Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

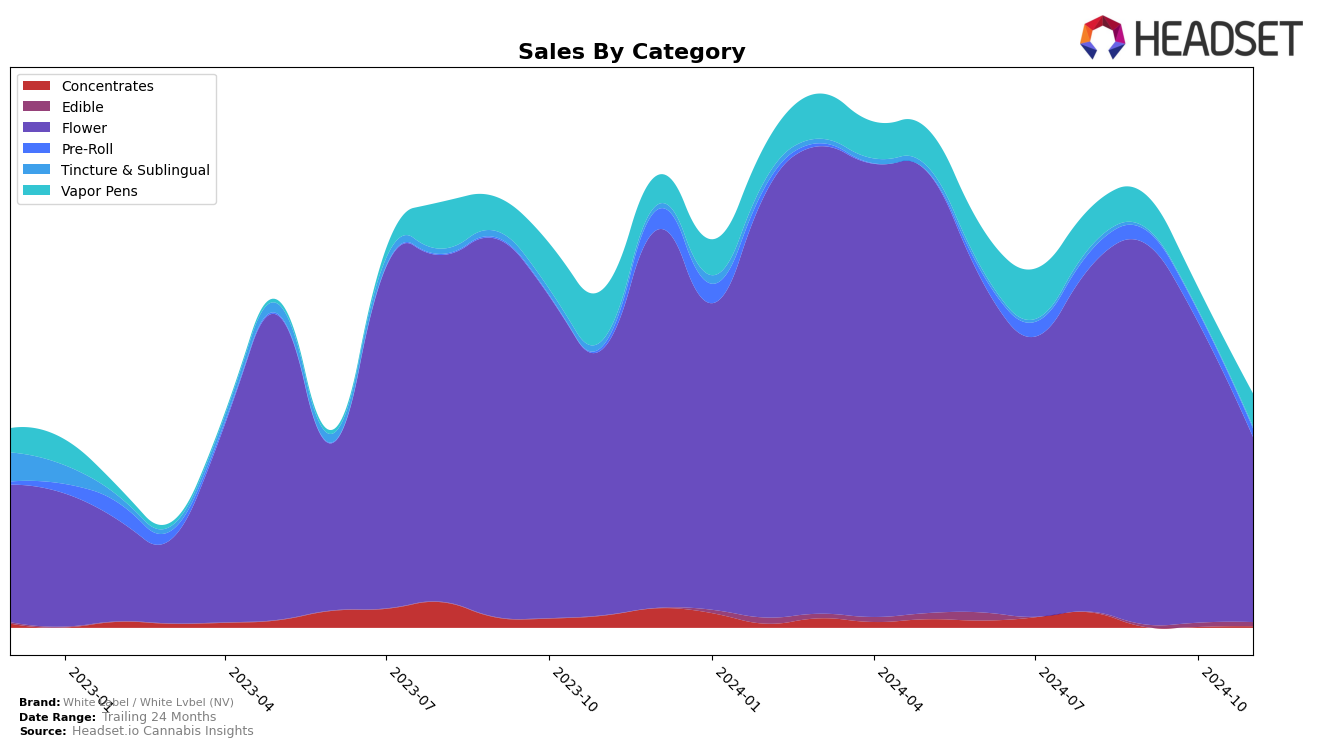

White Label / White Lvbel (NV) has shown a notable fluctuation in its performance within the Flower category in California. While the brand was not ranked in the top 30 across August to November 2024, there is a discernible downward trend in its ranking over these months, culminating in a rank of 93 by November. This decline in ranking is accompanied by a decrease in sales, from approximately $405,695 in August to $220,195 by November, indicating a potential challenge in maintaining its market position or consumer interest in this specific category within the state.

The absence of White Label / White Lvbel (NV) from the top 30 brands in the Flower category throughout these months in California suggests that the brand may need to reassess its strategy to regain its competitive edge. The lack of top 30 rankings could be viewed as a negative indicator for the brand's visibility and influence in the Flower category in this region. Understanding the factors contributing to this performance, such as market competition, consumer preferences, or product offerings, could be crucial for the brand to strategize effectively moving forward.

Competitive Landscape

In the competitive landscape of the California flower category, White Label / White Lvbel (NV) has experienced notable fluctuations in rank and sales over the past few months. In August 2024, the brand held a respectable 72nd position, climbing to 65th in September, before dropping to 74th in October and further to 93rd in November. This decline in rank is mirrored by a decrease in sales, from a high in September to a significant drop by November. Competitors such as CRU Cannabis and Revelry Herb Company have also seen rank fluctuations, but The Fight maintained a relatively stable position, indicating a potential shift in consumer preferences or competitive strategies. The data suggests that White Label / White Lvbel (NV) may need to reassess its market approach to regain its earlier momentum and address the competitive pressures in the California flower market.

Notable Products

In November 2024, the top-performing product for White Label / White Lvbel (NV) was Ice Cream Cake (7g) in the Flower category, achieving the number one rank with notable sales of 1,353 units. Following closely was Gush Mints (28g), also in the Flower category, which secured the second rank. The Sativa Pre-Roll (1g) made a significant leap to third place from its previous fifth position in September 2024, indicating a strong upward trend in popularity. Indica Pre-Roll (1g) entered the rankings at fourth place, showcasing a new preference among consumers. Tuscan Gelato (3.5g), which was ranked fourth in August 2024, has now moved to fifth place, reflecting a slight decline in its ranking over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.