Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

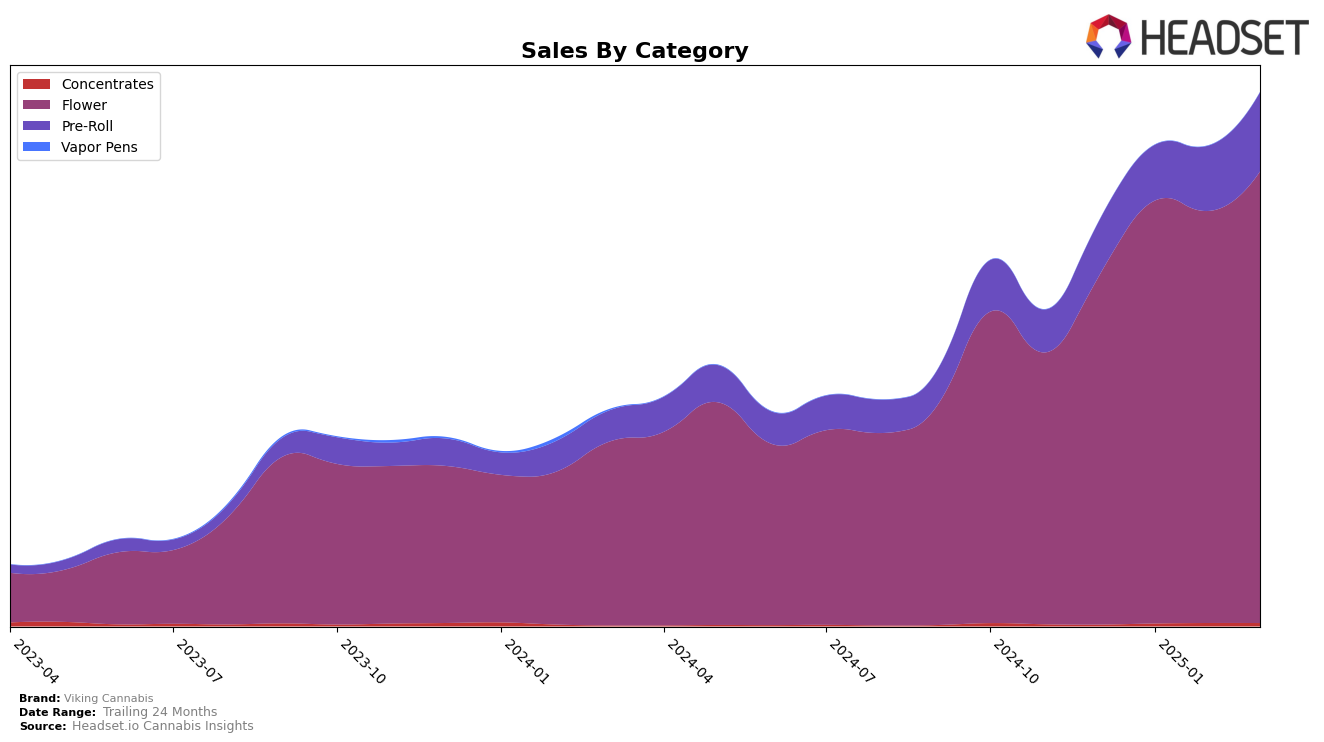

In the Washington market, Viking Cannabis has demonstrated a strong performance in the Flower category. The brand improved its ranking from 11th in December 2024 to 7th by February 2025, before settling at 8th in March 2025. This upward trend indicates a positive reception and growing consumer base, as reflected by a notable increase in sales from $412,671 in December to $533,871 by March. However, it's important to note that Viking Cannabis did not make it to the top 30 in other crucial categories, which may suggest areas for potential growth or a need to diversify their product offerings to capture a larger market share.

In the Pre-Roll category, Viking Cannabis started outside the top 30, but by March 2025, it had climbed to 37th place in Washington. This improvement, although not placing them within the top 30, highlights a significant upward trajectory, with sales increasing from $64,771 in December 2024 to $93,292 in March 2025. While this progress is commendable, the brand's absence from the top 30 in the initial months underscores the competitive nature of the Pre-Roll market and the challenges Viking Cannabis faces in achieving a more dominant position. This could be an area of focus for the brand as it seeks to expand its influence and consumer reach within the state.

Competitive Landscape

In the competitive landscape of the Washington flower category, Viking Cannabis has demonstrated a notable upward trajectory in rankings and sales over the past few months. Starting from a rank of 11th in December 2024, Viking Cannabis climbed to 8th in January 2025, further advancing to 7th in February before slightly dipping back to 8th in March. This positive momentum is underscored by a significant increase in sales, particularly from January to March, where sales rose from $499,847 to $533,871. In comparison, Fifty Fold maintained a relatively stable position, hovering around the 9th and 10th ranks with lower sales figures than Viking Cannabis in March. Meanwhile, Fire Bros. consistently outperformed Viking Cannabis in terms of rank, maintaining a position between 6th and 7th, with higher sales in March. However, WA Grower, which peaked at 3rd in February, experienced a decline to 6th in March, indicating potential volatility. The steady performance of Viking Cannabis amidst these fluctuations suggests a strengthening brand presence and growing consumer preference in the Washington flower market.

Notable Products

In March 2025, Candy Mac (3.5g) emerged as the top-performing product for Viking Cannabis, climbing from its consistent second-place position in previous months to secure the number one rank with sales reaching 2228 units. The previously top-ranked Oil Tanker (3.5g) dropped to second place, despite maintaining strong sales figures. Oreoz (3.5g) held steady at third place, showing a consistent upward trend in sales over the months. Old School Lemons (3.5g) remained in fourth place, experiencing a slight decline in sales compared to February. The Old School Lemons Pre-Roll 2-Pack (1g) maintained its fifth position, rebounding in March after no sales were recorded in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.