May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

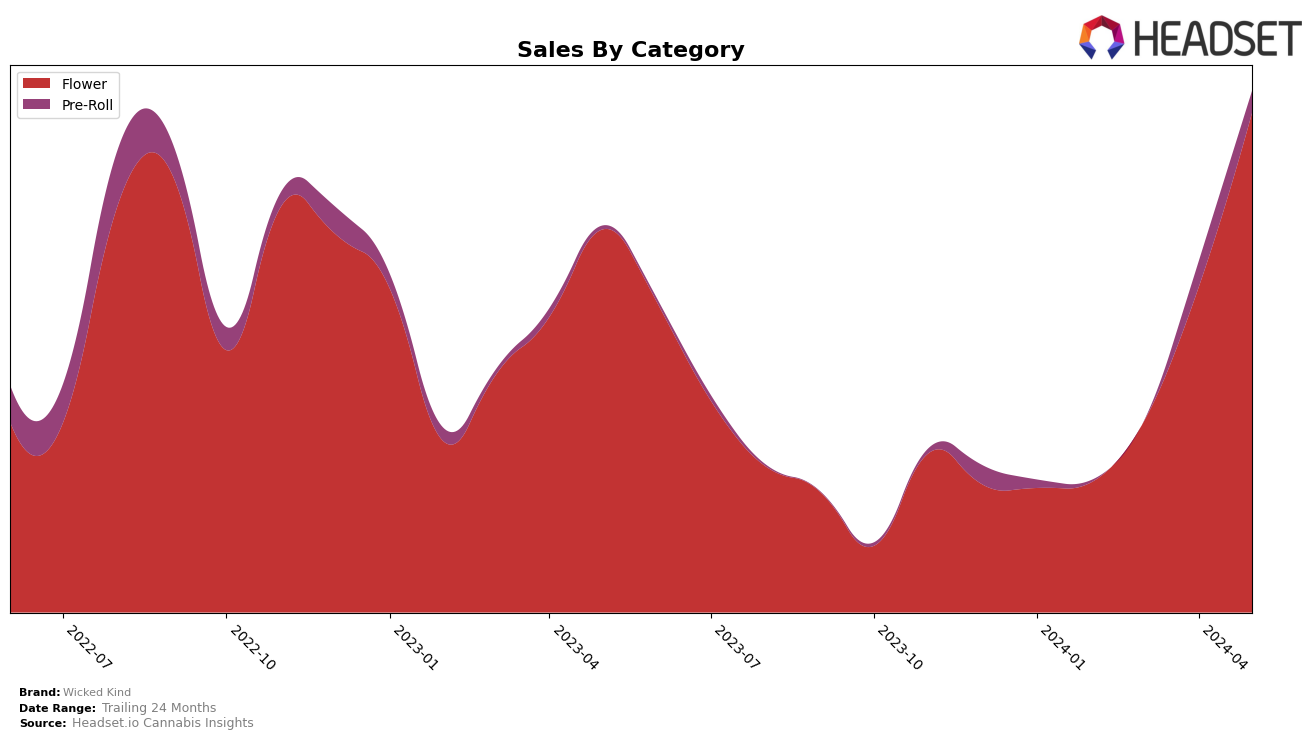

Wicked Kind has shown notable performance fluctuations across various categories and states, particularly in Oregon. In the Flower category, Wicked Kind made a significant leap from not being in the top 30 brands in February 2024 to securing the 22nd spot by May 2024. This upward trajectory indicates a strong market presence and growing consumer preference. Their sales figures also reflect this positive trend, with a substantial increase from $106,653 in February to $279,470 in May. However, it is important to note that Wicked Kind was not ranked in the top 30 for February, which could be seen as a slow start to the year.

In the Pre-Roll category, Wicked Kind's performance in Oregon was less impressive. The brand did not appear in the top 30 rankings until April 2024, where it entered at the 91st position. This late entry and low rank suggest that the brand is struggling to gain a foothold in this specific category. Despite this, the brand's presence in the top 100 indicates potential for growth, although it is currently lagging behind its competitors. The sales data for this category was not as robust as the Flower category, further highlighting areas for improvement. As Wicked Kind continues to expand and refine its product offerings, monitoring these trends will be crucial for understanding its market dynamics.

Competitive Landscape

In the highly competitive Oregon flower category, Wicked Kind has shown a notable upward trajectory in recent months, which is crucial for its market positioning and potential sales growth. After not being in the top 20 in February 2024, Wicked Kind surged to rank 80 in March, 41 in April, and 22 in May. This rapid ascent indicates a strong market response and increasing consumer demand. In contrast, competitors like William's Wonder Farms and Frontier Farms have experienced more stable but less dramatic changes in rank, with William's Wonder Farms hovering around the 19-20 range and Frontier Farms fluctuating significantly, peaking at 15 in April. PDX Organics also shows volatility, dropping out of the top 20 in April but returning in May. Meanwhile, Urban Canna has seen a decline from a high of 9 in March to 23 in May. These shifts highlight Wicked Kind's potential to capitalize on its recent momentum to capture more market share and drive sales, especially as other brands face inconsistent rankings.

Notable Products

In May-2024, Glitterati (Bulk) from Wicked Kind maintained its top position in the Flower category with impressive sales of 13,392 units. Dog Licker Popcorn (Bulk) debuted strongly at the second rank. Glitter Bomb (Bulk) secured the third spot, followed by Rose Gold Runtz (Bulk) and Diamond Runtz (Bulk) in fourth and fifth positions, respectively. Notably, Glitterati (Bulk) has consistently ranked first since March-2024, showing a steady increase in sales. The new entries in May-2024 indicate a dynamic shift in consumer preferences within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.