Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

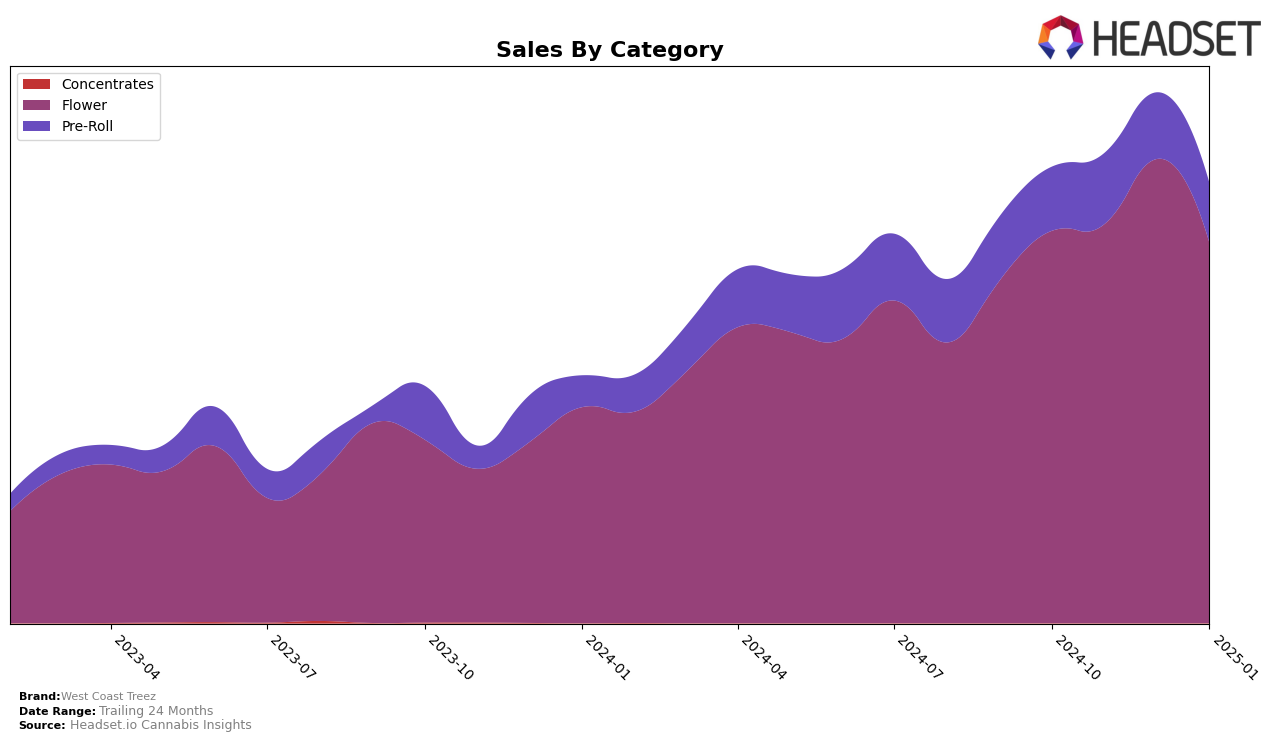

West Coast Treez has demonstrated a steady performance in the California market, particularly in the Flower category. From October 2024 to January 2025, the brand maintained a consistent position, improving slightly from a rank of 20 to 18. This suggests a stable demand for their Flower products, which is further supported by a notable increase in sales during December 2024. However, the subsequent decrease in January 2025 sales indicates potential seasonal fluctuations or market dynamics that could be influencing consumer purchasing behavior.

In contrast, West Coast Treez's performance in the Pre-Roll category in California has been more variable, with rankings fluctuating between 45 and 51. Despite these fluctuations, the brand did not break into the top 30, which may indicate challenges in capturing a larger market share in this category. The sales figures reflect a similar trend, with a peak in November 2024 followed by a decline. This variability suggests that while the brand has a presence in the Pre-Roll category, there may be opportunities for growth or a need for strategic adjustments to enhance their competitive edge.

Competitive Landscape

In the competitive landscape of the California flower category, West Coast Treez has shown a notable resilience and slight upward trend in its rankings over the last few months. Starting at the 20th position in October 2024, West Coast Treez maintained its rank in November before climbing to 18th in December and January 2025. This improvement in rank coincides with a significant sales increase in December, suggesting effective marketing or product strategies during that period. In contrast, West Coast Cure, which started at 11th place in October, experienced a decline to 19th by January, indicating potential challenges in maintaining their market position. Similarly, Connected Cannabis Co. saw fluctuating ranks, peaking at 13th in November but dropping to 16th by January. Meanwhile, Dime Bag (CA) and Yada Yada also faced downward trends, with Yada Yada managing to surpass West Coast Treez briefly in January. These dynamics highlight West Coast Treez's potential for further growth and the importance of strategic positioning in a competitive market.

Notable Products

In January 2025, the top-performing product from West Coast Treez was Tahoe Vibes Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place rank from December 2024 with sales of 12,388 units. Mendo Breeze Pre-Roll (1g) followed closely in the second position, having improved from third place in December. LA Sunrise Pre-Roll (1g) dropped to third place after previously holding the second spot in December. Hollywood Haze Pre-Roll (1g) made its debut in the rankings at fourth place. Newport Nirvana Pre-Roll (1g) remained steady at fifth place since its entry into the rankings in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.