Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

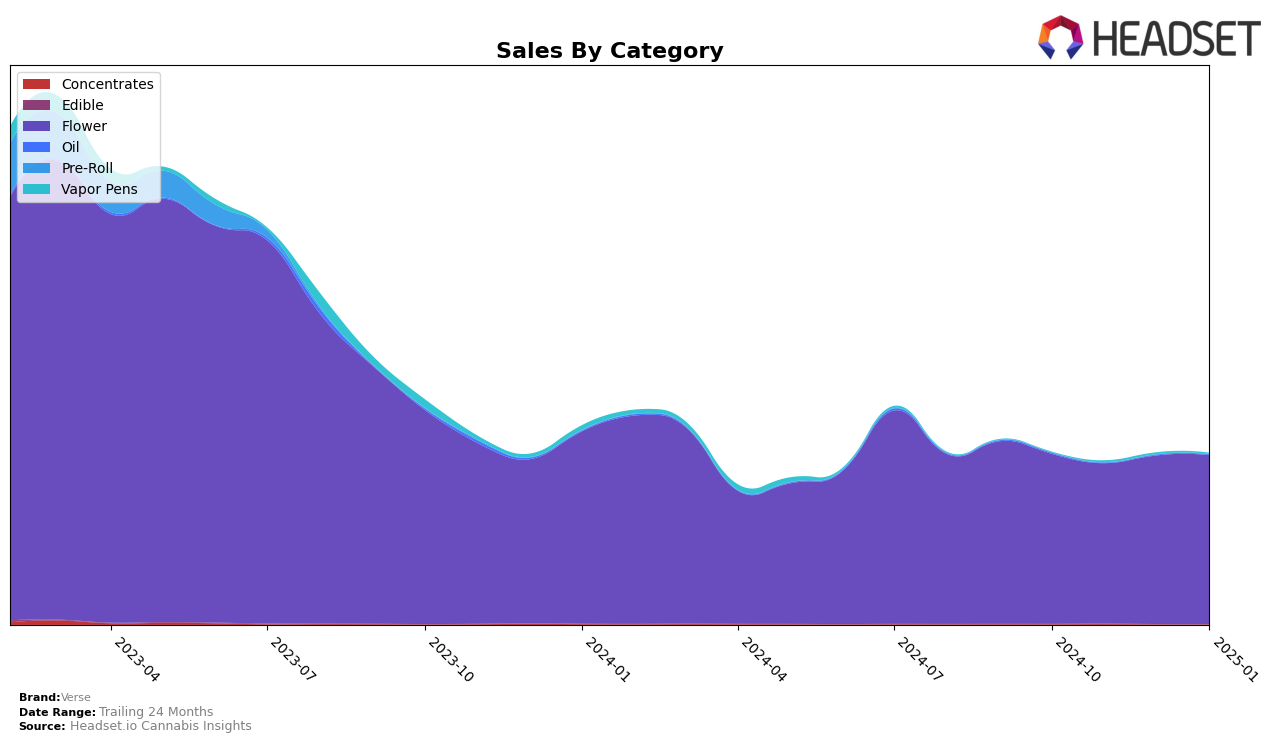

In the Canadian market, Verse has shown varied performance across provinces and categories. In Alberta, the brand has experienced some fluctuations in the Flower category, with its ranking moving from 67th in October 2024 to 64th by January 2025. This upward movement, despite not placing in the top 30, suggests a potential recovery after a dip in sales during November and December 2024. The brand's sales in Alberta reflect this trend, as they decreased to $54,842 in December before rebounding to $71,333 in January. These shifts indicate that while Verse is not yet a top contender in Alberta's Flower category, it is making strides towards better positioning.

In Ontario, Verse's performance in the Flower category has been relatively stable, maintaining a ranking in the low 70s throughout the observed months. While the brand did not break into the top 30, it did experience a notable sales increase in December 2024, suggesting a temporary boost in consumer interest or successful promotional efforts during that period. However, the subsequent decline in January 2025 indicates challenges in sustaining this momentum. The consistent ranking and sales figures suggest that Verse has a steady presence in Ontario, though there is room for growth to climb into the more competitive ranks.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Verse has shown a relatively stable performance in terms of rank, maintaining a position in the 70s from October 2024 to January 2025. Despite this stability, Verse's sales have seen fluctuations, with a notable increase in December 2024. Compared to competitors like QWEST and Freedom Cannabis, which have experienced declining sales and ranks, Verse's consistent rank suggests a steady market presence. However, brands like MELT and BC Smalls have shown dynamic changes, with MELT improving its rank significantly by January 2025 and BC Smalls entering the top 20 ranks by December 2024. These shifts indicate a competitive market where Verse must leverage its stable sales performance to enhance its rank and capture more market share.

Notable Products

In January 2025, BC God Bud (28g) from Verse continued its reign as the top-performing product, maintaining its number one rank from October through December 2024 with a sales figure of 2576 units. The Peach Dream 510 Thread Distillate Cartridge (1g) held steady at the second position, showing consistent performance since November 2024. CBD Drops (20ml) climbed to the third rank, improving from its fifth position in November 2024, despite a slight decline in sales. Notably, Okanagan Sugar Live Resin Badder (1g) and Okanagan Sugar Live Terp Cartridge (1g) were absent from the January 2025 rankings, indicating a potential shift in consumer preferences or availability. Overall, the top three products have shown resilience, with BC God Bud (28g) leading the pack in both ranking and sales volume.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.