Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

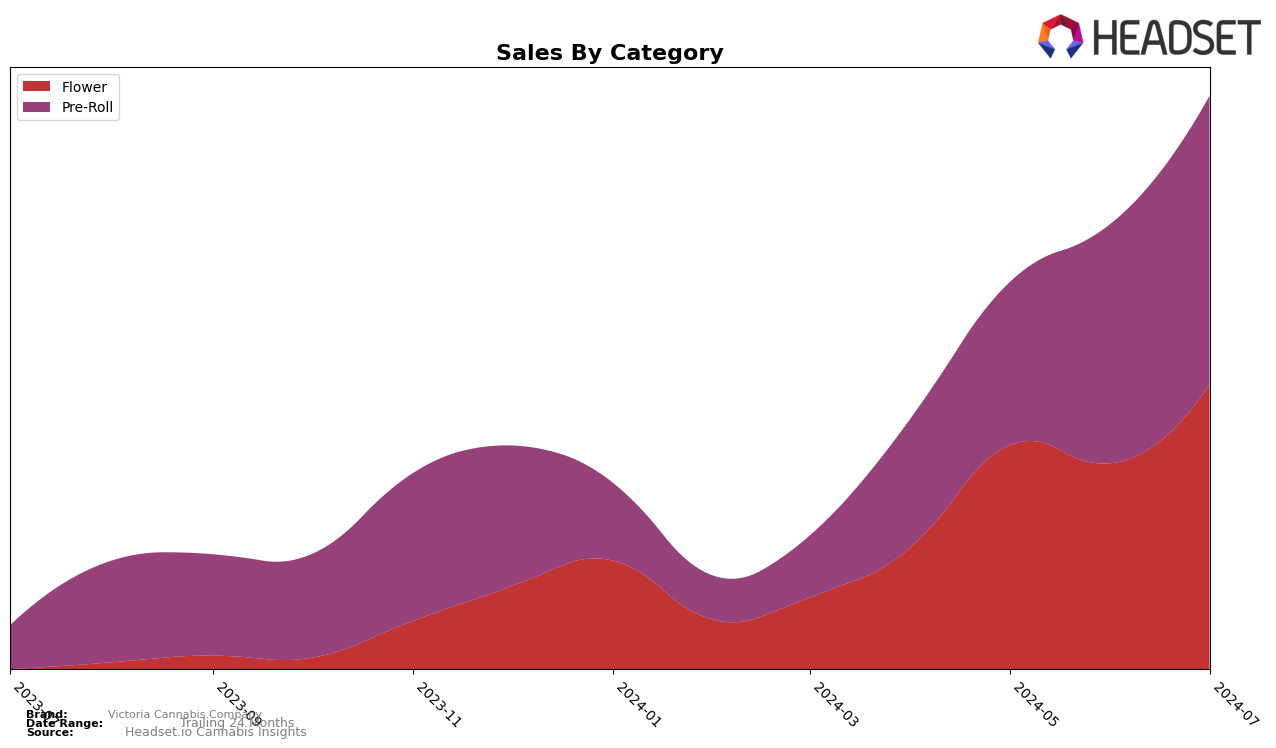

Victoria Cannabis Company has shown notable performance shifts across different categories and regions over recent months. In British Columbia, the brand's position in the Flower category has seen a significant improvement. Starting from a rank of 55 in April 2024, they have climbed to 29 by July 2024, indicating a consistent upward trend. This movement is accompanied by a substantial increase in sales, from $68,674 in April to $166,819 in July. Such a trend suggests a growing consumer preference for their Flower products, possibly due to improved quality or effective marketing strategies.

In the Pre-Roll category within British Columbia, Victoria Cannabis Company has also made strides, though at a slightly more gradual pace. The brand moved from a rank of 61 in April to 41 by July, showing steady progress. Sales figures support this positive trend, increasing from $73,542 in April to $126,459 in July. However, the brand's placement outside the top 30 in both categories earlier in the year highlights areas for potential improvement. The data suggests that while the brand is gaining traction, there is still room for growth to compete with top-tier brands.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Victoria Cannabis Company has shown a notable upward trend in its ranking over the past few months. Starting from a rank of 55 in April 2024, the brand has climbed to 29 by July 2024. This significant improvement in rank is indicative of a positive reception in the market, likely driven by increased consumer preference or effective marketing strategies. In contrast, competitors such as DOJA and 3Saints have experienced a decline in their rankings, with DOJA dropping out of the top 20 entirely and 3Saints falling from 24 to 30 over the same period. Meanwhile, Color Cannabis has shown a fluctuating but ultimately positive trend, ending July at rank 27. Another competitor, 18twelve, has also seen an improvement, moving from rank 40 in April to 31 in July. These shifts suggest a dynamic market where Victoria Cannabis Company is gaining ground, potentially at the expense of some established brands, making it a key player to watch in the Flower category in British Columbia.

Notable Products

In July 2024, Victoria Cannabis Company's top-performing product was G Wagon Pre-Roll 3-Pack (1.5g), maintaining its number one rank for four consecutive months with sales reaching 3695 units. The second spot was held by Pomelo Skunk Pre-Roll 3-Pack (1.5g), which rose from third place in June to second in July, showing a significant sales increase to 2416 units. G Wagon (3.5g) secured the third rank, up from fourth in June, with notable sales growth. The G Wagon Pre-Roll 5-Pack (2.5g) dropped to fourth place, despite consistent performance in previous months. Finally, G Wagon (7g) entered the top five in July with a fifth-place ranking, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.