Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

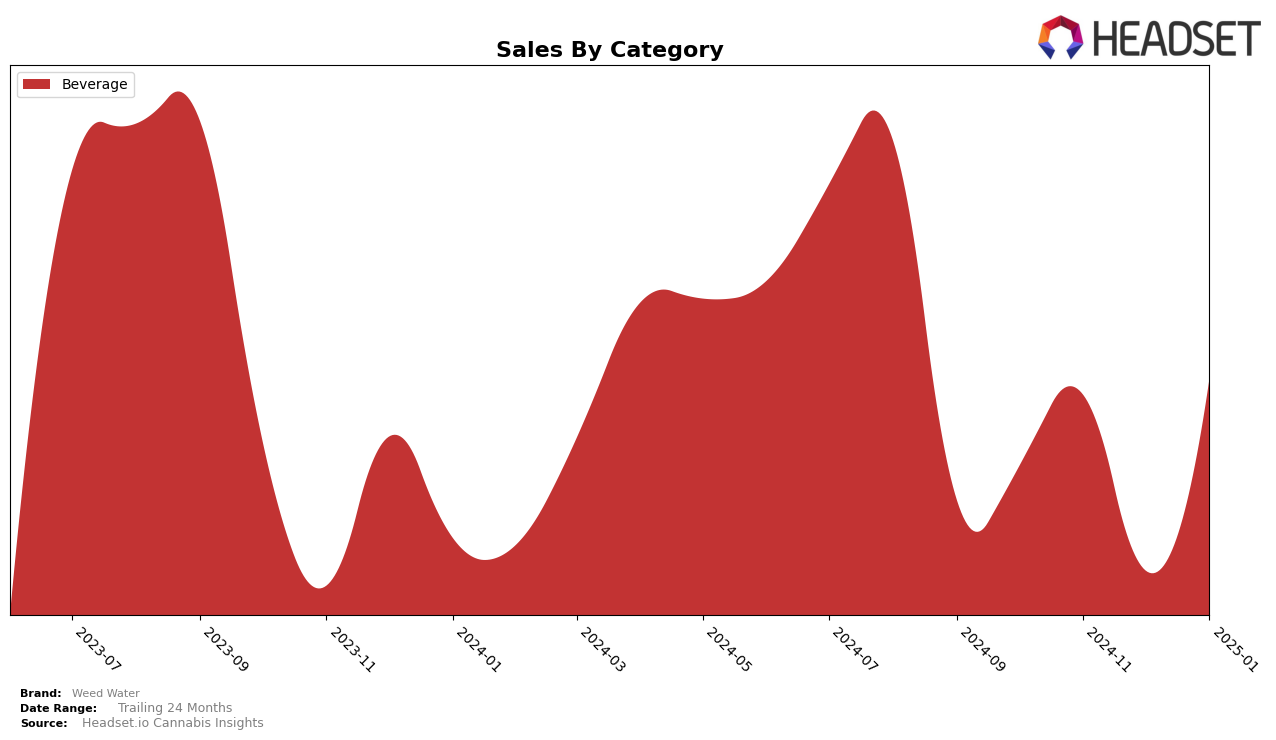

Weed Water has maintained a consistent presence in the beverage category within the state of New York. Over the months from October 2024 to January 2025, the brand has consistently held the 5th rank, indicating a stable position among the top competitors in this category. Despite fluctuations in sales figures, with a notable dip in December 2024, Weed Water's ability to retain its rank suggests a strong brand loyalty and market presence. This consistency is a positive indicator of its performance, especially given the competitive nature of the cannabis beverage market.

Interestingly, Weed Water's absence from the top 30 in other states or provinces highlights areas for potential growth or market entry. This absence could be seen as a limitation, but it also signifies untapped markets where the brand could expand its reach. The steady performance in New York might serve as a model for strategies to penetrate other regions. Understanding the dynamics and consumer preferences in these potential markets could help Weed Water replicate its success and possibly improve its rankings and presence in more states in the future.

Competitive Landscape

In the competitive landscape of the beverage category in New York, Weed Water consistently held the 5th rank from October 2024 to January 2025, indicating a stable position but also highlighting a potential area for growth. Notably, Harney Brothers Cannabis maintained its 3rd rank throughout the same period, with sales figures significantly higher than Weed Water, suggesting a strong consumer preference or market strategy that Weed Water could learn from. Similarly, MyHi held the 4th rank consistently, with sales figures fluctuating but generally higher than Weed Water, indicating a competitive edge that Weed Water might need to address to climb the ranks. The consistent ranking of Weed Water, despite fluctuations in sales, suggests a loyal customer base but also points to the need for strategic initiatives to boost sales and improve ranking in a competitive market.

Notable Products

In January 2025, the top-performing product for Weed Water was the CBD/THC 1:5 Pineapple Express Water (2mg CBD, 10mg THC), maintaining its first-place ranking from previous months with sales of 1940 units. The Gelato 41 Water (2mg CBD, 10mg THC) climbed to second place, showing a significant increase in sales compared to December 2024. The CBD/THC 1:5 Gelato Water (2mg CBD, 10mg THC) moved up to third place, continuing its upward trend. The CBD/THC 1:5 Gelato Water 6-Pack (12mg CBD, 60mg THC) improved its ranking to fourth place. Meanwhile, the CBD/THC 1:5 Pineapple Express Water 6-Pack (12mg CBD, 60mg THC) dropped to fifth place, indicating a decline in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.