Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

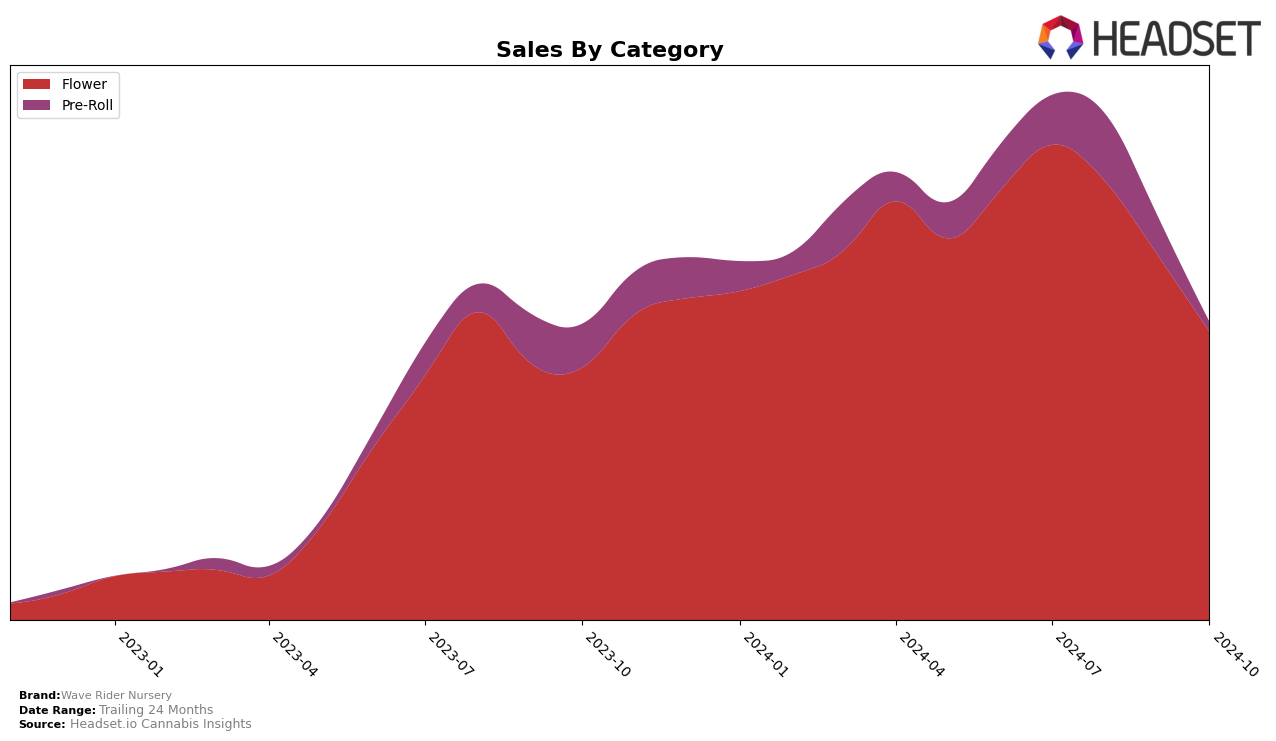

Wave Rider Nursery has shown varied performance across different categories in the competitive landscape of California. In the Flower category, the brand experienced a decline in rankings from July to October 2024, starting at 20th place and dropping to 26th by October. This downward trend is mirrored in their sales figures, which saw a significant decrease from $1,605,430 in July to $981,351 in October. Such a decline indicates potential challenges in maintaining market share or adapting to consumer preferences within this category. On the other hand, the Pre-Roll category showed a brief improvement in August, where the brand advanced to 48th place from 65th in July, but it failed to maintain this momentum, as it fell out of the top 30 by October. This fluctuation in rankings suggests that while there was an initial increase in consumer interest or distribution effectiveness, sustaining that growth proved challenging.

The absence of Wave Rider Nursery in the top 30 rankings for the Pre-Roll category in October could be seen as a setback, emphasizing the competitive pressures in California's cannabis market. It highlights the importance of strategic adjustments to regain traction. Despite these challenges, the brand's resilience in the Flower category, where it remained within the top 30 throughout the observed months, suggests a core strength that could be leveraged for future growth. The contrasting performance across categories illustrates the dynamic nature of the cannabis market and the need for brands like Wave Rider Nursery to continuously innovate and adapt to changing consumer demands and market conditions.

Competitive Landscape

In the competitive landscape of the California flower category, Wave Rider Nursery has experienced notable fluctuations in rank and sales over the past few months. Starting from a strong position at rank 20 in July 2024, Wave Rider Nursery saw a slight improvement to rank 19 in August, but then experienced a decline, falling to rank 21 in September and further to rank 26 by October. This downward trend in rank is mirrored by a decrease in sales, with October's sales figures significantly lower than those in July. In contrast, competitors like Maven Genetics and Decibel Gardens have shown upward momentum. Maven Genetics improved its rank from 34 in July to 24 in October, while Decibel Gardens climbed from 33 to 27 in the same period. These competitors not only improved their rankings but also demonstrated an increase in sales, suggesting a growing consumer preference. The competitive pressure from brands like Astronauts (CA), which maintained a relatively stable rank, further highlights the challenges Wave Rider Nursery faces in maintaining its market position in the dynamic California flower market.

Notable Products

In October 2024, Peanut Butter Breath (3.5g) reclaimed its position as the top-selling product for Wave Rider Nursery, despite a decrease in sales to 3,294 units. GMO-BX1 (3.5g) showed a notable rise, moving up to second place from fourth in September. Blueberry Pancakes (3.5g), which was the top product in September, fell to third place. Lemon Bars (3.5g) experienced a consistent decline in ranking, moving from third in September to fourth in October. Lastly, Lemon Bars (14g) maintained its fifth position, having been absent from rankings in August and September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.