Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

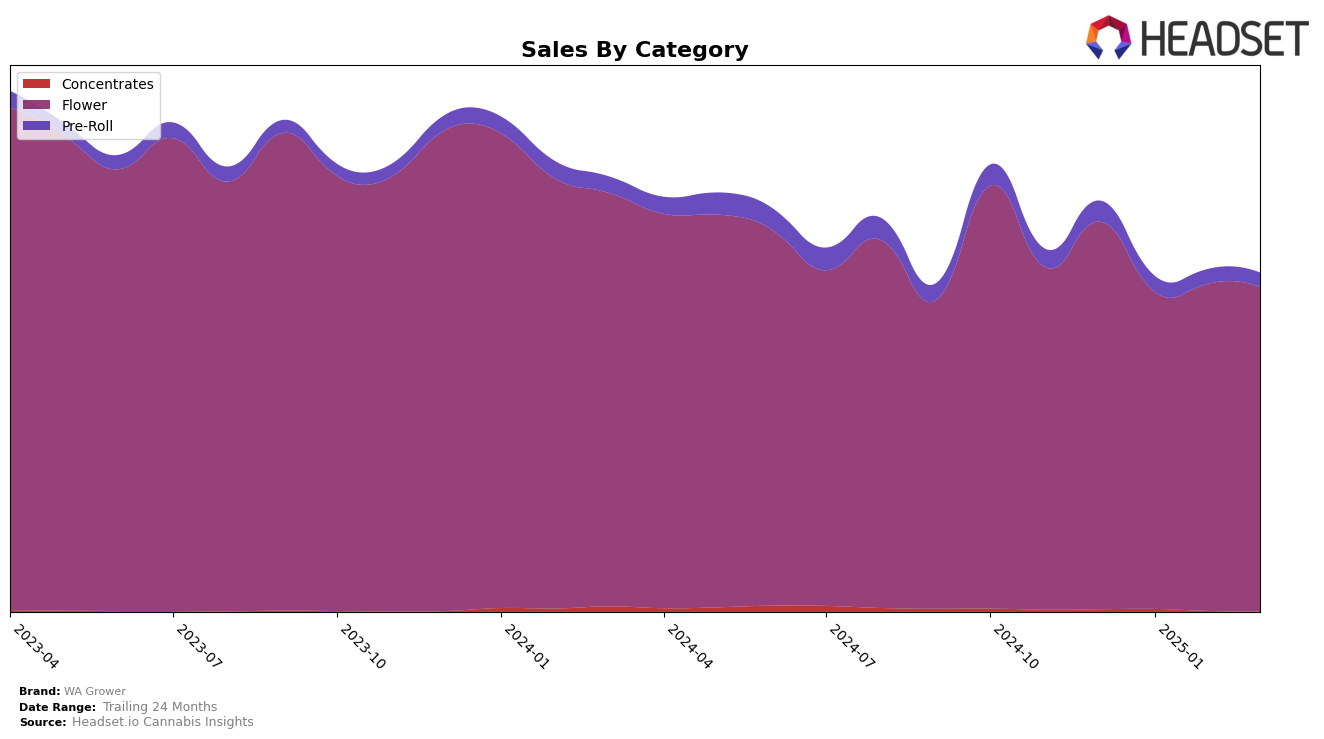

WA Grower has demonstrated a strong presence in the Washington market, particularly within the Flower category. Over the months from December 2024 to March 2025, the brand consistently maintained a top position, peaking at rank 3 in February 2025 before slightly dropping to rank 6 in March 2025. This fluctuation suggests a competitive market landscape where WA Grower remains a significant player. Despite a decline in sales from December to January, the brand managed to recover slightly in February, indicating resilience and potential strategic adjustments. In contrast, their performance in the Pre-Roll category was less notable, as evidenced by their absence from the top 30 ranks after December 2024, highlighting a potential area for growth or increased focus.

The absence of WA Grower from the top 30 in the Pre-Roll category post-December 2024 in Washington could be seen as a missed opportunity in a growing segment of the market. This lack of presence might suggest either a strategic withdrawal from this category or a need to innovate and capture market share. However, their consistent performance in the Flower category showcases their strength and brand loyalty within this segment. As they navigate these dynamics, understanding the shifts in consumer preferences and competitive strategies will be crucial for WA Grower to enhance its market position and explore potential growth avenues in other categories or states.

Competitive Landscape

In the competitive landscape of the Washington flower market, WA Grower has shown notable fluctuations in its ranking and sales performance over the past few months. Starting from a strong position in December 2024, ranked 5th, WA Grower maintained this rank in January 2025, then climbed to 3rd in February 2025, before slipping back to 6th in March 2025. This dynamic change in rank reflects a competitive environment where brands like Lifted Cannabis Co and Redbird (formerly The Virginia Company) have also been vying for top positions. Notably, Redbird experienced a significant jump from 8th in February to 4th in March, which may have contributed to WA Grower's decline. Meanwhile, Fire Bros. maintained a relatively stable presence, hovering around the 6th and 7th positions, indicating consistent competition. Despite these shifts, WA Grower's sales figures have shown resilience, with a peak in February 2025, suggesting strong consumer demand that could be leveraged for future growth.

Notable Products

In March 2025, Gorilla Glitter Glue (7g) maintained its position as the top-performing product for WA Grower, with sales reaching 1514 units. Gorilla Glue #4 (3.5g) climbed back to the second spot, after slipping to fourth place in February. Gorilla Glue #4 (7g) re-entered the rankings at third place, showing a resurgence in sales. White Widow (7g) made its debut in the rankings at fourth place, indicating a growing customer interest. Runtz (3.5g) rounded out the top five, marking its first appearance in the monthly rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.