Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

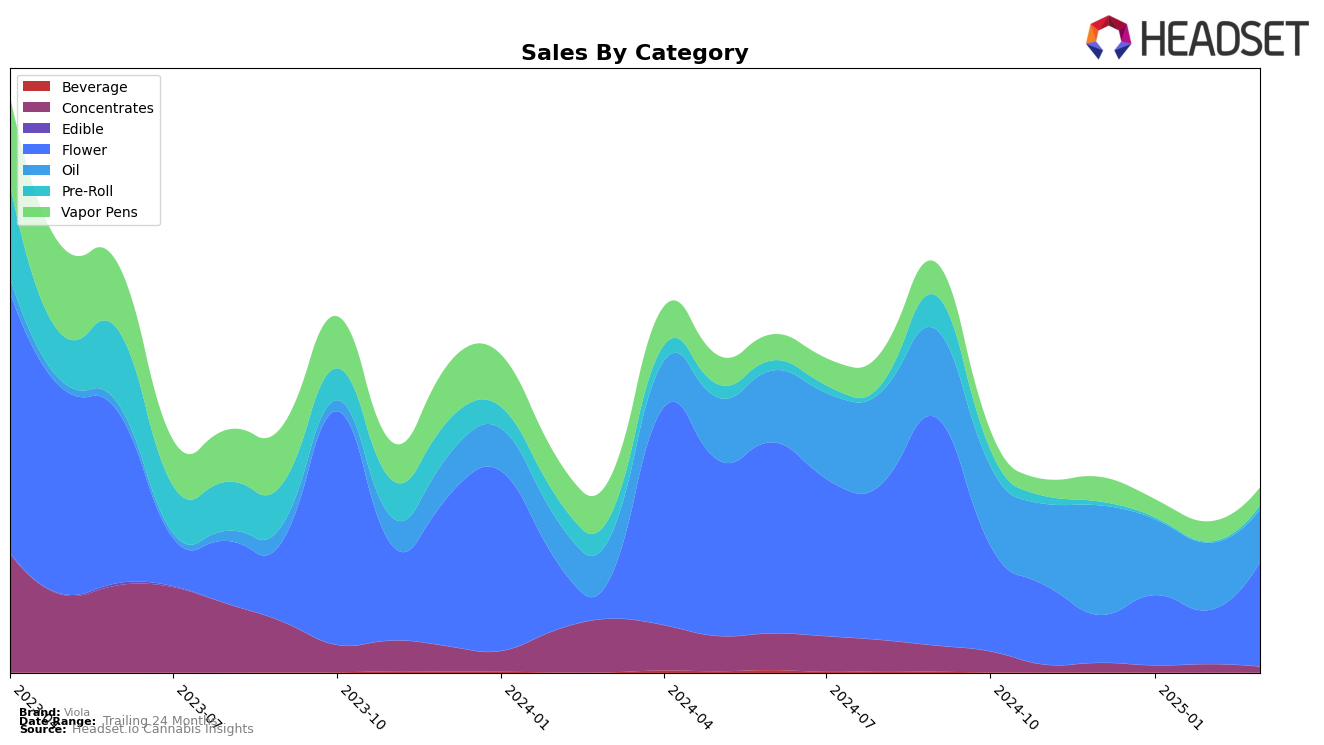

Viola has shown notable performance across different categories and regions, with significant movements observed in both Colorado and Ontario. In Colorado, Viola's presence in the Flower category has been increasingly competitive. Despite not being in the top 30 brands in December 2024, Viola made substantial progress by March 2025, climbing to the 54th rank. This upward trajectory is indicative of a strong market strategy and increasing consumer preference for Viola's offerings in Colorado. However, the brand still has room for improvement to break into the top rankings, which could be a potential target for future growth.

In Ontario, Viola has maintained a consistent presence in the Oil category, consistently ranking within the top 6 brands from December 2024 to March 2025. This stability suggests a strong foothold in the market, although a slight decline from 5th to 6th position by March 2025 indicates increased competition or a shift in consumer preferences. The sales figures reflect a downward trend over these months, which might warrant a strategic review to maintain or improve their market position. This indicates that while Viola has established a solid brand presence in Ontario, there is potential for further growth and market adaptation to sustain its competitive edge.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Viola has demonstrated a notable upward trajectory in its rankings and sales from December 2024 to March 2025. Starting at a rank of 92 in December, Viola climbed to 54 by March, showcasing a significant improvement in market presence. This upward trend is reflected in its sales, which more than tripled from December to March. In contrast, The Colorado Cannabis Co. experienced a decline in rank from 39 to 48 during the same period, despite maintaining higher sales figures overall. Similarly, Summit and Sunshine Extracts both saw their rankings drop, with Summit moving from 32 to 56 and Sunshine Extracts from 37 to 57, indicating potential challenges in sustaining their market positions. Meanwhile, Rocky Mountain High showed a slight improvement in rank, moving from 60 to 52, aligning closely with Viola's performance in March. These dynamics suggest that Viola is gaining competitive ground, potentially benefiting from strategic initiatives or market shifts that have bolstered its standing in the Colorado Flower market.

Notable Products

In March 2025, the top-performing product for Viola was Gastropops Smalls (Bulk) in the Flower category, which surged to the number one spot with impressive sales of 5,965 units. This marks a significant rise from its fourth-place position in January 2025. Subzero (Bulk), also in the Flower category, ranked second, showing a notable climb from its previous fifth place in December 2024. Frozen Yogurt Smalls (Bulk) debuted in the rankings at third place, while Oreoz Smalls (Bulk) followed in fourth. The Water Soluble THC Infuser Oil (20ml), a consistent leader in prior months, dropped to fifth place, reflecting a decrease in sales from its peak in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.