Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

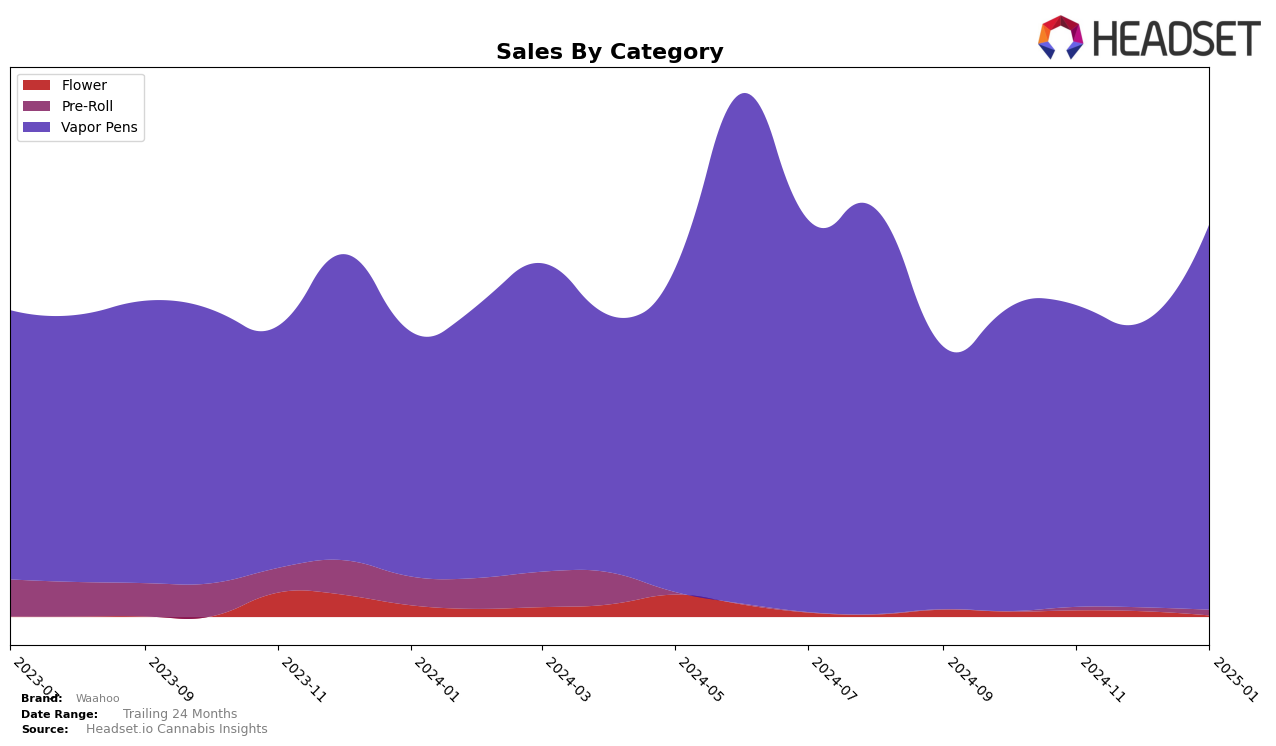

In the Vapor Pens category, Waahoo has shown a resilient performance in New York. The brand maintained its presence within the top 30 rankings across the months analyzed, indicating a consistent demand for its products. Starting at rank 25 in October 2024, Waahoo experienced a slight decline, dropping to rank 30 in both November and December. However, by January 2025, Waahoo improved its position to rank 28, suggesting a positive momentum entering the new year. This upward trend in January is particularly noteworthy, as it coincides with a significant increase in sales compared to the previous month, which could be indicative of successful marketing strategies or product launches.

While Waahoo's ability to remain within the top 30 in New York is commendable, the fluctuations in their rankings highlight the competitive nature of the Vapor Pens category. The fact that Waahoo was not absent from the top 30 at any point during these months is a positive sign of brand strength and consumer loyalty. However, the brand's journey from rank 25 to 30 and back to 28 also suggests there are areas for improvement to gain a stronger foothold in the market. Observing the shifts in rankings and sales figures over time can provide valuable insights into consumer preferences and market dynamics, which Waahoo can leverage to enhance its market position further.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Waahoo has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. Starting at rank 25 in October 2024, Waahoo saw a slight drop to 30 by November and December, before improving to rank 28 in January 2025. This suggests a recovery in market position, possibly driven by a strategic response to competitors. Notably, CRU Cannabis consistently maintained a higher rank than Waahoo in October, but fell out of the top 20 by November, indicating a potential opportunity for Waahoo to capture more market share. Meanwhile, Dime Industries and Hudson Cannabis showed upward trends, with Dime Industries climbing from rank 40 to 27 and Hudson Cannabis improving from 46 to 29, highlighting the competitive pressure Waahoo faces. Hashtag Honey also presented a volatile trajectory, peaking at rank 24 in December before dropping to 32 in January, which could signal a shift in consumer preferences or marketing effectiveness. Overall, Waahoo's ability to regain rank in January suggests resilience and potential for growth amidst a competitive and shifting market.

Notable Products

In January 2025, Waahoo's top-performing product was the Sour Diesel Distillate Cartridge (1g) from the Vapor Pens category, which climbed from its consistent second-place ranking in the previous months to secure the top spot with sales reaching 1,703 units. The Acapulco Gold Ceramic Distillate Cartridge (1g), previously holding the number one position, fell to second place despite maintaining strong sales figures of 1,462 units. The Pineapple Trainwreck Distillate Cartridge (1g) remained steady in third place, showing a gradual increase in sales over the months. Devil Fruit Distillate Cartridge (1g) and Granddaddy Purple Ceramic Distillate Cartridge (1g) continued to hold their fourth and fifth positions respectively, with both products showing a consistent sales trajectory. This shift in rankings highlights the growing popularity of Sour Diesel among consumers, overtaking Acapulco Gold's long-standing dominance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.