Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

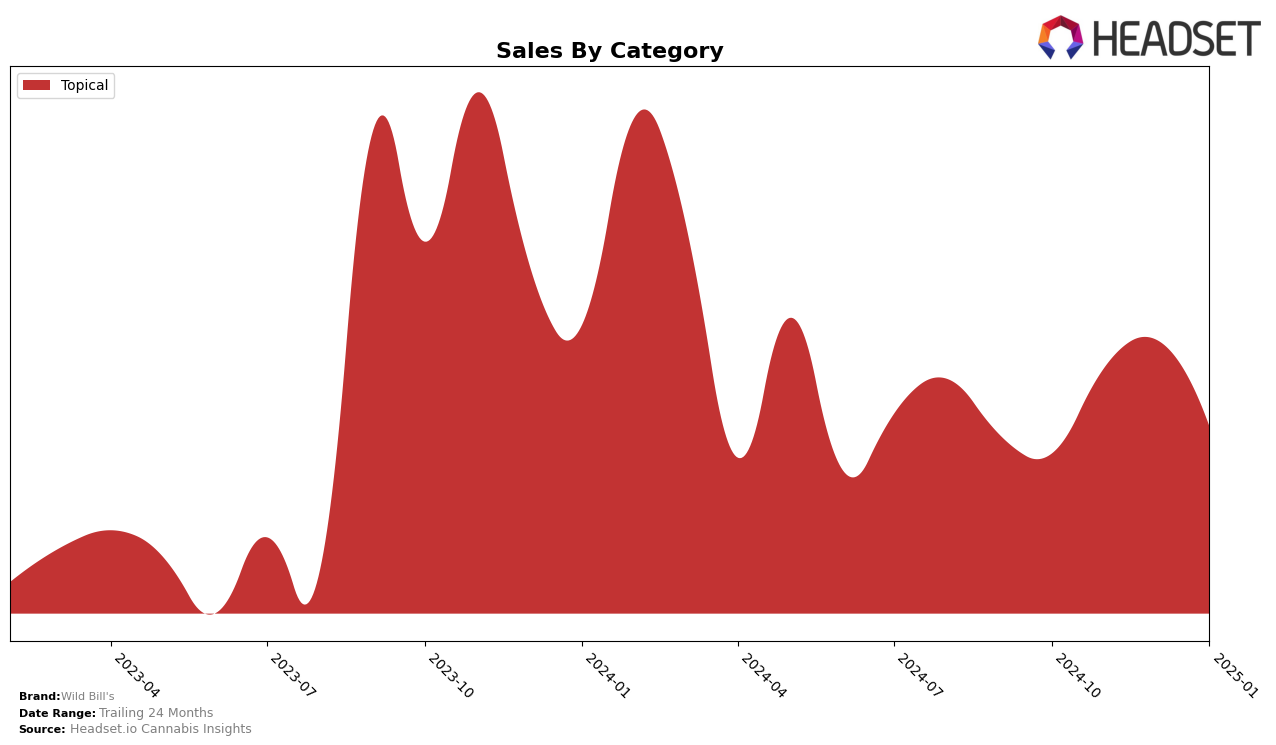

Wild Bill's has shown notable movement in the Topical category in California. After not ranking in the top 30 brands in October 2024, they made a significant leap to 14th place in November and maintained a strong presence with a 15th place ranking in December. This upward trend is indicative of the brand's growing popularity and effectiveness in the Topical category within the state. The absence of a ranking in October suggests that their entry into the top 30 was a substantial achievement, highlighting a successful strategy or product introduction that resonated well with consumers during the holiday season.

While Wild Bill's has made strides in California's Topical category, the data does not indicate their presence in other states or categories within the top 30 rankings. This could be seen as a limitation in their market reach or an area of opportunity for future growth. The consistency in their ranking from November to December suggests a stable consumer base, but the lack of data for January may imply either a drop in ranking or an omission from the top 30 once again. The sales figures for November, which surpassed $11,000, underscore a positive reception, yet the absence of December and January sales data leaves some aspects of their performance open to interpretation and further analysis.

Competitive Landscape

In the competitive landscape of California's Topical cannabis market, Wild Bill's has experienced fluctuations in its ranking, notably entering the top 20 in November 2024 at 14th place and maintaining a similar position in December 2024 at 15th. This entry into the rankings suggests a positive momentum in sales, contrasting with brands like OM, which consistently held a stronger position at 11th place from October through December 2024 before slightly dropping to 12th in January 2025. Meanwhile, Proof showed a dynamic performance, improving from 13th to 11th by January 2025, indicating a competitive edge over Wild Bill's. Additionally, Blue Sage and Opi-Not emerged in the rankings in January 2025 at 12th and 14th respectively, suggesting new competitive pressures. These shifts highlight the need for Wild Bill's to strategize effectively to maintain and improve its market position amidst these dynamic competitors.

Notable Products

In January 2025, Miracle Balm (600mg THC, 2oz) maintained its top position as the best-selling product for Wild Bill's, continuing its lead from previous months. Despite a slight dip in sales to 172 units, it remains the number one ranked product in the Topical category. This product has consistently held the top spot since October 2024, indicating strong and stable consumer demand. Other products have seen fluctuations in their rankings, but Miracle Balm's consistent performance highlights its popularity. The sustained leadership of this product suggests it is a key driver of sales for Wild Bill's.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.