Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

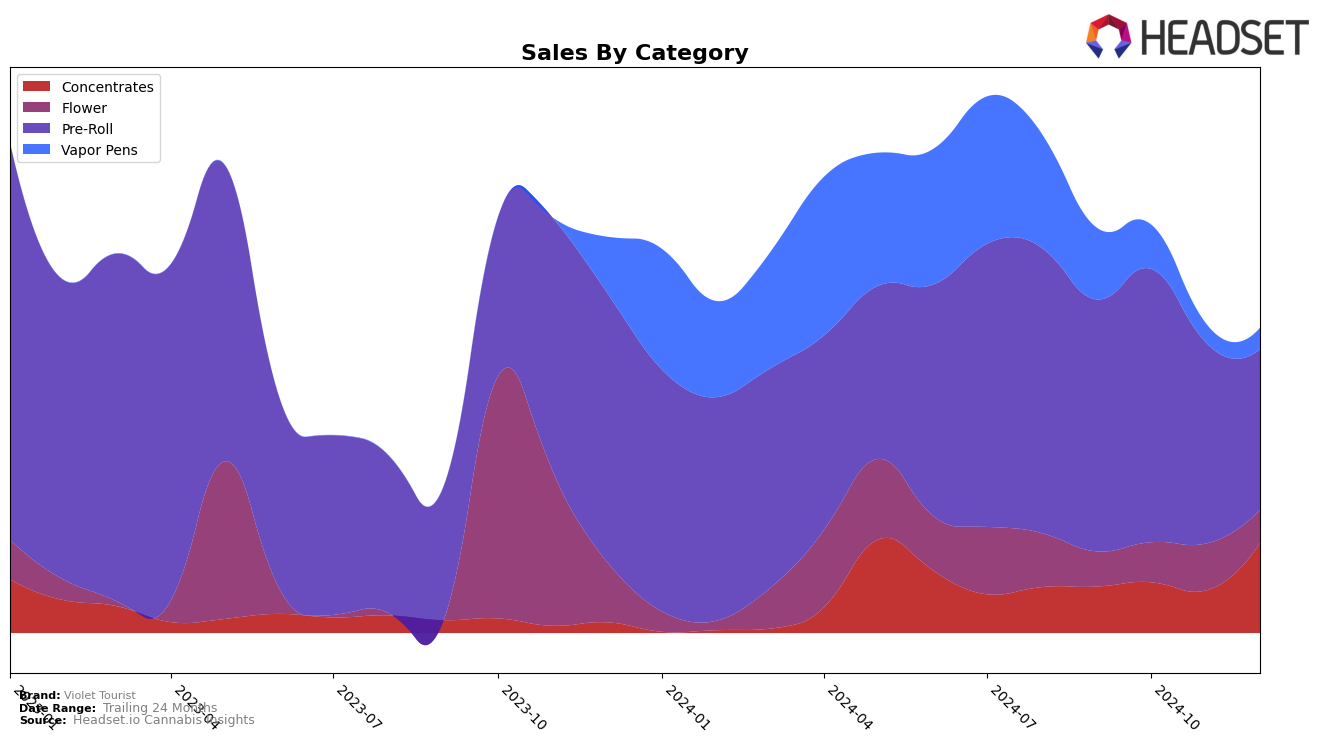

Violet Tourist's performance across various categories in Alberta shows some notable trends. In the Concentrates category, the brand saw a significant improvement in its ranking, moving from 42nd place in November 2024 to 28th place by December 2024, indicating a strong upward trajectory. This improvement is backed by a substantial increase in sales, with December's figures more than doubling those in November. However, in the Pre-Roll category, Violet Tourist did not maintain a position in the top 30 brands by December 2024, which could be seen as a potential area for concern. Meanwhile, the Vapor Pens category saw the brand dropping out of the rankings after October, suggesting a need for strategic reassessment in this segment.

In Saskatchewan, Violet Tourist's performance in the Pre-Roll category remained relatively stable. The brand consistently ranked in the mid-50s throughout the final months of 2024, maintaining its 56th position from November to December. This steadiness in ranking, despite fluctuations in sales figures, suggests a consistent consumer base in the region. However, the absence of Violet Tourist in the top rankings for other categories in Saskatchewan indicates a limited market presence beyond Pre-Rolls. This could present both a challenge and an opportunity for the brand to explore and expand its offerings in the province.

Competitive Landscape

In the Alberta concentrates market, Violet Tourist has shown a notable upward trajectory in its rank from September to December 2024, moving from 37th to 28th place. This improvement highlights a significant increase in sales, particularly in December, where Violet Tourist's sales surpassed those of Greybeard, which experienced a decline in both rank and sales during the same period. Despite being behind Freedom Cannabis, which consistently maintained a higher rank, Violet Tourist's December sales were competitive, suggesting a potential for further growth. Meanwhile, Distinkt saw a fluctuating rank but ended the year ahead of Violet Tourist, indicating a competitive landscape. Nebulous Cannabis remained relatively stable, closely trailing Violet Tourist by December. These dynamics suggest that while Violet Tourist is gaining momentum, it faces stiff competition from established brands, necessitating strategic efforts to maintain and enhance its market position.

Notable Products

In December 2024, the top-performing product for Violet Tourist was Mini J's - Lilac Diesel Pre-Roll 5-Pack (1.75g) in the Pre-Roll category, maintaining its first-place ranking from the previous two months with sales hitting 973 units. Sage n' Sour Terp Slush (1g) in the Concentrates category rose to second place, showing a significant increase from its third-place position in November. The Mini J's - Lilac Diesel Pre-Roll 10-Pack (3.5g) moved up to third place, after not being ranked in November, with steady sales performance. The Day & Night Combo Pack Pre-Roll 10-Pack (3.5g) remained stable in fourth place, consistent with its November ranking. Lastly, Mini J's - Cool Mint Crush Infused Pre-Roll 5-Pack (1.75g) held its fifth-place rank, indicating a consistent demand for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.