Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

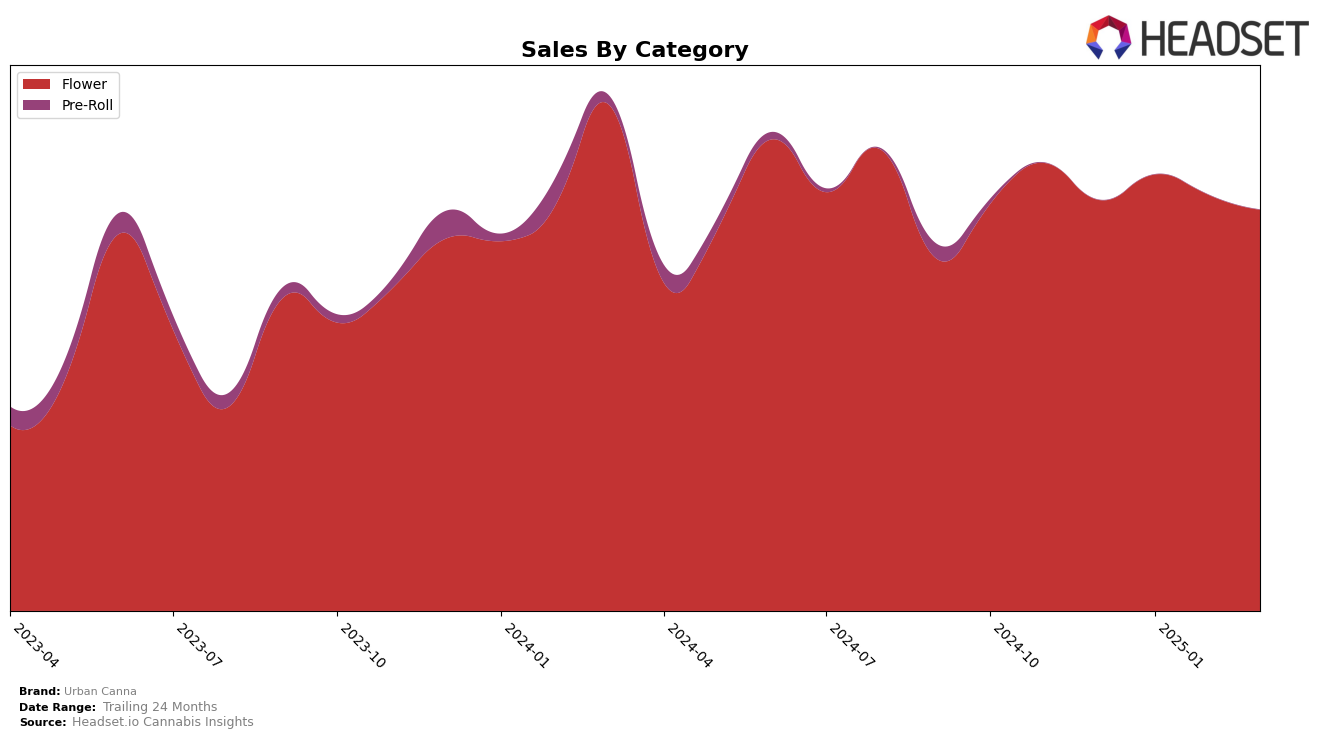

Urban Canna has shown a steady presence in the Oregon market, particularly in the Flower category. Throughout the months from December 2024 to March 2025, the brand maintained a ranking within the top 20, with its highest position being 15th in February 2025. This consistency indicates a strong foothold in Oregon's competitive cannabis market. Despite a slight dip in March 2025 to 18th place, Urban Canna's ability to remain in the top 20 underscores its resilience and consumer appeal in the Flower category.

It's important to note that Urban Canna did not appear in the top 30 rankings for any other states or categories during this period. This absence could be seen as an area for potential growth or a strategic focus on the Oregon market. The sales figures for Oregon show a slight fluctuation, with a peak in January 2025, suggesting a seasonal or promotional influence. The brand's decision to concentrate on Oregon might be a calculated move to strengthen its market share before expanding into other regions. This strategy could be pivotal for Urban Canna's long-term growth and sustainability in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Urban Canna has demonstrated resilience and adaptability, maintaining a relatively stable position in the rankings from December 2024 to March 2025. While Urban Canna experienced a slight dip from 15th to 18th place in March 2025, it remains competitive against brands like Focus North, which consistently held ranks between 14th and 16th during the same period. Notably, Dog House and BJ's A-Grade showed significant fluctuations, with BJ's A-Grade making a remarkable leap from 71st in January to 20th in March, suggesting a potential threat if their upward trend continues. Meanwhile, Earl Baker closely trails Urban Canna, ending March 2025 just one rank behind. Despite these shifts, Urban Canna's sales figures indicate a consistent performance, slightly declining in March but remaining competitive, underscoring the brand's ability to maintain its market share amidst a dynamic competitive environment.

Notable Products

In March 2025, Urban Canna's top-performing product was Motor OG (Bulk) in the Flower category, achieving the number one rank with sales of 1783 units. Hash Burger (Bulk) followed closely in second place, while Flavor Flav (Bulk) secured the third spot. Notably, Lung Buster (Bulk), which held the top rank in January and February, dropped to fourth place in March, showing a significant decrease in sales. Dirty Bananas (Bulk) also experienced a decline, moving from second place in February to fifth in March. These shifts highlight changing consumer preferences within Urban Canna's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.