Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

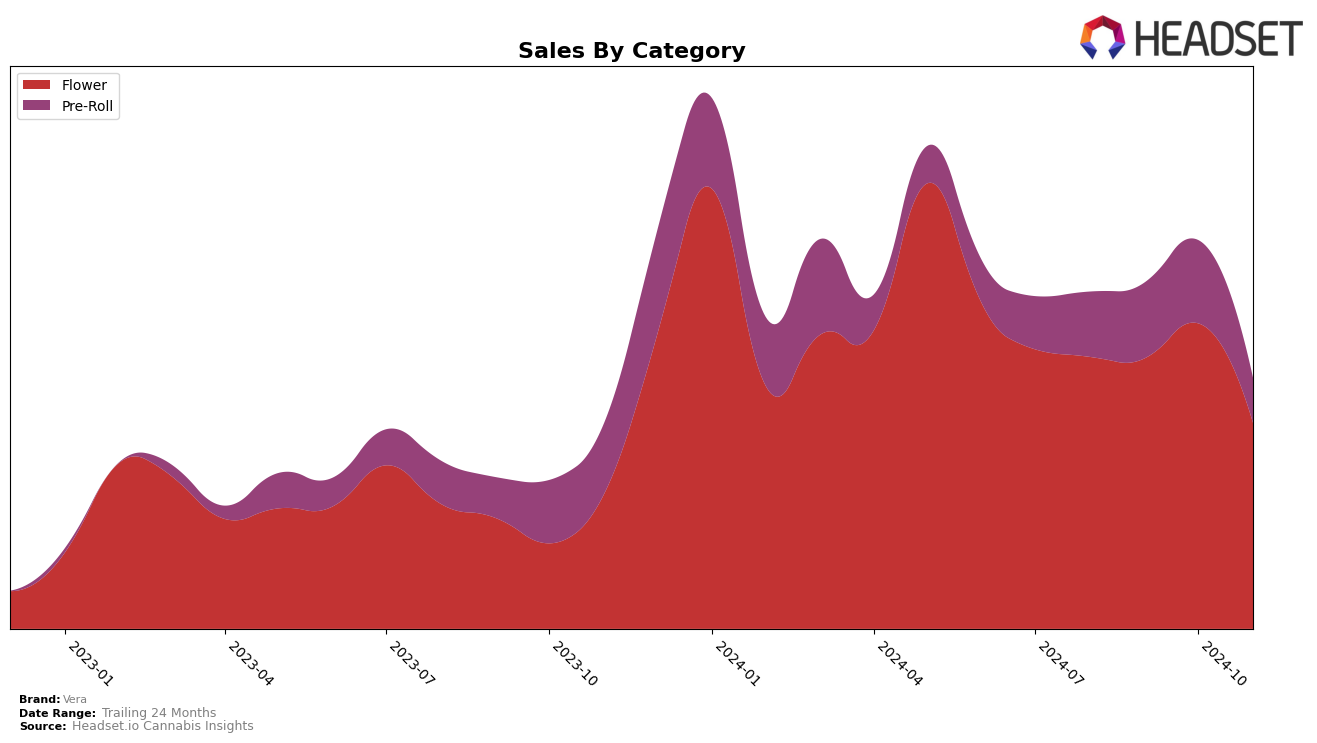

Vera has shown notable performance in the Colorado market, particularly in the Flower category. Over the past few months, Vera has climbed from the 36th position in August to a commendable 17th place by October, although it slipped slightly to 21st in November. This upward trend, despite the recent dip, indicates a strong market presence and growing consumer preference for their Flower products. The significant increase in sales from August to October highlights this positive momentum. However, maintaining a top 30 position consistently in Colorado suggests that Vera is effectively navigating the competitive landscape in this category.

In contrast, Vera's performance in the Pre-Roll category in Colorado has been more volatile. While they managed to hold steady at the 26th rank from August to September, they improved slightly to 23rd in October before dropping to 32nd in November. This fluctuation indicates challenges in sustaining their market position in the Pre-Roll segment. The drop out of the top 30 in November could be a point of concern, as it suggests a potential loss of market share or consumer interest. This inconsistency in rankings across months might reflect the need for strategic adjustments to enhance their competitiveness in this category.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Vera has demonstrated notable fluctuations in its market position over the past few months. Starting from August 2024, Vera was ranked 36th, but it made a significant leap to 17th place by October, before slightly declining to 21st in November. This trajectory is indicative of a robust growth phase, particularly between September and October, where Vera's sales surged, aligning with its improved ranking. In comparison, LoCol Love (TWG Limited) consistently outperformed Vera, maintaining a higher rank throughout, peaking at 19th in November. Meanwhile, The Colorado Cannabis Co. also showed upward momentum, reaching 20th place in November, closely trailing Vera. On the other hand, Bloom County and Antero Sciences experienced more volatility, with Bloom County dropping to 23rd and Antero Sciences to 22nd in November, indicating potential opportunities for Vera to capitalize on its competitors' inconsistencies. Overall, Vera's dynamic rise and the competitive shifts present a compelling narrative of growth potential amidst a competitive market.

Notable Products

In November 2024, Candy Cartel (1g) emerged as the top-performing product from Vera, securing the first rank with notable sales of 3,391 units. Blueberry Chemonade (Bulk) maintained its strong position at second place, despite a decrease in sales from 4,577 units in October to 2,387 units in November. Garlic & Skunk (Bulk) climbed into the third position, marking a significant presence in the Flower category. Double Mandarin Daiquiri (Bulk) improved its ranking from fifth to fourth, showcasing consistent demand. Meanwhile, Jack Herer Pre-Roll (1g) experienced a drop from third to fifth place, reflecting a decline in sales performance compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.