Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

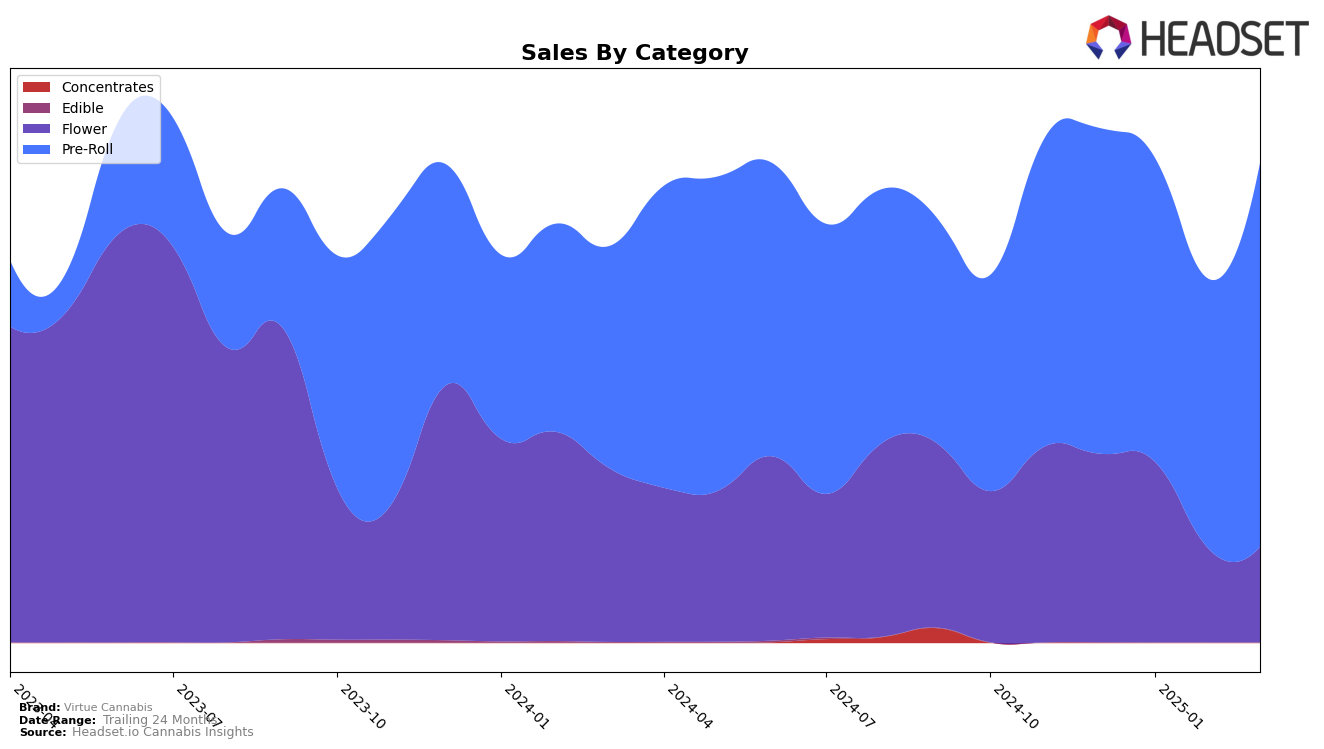

Virtue Cannabis has shown varied performance across different states and categories, with some notable movements worth highlighting. In Alberta, their Flower category saw a decline in rankings, dropping from 43rd in December 2024 to 52nd by March 2025. This indicates a potential challenge in maintaining market presence in this category. However, the Pre-Roll category in Alberta tells a different story, where Virtue Cannabis improved its position significantly, moving from 23rd in December to 17th by March. This upward trend in Pre-Rolls suggests a growing consumer preference for their offerings in this segment.

In contrast, Virtue Cannabis did not maintain a top 30 position in certain categories and regions, signaling areas for potential improvement. For instance, in British Columbia, the Flower category saw a disappearance from the top rankings after February 2025, and the Pre-Roll category was not in the top 30 after December 2024. This absence could be a concern for the brand's visibility and sales in British Columbia. Similarly, in Nevada and Saskatchewan, Virtue Cannabis did not sustain their rankings past January 2025, which might indicate increased competition or shifting consumer tastes in these markets.

Competitive Landscape

In the competitive landscape of the Alberta pre-roll market, Virtue Cannabis has demonstrated a promising upward trajectory in terms of rank and sales. Starting from the 23rd position in December 2024, Virtue Cannabis has steadily climbed to the 17th position by March 2025. This improvement in rank is indicative of a positive trend, particularly when compared to competitors like 1964 Supply Co, which saw a decline from 12th to 15th place over the same period. Additionally, FIGR has shown a notable rise from 29th to 19th, yet still trails Virtue Cannabis. Meanwhile, Tribal and BoxHot have experienced fluctuations, with Tribal slightly ahead of Virtue Cannabis in March 2025. This competitive positioning suggests that Virtue Cannabis is effectively capturing market share and could continue to ascend if current trends persist.

Notable Products

In March 2025, the top-performing product from Virtue Cannabis was the Fruitloops Diamond Infused Pre-Roll 5-Pack (2.5g), maintaining its first-place ranking for four consecutive months with sales reaching 3,817 units. The Galactic Grape Infused Pre-Roll 5-Pack (2.5g) held steady at the second position, showing a consistent performance since February. Watermelon Mjto Ice Diamond Infused Pre-Roll 5-Pack (2.5g) remained third, mirroring its rank from the previous month. Liger Blood Infused Pre-Roll 5-Pack (2.5g) improved slightly from fifth to fourth place, while Galactic Glue Blunt (1g) dropped from fourth to fifth. Overall, the rankings have shown minor shifts, with Fruitloops Diamond consistently leading the pack.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.