Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

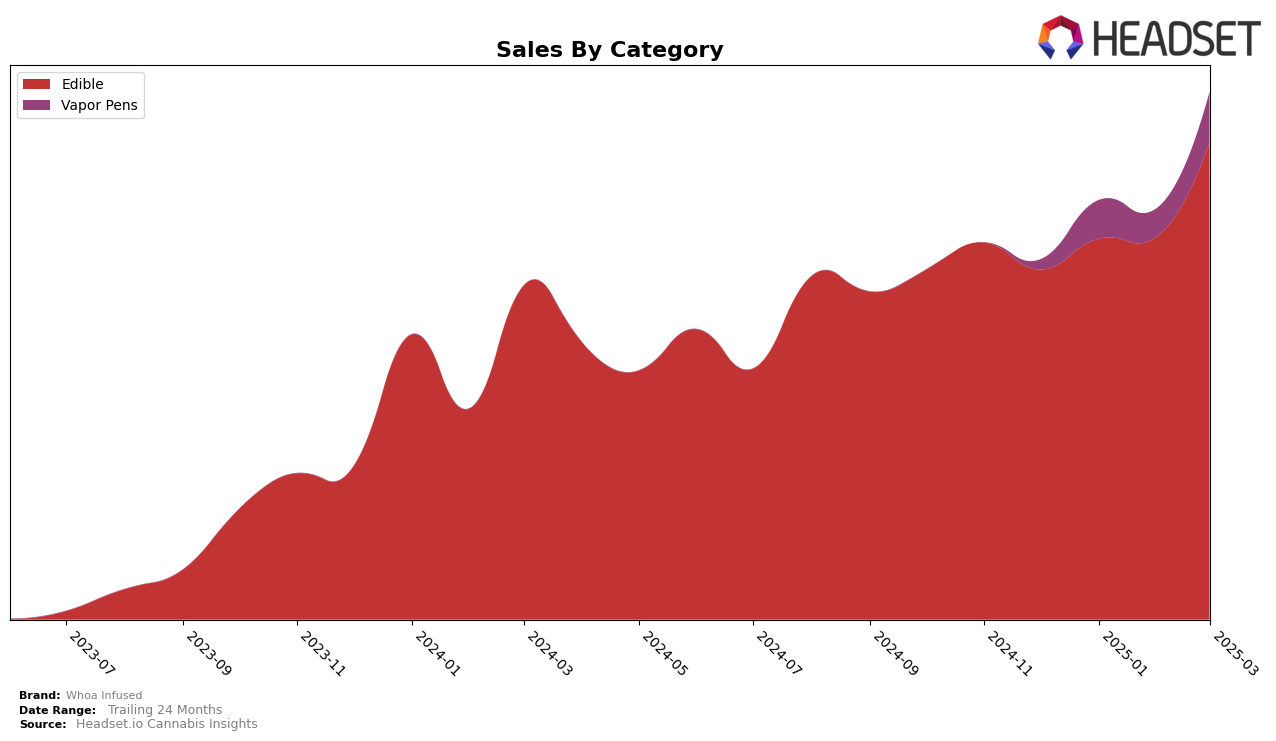

In the California market, Whoa Infused has shown a steady presence in the Edible category over the last few months. Starting from December 2024, the brand was ranked 27th, then slipped slightly to 29th in January 2025, before regaining its 27th position in February 2025. By March 2025, Whoa Infused improved its standing to 26th place, indicating a positive trajectory. This upward movement might be attributed to a significant increase in sales, particularly evident in March 2025, where sales figures reached a notable peak.

While Whoa Infused has managed to maintain a consistent ranking within the top 30 Edible brands in California, it is important to note that the brand's presence in other states or categories is not highlighted in the top 30 rankings. This absence could suggest either a strategic focus on the California market or challenges in penetrating other markets. The brand's ability to climb the ranks within a competitive category in California demonstrates its potential, yet its performance outside of this specific context remains an area to watch for future developments.

Competitive Landscape

In the competitive California edibles market, Whoa Infused has demonstrated a noteworthy upward trajectory in its rankings over the first quarter of 2025. Starting from a rank of 27 in December 2024, Whoa Infused experienced a slight dip to 29 in January but rebounded to 27 in February and further improved to 26 by March. This positive trend is underscored by a significant increase in sales, peaking at 218,872 in March, indicating a robust market presence. In comparison, Kushy Punch maintained a relatively stable position, hovering around the 28th and 29th ranks, while Punch Extracts / Punch Edibles showed fluctuating ranks from 21 to 25, suggesting a less consistent performance. Meanwhile, Terra held steady around the 24th rank, indicating a stable but not particularly dynamic presence. Notably, Gramlin entered the rankings in March at 27, which could pose new competition for Whoa Infused. Overall, Whoa Infused's consistent improvement in both rank and sales highlights its growing influence in the California edibles sector.

Notable Products

In March 2025, the top-performing product for Whoa Infused was Tangerine Gummy 10-Pack (100mg) in the Edible category, which climbed to the number one rank with sales reaching 3426 units. Strawberry Gummy 10-Pack (100mg) fell to the second position, despite maintaining the top rank in January and February. Green Apple Gummy (100mg) secured the third spot, marking its re-entry into the rankings after being absent in January and February. Watermelon Gummy 10-Pack (100mg) held steady at the fourth position, showing consistent performance since February. Sour Blue Raspberry Gummy 10-Pack (100mg) maintained its fifth-place rank, reflecting stable sales from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.