Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

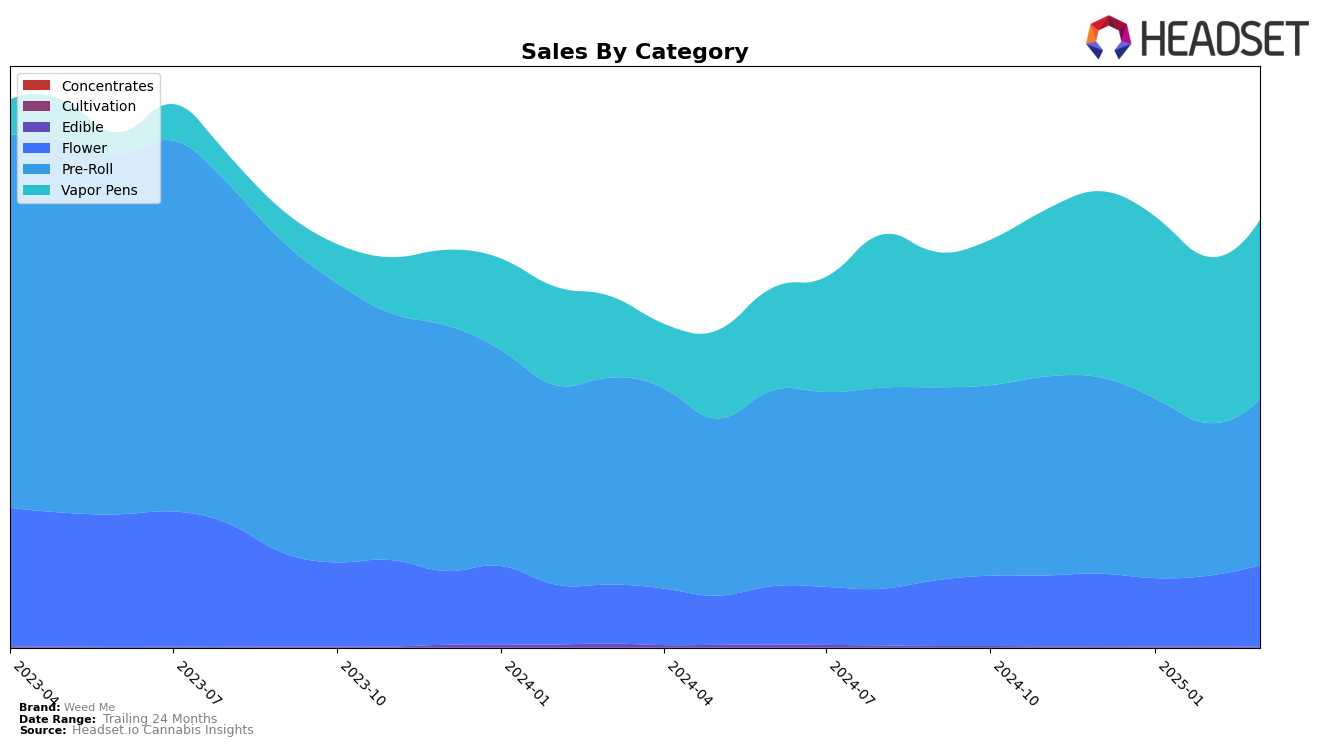

In the cannabis market, Weed Me has shown varied performance across different categories and regions. In Alberta, Weed Me's presence in the Flower category has been inconsistent, with rankings fluctuating outside the top 30, indicating a potential area for improvement. However, their performance in the Pre-Roll category has been more stable, maintaining a position within the top 10, although there was a slight decline in rank from 7th to 9th by March 2025. In the Vapor Pens category, Weed Me has shown resilience by improving its rank from 12th to 9th, suggesting a growing consumer preference for their products in this segment.

In British Columbia, Weed Me has demonstrated a strong foothold in the Flower category, climbing from 13th to 7th position by March 2025, reflecting a positive trend in sales and consumer acceptance. Their Pre-Roll products have consistently held the 2nd rank, highlighting their strong market presence. Meanwhile, in Ontario, Weed Me's performance in the Flower and Pre-Roll categories has been less prominent, with rankings outside the top 30, indicating challenges in these segments. However, their Vapor Pens have maintained a solid position within the top 10, suggesting a competitive edge in this category. In Saskatchewan, Weed Me's Vapor Pens have shown a steady improvement, climbing from 10th to 7th place, indicating a strengthening market position in this region.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Weed Me consistently holds the second rank from December 2024 through March 2025, showcasing its stable market position. Despite a slight dip in sales from December to February, Weed Me's sales rebounded in March, indicating resilience and potential customer loyalty. In contrast, General Admission maintains its lead at the top rank, although its sales show a downward trend over the same period. Meanwhile, Jeeter and Shred alternate between third and fourth positions, with Jeeter consistently outperforming Shred in sales. This competitive dynamic suggests that while Weed Me is a strong contender, it faces significant competition from General Admission's dominance and Jeeter's consistent performance, highlighting the need for strategic marketing efforts to maintain and potentially improve its market share.

Notable Products

In March 2025, the top-performing product from Weed Me was the Max - Seedless Grape Liquid Diamond Cartridge (1g) in the Vapor Pens category, maintaining its rank at number 1 with sales of 22,099. The Sativa 420 Pre-Roll 20-Pack (8g) held steady in the second position, showing a slight recovery in sales from February. Max- Mango Blueberry Slush Liquid Diamond Cartridge (1g) improved its rank to third place in March, up from fourth in the previous two months. Black Mountain Side Pre-Roll 3-Pack (1.5g) dropped to fourth place after a strong performance in February. Indica 420 Pre-Roll 20-Pack (8g) re-entered the rankings in fifth place, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.