Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

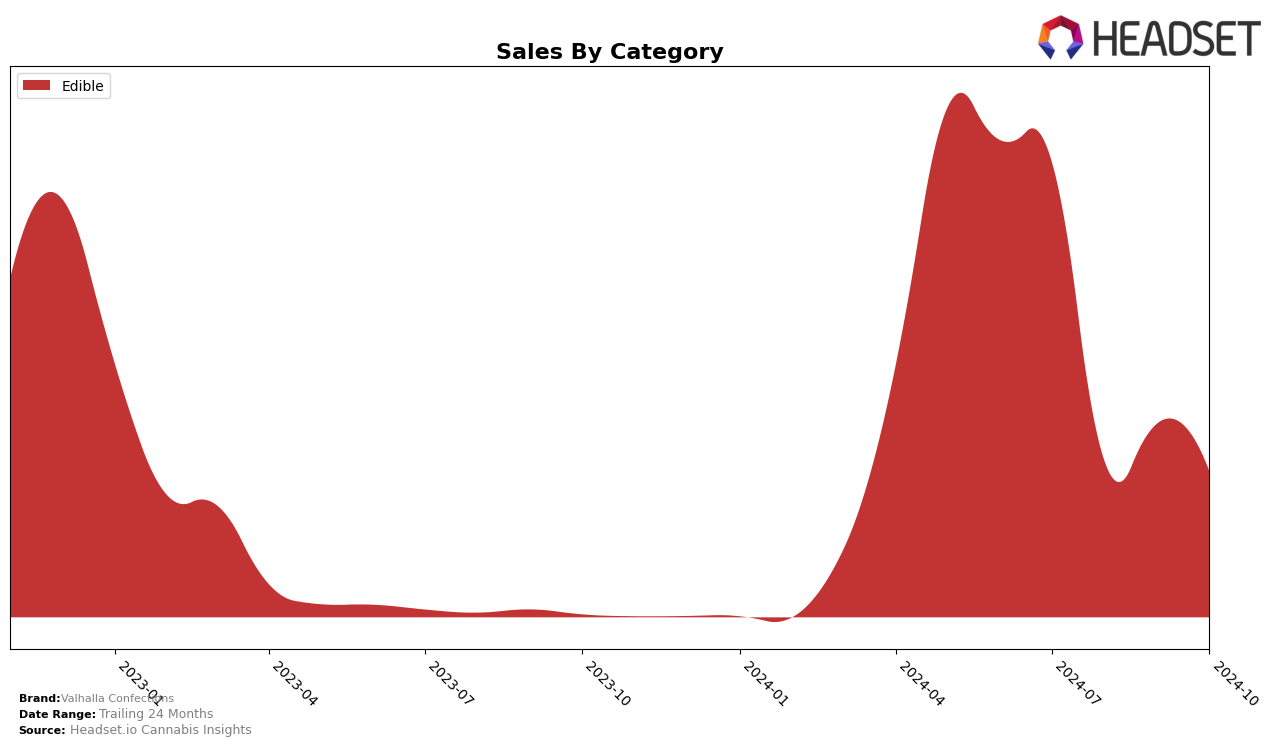

Valhalla Confections has shown a fluctuating performance in the Maryland edibles market over the past few months. Starting in July 2024, the brand was ranked 26th, indicating a solid presence among the top 30 edible brands. However, in August, they slipped out of the top 30, which could be a cause for concern regarding their market strategy or competitive pressures. The brand managed to recover slightly in September, climbing back to the 28th position but experienced another dip to the 30th rank by October. This pattern suggests a volatile market position, which may require strategic adjustments to maintain or improve their standing.

From a sales perspective, Valhalla Confections experienced a significant drop from July to August, with sales decreasing from $57,240 to $19,470. This decline might be attributed to seasonal market changes or increased competition. Although there was a slight sales recovery in September, reaching $24,417, the downward trend continued into October with sales falling to $18,343. The sales trajectory reflects the challenges the brand faces in sustaining its market share, especially when not consistently ranked within the top 30. These insights could guide the brand in refining its approach to better capture consumer interest and stabilize its market position in Maryland.

Competitive Landscape

In the Maryland edibles market, Valhalla Confections has experienced fluctuating rankings over the past few months, indicating a competitive landscape. As of October 2024, Valhalla Confections ranked 30th, showing a slight decline from its 28th position in September. This is in contrast to Fireball Cannabis, which has consistently outperformed Valhalla Confections, maintaining a higher rank of 27th in October. Meanwhile, Lux by CannAscend has shown a dynamic performance, ranking 28th in October, suggesting a potential threat as it occasionally surpasses Valhalla Confections. Interestingly, Grass re-entered the rankings in October at 34th after being absent in previous months, indicating a resurgence that could further intensify competition. These shifts in rankings highlight the need for Valhalla Confections to strategize effectively to maintain and improve its market position amidst these competitive pressures.

Notable Products

In October 2024, the top-performing product from Valhalla Confections was Indica Blue Raspberry Soft Lozenges 10-Pack (100mg), which rose to the first rank with sales of 270 units. Sweet Orange Gummies 10-Pack (100mg) slipped to the second position from its top spot in September, while Strawberry Lemonade Gummy 10-Pack (100mg) improved its ranking from fourth to third. Notably, Pineapple Mango Gummies 10-Pack (100mg) made its debut in the rankings at fourth place. Sativa Green Apple Gummies 10-Pack (100mg) maintained a stable presence, holding the fifth position after a peak in third place in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.