Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

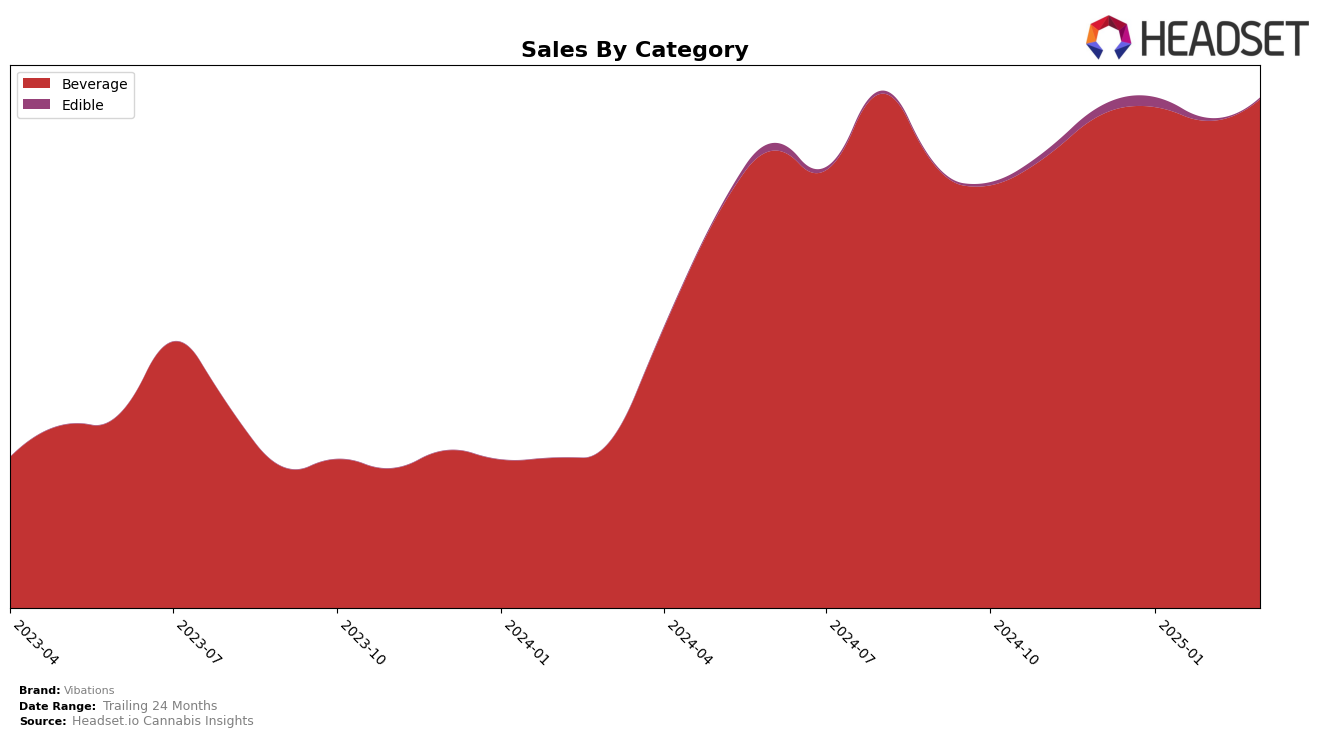

Vibations has demonstrated a consistent performance across several states, particularly in the beverage category. In Illinois, the brand maintained a strong presence, consistently ranking within the top 6 throughout the months from December 2024 to March 2025, with a notable peak in sales in March. This stability highlights their solid market position in the state. Meanwhile, in Massachusetts, Vibations showed a slight improvement, climbing from a rank of 10 in December 2024 to 8 in January 2025, before stabilizing around 9 in the following months. This upward trend in Massachusetts indicates a positive reception and growing consumer interest.

In Maryland, Vibations has been a dominant player, consistently holding one of the top two positions in the beverage category. They secured the top spot in January 2025, showcasing their popularity and strong market hold. However, despite this success, there was a slight dip in sales in March 2025 compared to previous months, which could be a point of concern if the trend continues. Across these states, Vibations' ability to maintain or improve its rankings reflects a robust brand strategy, although the absence of a top 30 ranking in other states could indicate potential areas for growth and expansion.

Competitive Landscape

In the Maryland beverage category, Vibations has demonstrated a strong competitive presence, consistently ranking in the top two positions from December 2024 through March 2025. Vibations briefly claimed the top spot in January 2025, overtaking Keef Cola, which has maintained its dominance in the first position for three out of the four months. Despite Vibations' dip back to the second position in February and March, its sales figures have remained robust, indicating a stable customer base. Notably, Dixie Elixirs and Sunnies by SunMed have shown fluctuations in their rankings, with Dixie Elixirs dropping to fourth place by March 2025, while Sunnies by SunMed has climbed to third place, suggesting a dynamic market environment. These shifts highlight the competitive landscape Vibations operates within, where maintaining a top rank requires continuous innovation and customer engagement.

Notable Products

In March 2025, the top-performing product for Vibations was the Strawberry Lemonade Liquid Drink Mix 10-Pack (100mg) in the Beverage category, reclaiming its first-place ranking after a temporary dip to third in February. The Lemon Lime Energy Drink Mix 10-Pack (100mg) climbed to second place, showing a notable increase in sales from 1672 to 2528 units. The THC/THCV 2:1 Tropical Punch Drink Mix 10-Pack (100mg THC, 50mg THCV) fell from its top spot in February to third place in March. Meanwhile, the THC/CBN 2:1 Berry Chamomile Tea Drink Mix 10-Pack (100mg THC, 50mg CBN) consistently held its position in the top four, though it slipped to fourth place. Lastly, the Pomegranate Blueberry Acai Tea Powder Drink Mix 10-Pack (100mg) maintained its fifth-place ranking, continuing its trend of steady sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.