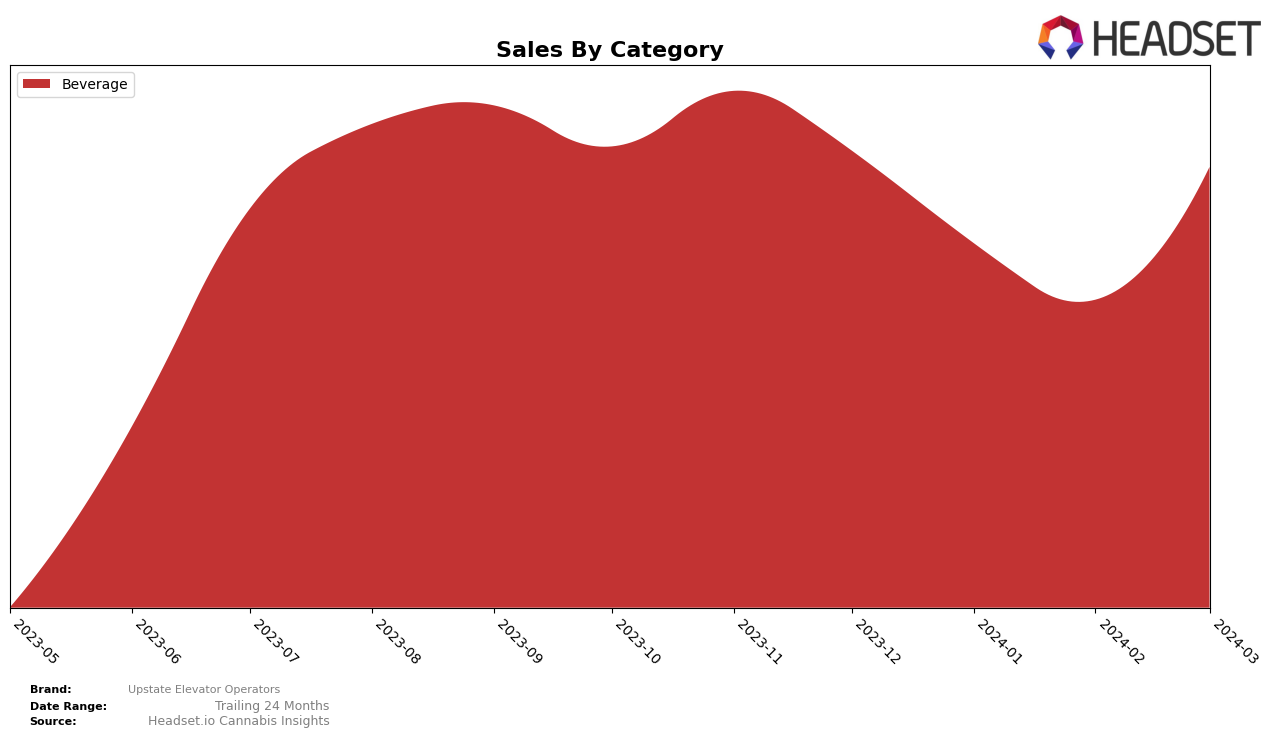

In the competitive cannabis market of Massachusetts, Upstate Elevator Operators has shown a noteworthy performance within the Beverage category, maintaining a presence within the top 30 brands over the recent months. Their ranking fluctuated slightly, moving from 24th in December 2023 and January 2024, to 25th in February 2024, before climbing back up to 22nd in March 2024. This movement indicates a resilience in maintaining their market position amidst competition, despite a noticeable dip in sales from December 2023's 4219 units to February 2024's 2901 units. However, the rebound in sales to 4076 units by March 2024 suggests a recovery and possibly an upward trend in consumer demand for their beverage offerings in Massachusetts. This performance is particularly impressive considering the brand's ability to remain within the top 30, a feat not achieved by all competitors.

While the raw sales details and specific ranking positions provide a glimpse into Upstate Elevator Operators' market dynamics in Massachusetts, the overall trend suggests a brand that is navigating the ebbs and flows of the cannabis beverage market with a degree of success. The slight dip in February 2024, followed by a recovery in March, could be indicative of various factors such as seasonal demand changes, promotional efforts, or shifts in consumer preferences. Without revealing all the intricacies of their performance, it's clear that Upstate Elevator Operators is a brand worth watching for those interested in the cannabis beverage sector. Their ability to bounce back and even improve their ranking in a competitive market speaks to their resilience and potentially strategic market maneuvers that have allowed them to maintain a solid footing in Massachusetts.

Competitive Landscape

In the competitive landscape of the beverage category in Massachusetts, Upstate Elevator Operators has shown a notable trend in its market position, moving from a rank of 24th in December 2023 to 22nd by March 2024. This upward trajectory in rank, despite fluctuations in sales, indicates a resilience and potential for growth amidst fierce competition. Notably, Cantrip, initially ranked higher at 18th in December 2023, experienced a significant drop in sales by February 2024, which led to it falling behind Upstate Elevator Operators in March. Meanwhile, Zenith, despite its lower sales figures, managed to climb into the top 20 by March 2024, showcasing the volatile nature of the market. Other competitors like Ocean Breeze and Canna Drinks remained at the lower end of the ranking spectrum, indicating a struggle to capture significant market share. This analysis underscores the dynamic nature of the beverage sector in Massachusetts, where brand positions can shift rapidly, highlighting the importance for Upstate Elevator Operators to continue innovating and adapting to maintain its upward momentum.

Notable Products

In March 2024, Upstate Elevator Operators saw Good Guava Seltzer (5mg) maintaining its position as the top-selling product across all categories, with impressive sales of 724 units. This product has consistently held the number one spot since December 2023, showcasing its enduring popularity. The second-ranking product, Blackberry Zinger Soda (5mg), also from the Beverage category, did not register sales in March, indicating a potential supply issue or a shift in consumer preference. There's a noticeable absence of other products in the dataset for March 2024, suggesting either a focused product line or limited data availability. The significant sales figure for Good Guava Seltzer (5mg) highlights its dominant market position and consumer preference within the Upstate Elevator Operators brand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.