Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

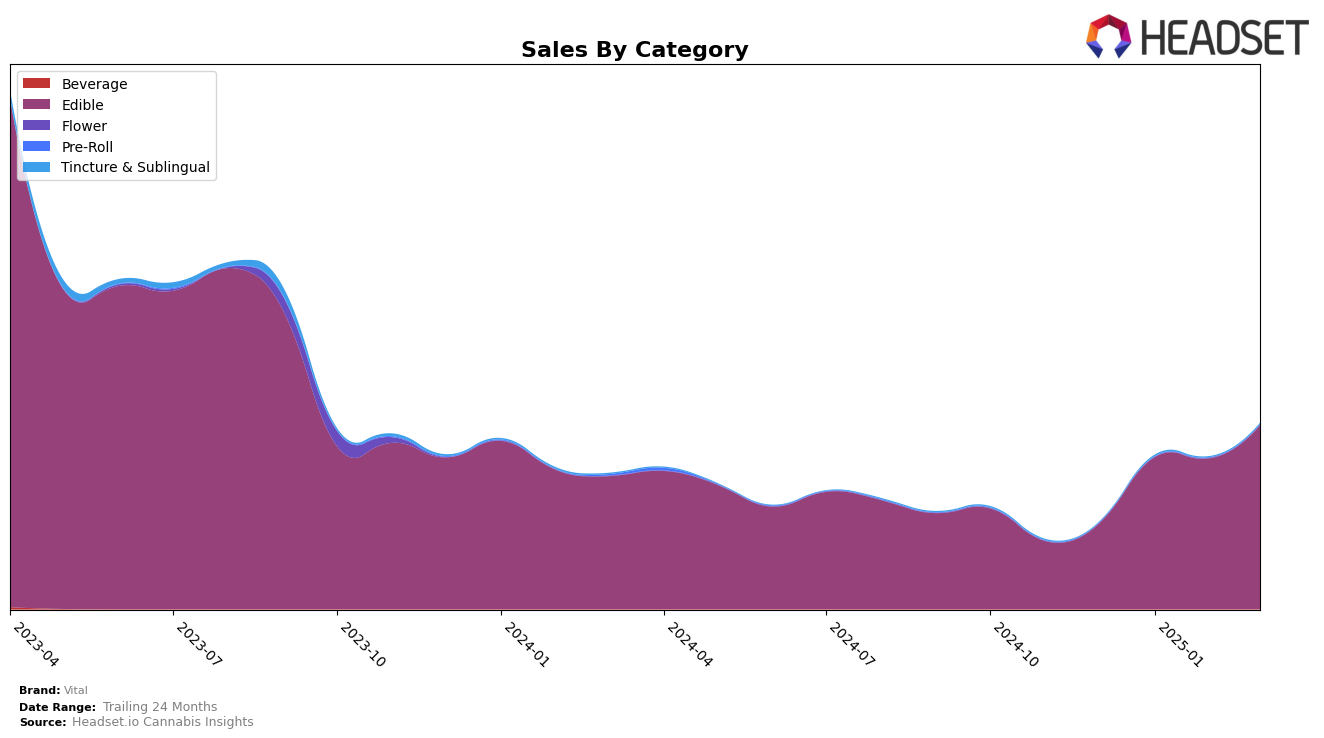

Vital has shown a promising trajectory in the Arizona market, especially within the Edible category. Starting at the 17th position in December 2024, the brand has consistently climbed the ranks, reaching the 12th spot by March 2025. This upward movement indicates a growing consumer preference and possibly an effective marketing strategy or product innovation that resonates well with the local audience. The consistent improvement in rankings over a few months suggests that Vital is becoming a more significant player in the Arizona edibles landscape, which could be a positive indicator for future performance.

While Vital's performance in Arizona is noteworthy, it's important to recognize that the brand's absence from the top 30 in other states or provinces might indicate areas for potential growth or challenges in expanding its market presence. Not being ranked in the top 30 in other regions could suggest that Vital either hasn't penetrated those markets effectively or faces stiff competition. Understanding the dynamics in these other markets could provide insights into potential strategies for Vital to enhance its footprint beyond Arizona.

Competitive Landscape

In the competitive landscape of the Edible category in Arizona, Vital has demonstrated a notable upward trajectory in its rankings, moving from 17th place in December 2024 to securing the 12th spot by March 2025. This improvement in rank is indicative of a strategic growth in sales, with a significant increase from January to March 2025. In contrast, Sofa King Tasty and Zenzona have experienced fluctuations, with Sofa King Tasty dropping from 13th to 15th place, and Zenzona maintaining a relatively stable position but still trailing behind Vital in March. Meanwhile, Good Tide has consistently held the 11th rank, indicating a strong foothold just ahead of Vital. The brand brix remains a formidable competitor, consistently ranking higher than Vital, but its slight decline from 8th to 10th place by March 2025 suggests potential vulnerabilities that Vital could capitalize on. These dynamics highlight Vital's potential to continue climbing the ranks if it sustains its current growth momentum.

Notable Products

In March 2025, Vital's top-performing product was the Tropical Mango RSO Gummies 10-Pack (100mg), maintaining its number one rank for four consecutive months with sales reaching 5485 units. The Grape Fast Acting Gummies 10-Pack (100mg) consistently held the second position, showing a significant increase in sales to 4717 units. The CBD/THC 2:1 Kiwi Strawberry Pectin Vegan Gummies moved up to third place from fifth in the previous two months, indicating a growing consumer preference. The CBN/THC 1:2 Indica Cran Raspberry Pectin Gummies dropped one spot to fourth place, despite stable sales figures. Notably, Black Cherry Pectin RSO Gummies entered the rankings in March at fifth, suggesting a positive reception in its debut month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.